|

Source: VietstockFinance

|

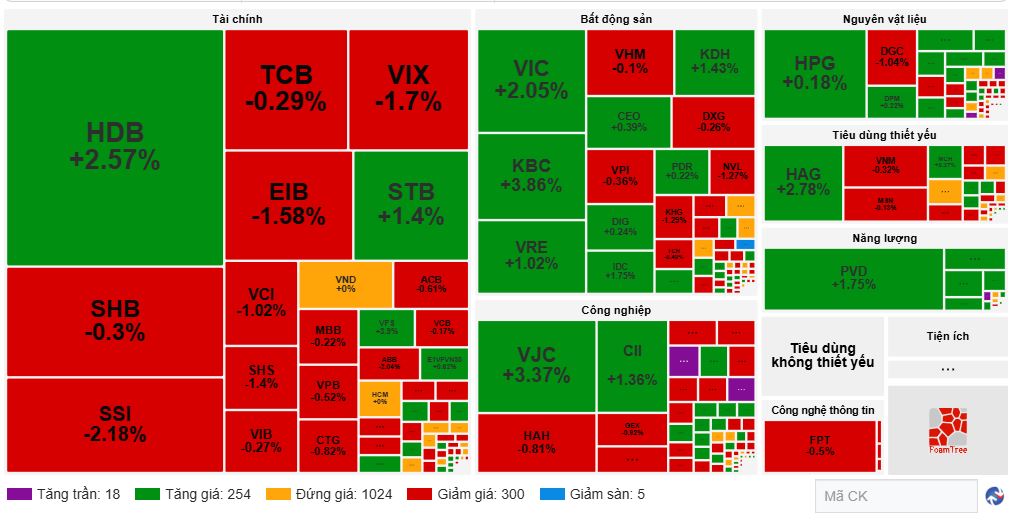

The financial sector was bathed in red today, with SSI plummeting by 4.5%. Other stocks like SHS, EIB, VND, MBS, and ABB also saw declines of 3-4%. A few exceptions, such as HDB, LPB, and VFS, managed to stay in the green.

Real estate stocks followed a similar trend, with VRE, DIG, IDC, VHM, CEO, NVL, PDR, and KHG all closing lower. However, VIC, KBC, and VPI bucked the trend and ended the day with gains.

Most sectors ended the day in the red, but industrial goods stood out with positive performances from GEE, GEX, BMP, PAC, and SJG. Notably, GEE and PAC hit their upper limits.

VJC was a bright spot, surging from the opening bell and closing in the purple zone.

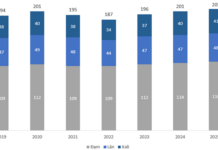

Trading volume improved significantly in the afternoon session, with HOSE seeing a 50% increase compared to the previous day and HNX doubling its volume. The market closed with a total trading value of nearly 30 trillion VND, indicating more aggressive bottom-fishing activity.

Morning Session: Selling Pressure Dominates

By the end of the morning session, selling pressure intensified, with nearly 370 stocks declining compared to 250 advancing. Thanks to blue-chip support, the VN-Index still managed a 3-point gain to 1,670.7. In contrast, the HNX-Index fell by 1.3 points to around 260.

Real estate stocks remained the primary support for the market. VIC rose nearly 3%, KBC gained over 3.4%, and KDH increased by more than 1%. VRE edged up 0.3%. Notably, VIC alone contributed over 6% to the HOSE index.

| Top 10 Stocks Impacting VN-Index in the Morning Session of November 25, 2025 |

Towards the end of the session, HAG surged by over 5.5%, becoming the star of the essential consumer goods sector amidst widespread divergence. Large-cap stocks like MSN, VNM, and others such as DBC, SBT, BAF, and ANV declined. Conversely, HNG, ANT, AFX, MML, and SAB ended in the green.

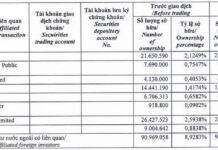

Liquidity improved in the morning session, with trading value reaching nearly 13 trillion VND. Foreign investors net sold over 400 billion VND, focusing on SSI, VHM, VRE, and VIC. Meanwhile, HDB saw significant net buying.

| Top 10 Stocks with Strongest Foreign Net Buying/Selling in the Morning Session of November 25, 2025 |

10:40 AM: Continued Divergence

Divergent trends persisted in the following hours of the morning session. The VN-Index maintained a 4-point gain, but the number of declining stocks began to rise. By 10:30 AM, 280 stocks were down, while advancing stocks remained near 260.

The banking and securities sectors exerted significant pressure on the market. Notable decliners included TCB, EIB, SSI, VIX, VCI, SHS, ACB, and CTG. Real estate stocks performed better, with VIC, KBC, VRE, KDH, CEO, PDR, DIG, and IDC all advancing. VIC, up over 2%, contributed nearly 4 points to the index, while KBC also showed strong gains of nearly 4%.

VJC maintained a nearly 4% gain, significantly supporting the index.

The energy sector remained positive, with PVD, PVS, PVT, BSR, PLX, and OIL all in the green.

Liquidity improved compared to the previous session, with trading value reaching nearly 8 trillion VND by 10:40 AM, a 40% increase from the same time yesterday.

Source: VietstockFinance

|

Market Open: Mixed Signals, Blue-Chip Support

At the open on November 25, the VN-Index rose slightly by nearly 6 points. Buying pressure dominated, with nearly 240 advancing stocks and over 150 declining.

Sector performance was mixed, with green and red interspersed across most industries.

Several blue-chip stocks supported the index early on. In the financial sector, HDB, STB, and MBB advanced. Vingroup stocks also performed well, with VRE, VIC, and VHM up around 1%. VPL surged by 5%.

The energy sector showed strength, with PVT, PVS, BSR, OIL, and PVP in the green. However, PVD and PLX diverged.

Early in the session, several stocks hit their upper limits with notable liquidity, including HID, PAC, PLP, ABS, HLC, and LGL…

– 15:55 November 25, 2025

Vietstock Daily 26/11/2025: Is the Wind Shifting?

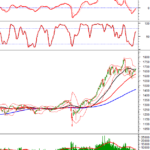

The VN-Index reversed its course, dipping after testing the 50-day SMA, signaling persistent selling pressure as it nears a critical resistance level. The Stochastic Oscillator shows early signs of weakening, and if a sell signal reemerges alongside the index closing below the 50-day SMA in upcoming sessions, the likelihood of a renewed corrective phase significantly increases.

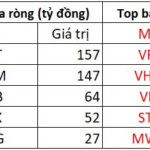

“Brokerage Firms’ Proprietary Trading Arms Invest Nearly $17 Million in Vietnamese Stocks on Monday: Which Stocks Were Most Sought After?”

Proprietary trading desks at Vietnamese securities firms collectively executed a net buy of VND 364 billion on the Ho Chi Minh Stock Exchange (HOSE) during the referenced period.