Chairman Do Huu Ha

According to a November 24th announcement, the CRV Board of Directors approved a public offering of 16.81 million shares at a price of VND 26,000 per share. The rights issue ratio is 40:1, meaning shareholders holding 40 shares are entitled to purchase 1 new share. The subscription and payment period runs from December 15th, 2025, to January 8th, 2026.

CRV’s Hoang Huy New City – II Project

With this issuance volume, the company expects to raise over VND 437 billion. According to the prospectus, the entire proceeds will be allocated to the investment and construction of the new urban area along the extended Do Muoi Road and its surrounding areas (Hoang Huy New City – II) in Thuy Nguyen District, Hai Phong City.

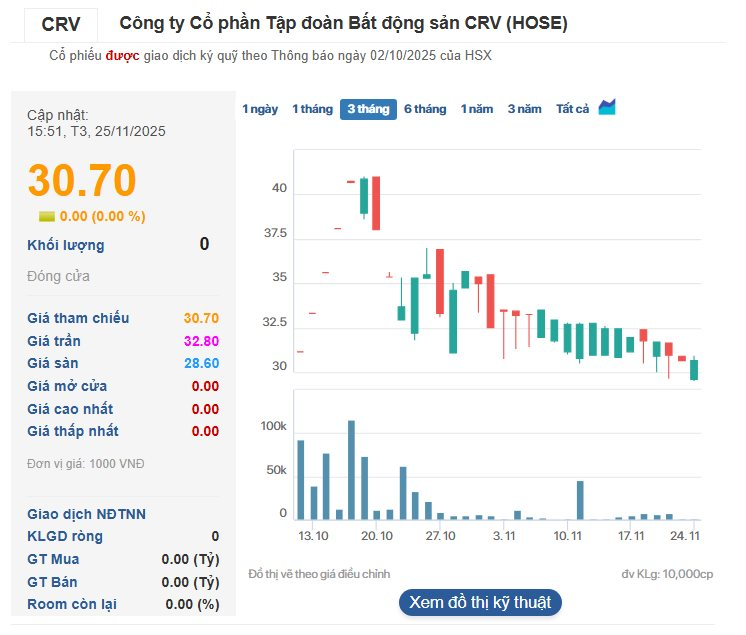

CRV Stock Price Movement

This capital raise comes as CRV shares are correcting following a sharp rise after their October 2025 listing. Closing at VND 30,700 per share on November 24th, the stock is down 25% from its all-time high of VND 40,900. The offering price for existing shareholders is approximately 15% below the current market price.

Financially, the interim consolidated report (April 1, 2025 – September 30, 2025) shows a significant decline in net revenue and profit after tax, down 80% and nearly 76% year-on-year, respectively. CRV’s management attributed this to the completion and handover of most units in older projects like Hoang Huy Commerce (H1 Tower), Hoang Huy Grand Tower, and Gold Tower, resulting in minimal revenue recognition during the period.

However, this phase is seen as a buildup to future profit realization. As of September 30, 2025, CRV’s total assets reached over VND 10,400 billion, an increase of nearly VND 1,500 billion from the beginning of the period. The most notable highlight is the “Short-term customer deposits” category, which surged 14-fold to nearly VND 1,966 billion.

Notably, the company disclosed in its explanation that customer prepayments for the Hoang Huy New City – II project alone have reached VND 1,884 billion. CRV anticipates handing over some low-rise units in this project during the final quarters of fiscal year 2025, thereby recognizing revenue and profit from this substantial “reserve.”

The company’s financial health remains robust, with cash and bank deposits exceeding VND 1,900 billion. Liquidity is limited due to a concentrated ownership structure, with over 89% of shares held by five major entities within Chairman Do Huu Ha’s ecosystem.

Shocking Market Volatility: CRV Offers 16.8 Million Shares to the Public

CRV Real Estate Group Joint Stock Company (HOSE: CRV) has announced a public offering of additional shares to raise capital for the development of a real estate project in Hai Phong City.

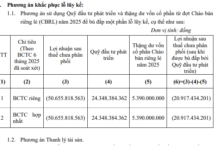

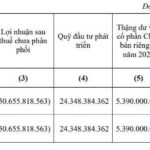

KIS Securities Finalizes Plan to Inject Hundreds of Billions into Proprietary Trading and Margin Lending

KIS Vietnam Securities Corporation (KIS Vietnam) has successfully obtained written approval from shareholders between November 5th and 15th. The outcome confirms the adjustment of certain details within the plan to offer over 78.9 million shares, as initially approved during the Extraordinary General Meeting of Shareholders on October 15th.