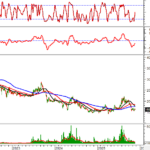

Despite the volatile stock market, HAG shares of Hoang Anh Gia Lai JSC maintained their upward trend on November 25th. The stock price surged over 3%, closing at 18,600 VND per share. This marks the fourth consecutive trading day of gains for HAG, bringing it close to the 10-year high it achieved last week.

Since the beginning of 2025, HAG’s stock price has climbed more than 54%, pushing the company’s market capitalization to 23,573 billion VND. Trading volume has also been notably robust. The November 25th session saw over 50.5 million shares change hands – the highest level in two years – with a total value of nearly 946 billion VND.

HAG’s positive performance stems from encouraging news from the company. On the afternoon of November 25th, Hoang Anh Gia Lai hosted an Investment Roadshow, showcasing its restructuring efforts and investment opportunities.

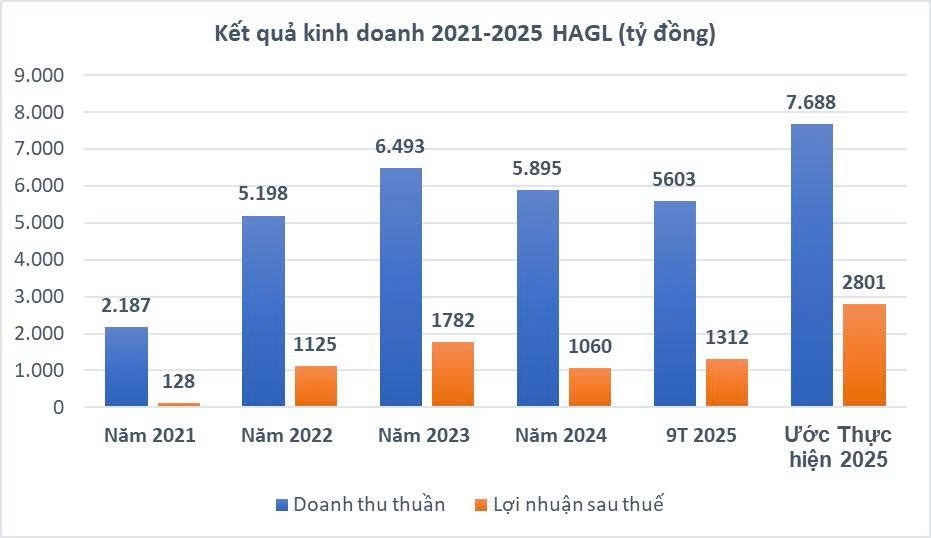

During a recent tour of its banana, durian, and silk farms across Vietnam, Laos, and Cambodia, HAGL shared projected 2025 financial results. The company anticipates revenue of 7,688 billion VND, a 30% increase year-over-year.

Net profit after tax is estimated at 2,800 billion VND, a remarkable 164% surge (equivalent to an additional 1,246 billion VND) compared to 2024. Basic earnings per share (EPS) are projected at 2,210 VND. This implies a fourth-quarter net profit of 1,500 billion VND, surpassing the combined profit of the first three quarters.

If approved by auditors, the projected 2025 revenue of 7,688 billion VND and net profit of 2,800 billion VND would be the highest in HAGL’s history.

As of Q3 2025, HAG owns 14,060 hectares of agricultural land, primarily located at elevations above 700 meters in the border regions of Vietnam (5,380 hectares), Laos (6,280 hectares), and Cambodia (2,400 hectares). Crop distribution includes 7,030 hectares of bananas, 3,040 hectares of coffee, 2,140 hectares of durian, and 850 hectares of macadamia.

In a recent report, BSC Securities noted that the banana segment has stabilized. HAG anticipates simultaneous harvesting of durian, silk, and pork from 2026-2027. The company plans to repopulate its pig farms by year-end, as disease risks subside and prices remain low. Coffee harvesting is expected to commence in 2028-2029.

BSC Research highlights that interest expenses are no longer a significant concern due to: (1) strong cash flow from the banana segment (800-1,000 billion VND annually); (2) completion of major CAPEX investments; and (3) high-yield harvesting of durian and silk starting in 2026.

HAG is also planning IPOs for two subsidiaries: Hung Thang Loi Gia Lai LLC (Laos) and Gia Suc Lo Pang JSC (Cambodia), opening new avenues for capital.

Notably, BSC suggests the possibility of extraordinary financial income related to waived interest expenses, which could significantly boost 2025 profits. BSC cites HAGL’s leadership, emphasizing that the company’s assets primarily consist of land and may not fully reflect the true value of its land holdings.

Top Hydropower Enterprise in Da Nang Announces Critical Update

The record date for shareholders is set for December 15, 2025, with the anticipated payment date following on December 25, 2025.

Upcoming Dividend Ex-Dates (Nov 24–28): Highest Cash Dividend at VND 8,500 per Share

This week, 10 companies are distributing cash dividends, with rates ranging from a high of 85% to a low of 2%.