FPT Securities JSC (FPTS, Stock Code: FTS, HoSE) has submitted a report on the stock transactions of related individuals to the internal personnel of the public company to the State Securities Commission of Vietnam (SSC), Ho Chi Minh City Stock Exchange (HoSE), and May Song Hong Textile Garment Joint Stock Company (Stock Code: MSH, HoSE).

Accordingly, FPTS successfully sold nearly 1.2 million MSH shares as previously registered. The transaction was executed via order matching from November 12, 2025, to November 20, 2025.

Following the transaction, FPTS reduced its MSH shareholdings from approximately 13.2 million shares to 12 million shares, decreasing its ownership stake from 11.728% to 10.665% of May Song Hong’s capital.

Illustrative image

Based on the closing price of MSH shares at VND 39,800 per share on November 12, 2025, FPTS is estimated to have generated over VND 47.6 billion from this sale.

In other news, on December 2, 2025, May Song Hong will finalize its shareholder list for an interim cash dividend payment for 2025 at a rate of 40%, meaning shareholders holding one share will receive VND 4,000. The payment is scheduled for December 25, 2025.

With over 112.5 million MSH shares outstanding, May Song Hong is expected to allocate more than VND 450 billion for this interim dividend distribution.

As of September 30, 2025, May Song Hong has four major shareholders, including three individual shareholders: Chairman Bui Duc Thinh and his two children.

Specifically, Chairman Bui Duc Thinh holds 26.9 million MSH shares (23.91%), estimated to receive VND 107.6 billion in dividends. Mr. Bui Viet Quang, Board Member and CEO (son of Chairman Bui Duc Thinh), owns 12.76 million shares (11.35%), expected to receive over VND 51 billion. Ms. Bui Thu Ha, Board Member and daughter of Chairman Bui Duc Thinh, holds 8.69 million shares (7.72%), estimated to receive VND 34.7 billion.

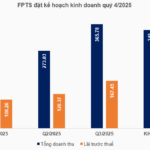

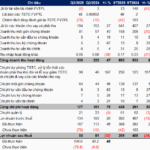

FPTS Targets 10% Profit Growth Above 2025 Plan

FPT Securities Corporation (FPTS, HOSE: FTS) has set an ambitious pre-tax profit target of VND 160 billion for Q4/2025, aiming to achieve a cumulative annual profit of VND 548 billion, surpassing its initial plan by 10%.