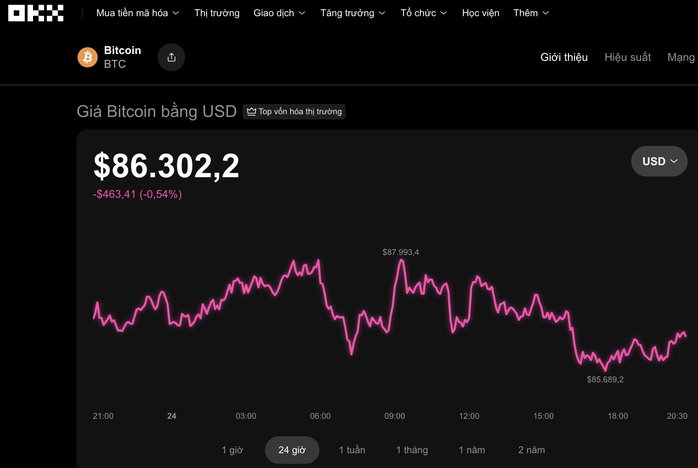

On the evening of November 24th, the cryptocurrency market exhibited mixed trends. Data from the OKX exchange revealed that Bitcoin experienced a decline of over 0.5% in the past 24 hours, settling around $86,300.

Several major cryptocurrencies followed suit, with Ethereum dropping nearly 1% to $2,819, BNB and Solana losing more than 1%, reaching $840 and $129 respectively. Conversely, XRP saw a nearly 2% increase, climbing to $2.

According to Cointelegraph, after dipping to the $80,500 range last week, Bitcoin’s price remains in a state of flux, lacking a clear trend as the end of November approaches.

The $88,000 mark is acting as a strong resistance level, repeatedly halting price advances. Market sentiment remains divided among investors.

Bitcoin is currently trading at $86,300. Source: OKX

Some believe this is a brief rebound within a broader downward trend, while others anticipate Bitcoin has established a short-term bottom.

If the price remains above $92,000 this week, the potential for a recovery to the $105,000 – $110,000 range becomes more plausible. Conversely, failure to break through could trigger a new downward movement.

On-chain data indicates that long-term holders are selling, while new investors are increasingly buying at higher prices.

Over the past 30 days, approximately 63,000 Bitcoin have been transferred from long-term to short-term holders. While this suggests the emergence of bottom-fishing, the risk remains high as selling pressure persists.

Market sentiment remains cautious. Although the fear index has slightly improved, it still resides in the “high fear” zone.

On social media, pessimism and panic selling among retail investors are at their highest levels in nearly two years.

This week, upcoming U.S. economic data releases could further influence market volatility. In the absence of clear directional cues, Bitcoin’s trajectory is likely to remain driven by short-term sentiment and capital flows.

The market is in a delicate position, with both a rebound and a deeper decline remaining plausible scenarios.

Bitcoin Plunges 40% from Peak as Investors Flee BlackRock’s Bitcoin Fund

BlackRock’s spot Bitcoin ETF is enduring its worst month since inception, mirroring Bitcoin’s steepest monthly decline in over three years.

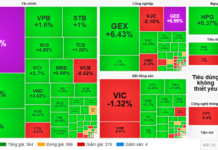

Where is the Stock Market’s Trading Focus Currently Directed?

The spotlight is now on sectors that have been attracting strong liquidity in recent sessions, including real estate, chemicals, and construction.