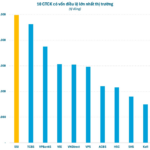

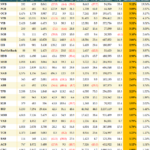

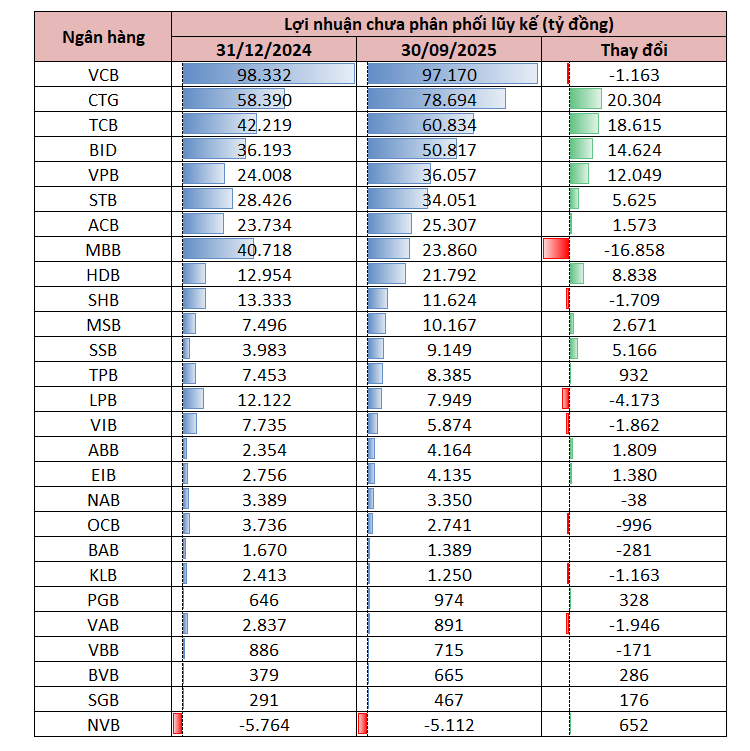

As of September 30, 2025, aggregated data reveals that 27 banks listed on the stock exchange hold nearly VND 500 trillion in retained earnings, marking a VND 65 trillion increase compared to the previous year-end. Amidst stringent capital requirements, fierce credit growth competition, and market share battles, retained earnings have emerged as a critical metric. It not only reflects financial health but also underscores the long-term strategic capabilities of individual banks.

The latest data highlights a significant disparity in retained earnings among banks, with a small group of large banks dominating. This concentration creates substantial differences in capital expansion, dividend payout capacity, and risk resilience.

Source: Author’s compilation from Q3/2025 financial reports

Vietcombank continues to solidify its position as the industry leader in financial strength, boasting over VND 97.17 trillion in retained earnings, far surpassing its peers. Consistently recording the highest profits in recent years, Vietcombank maintains a conservative dividend policy, creating a substantial capital buffer. This strategic approach provides a significant advantage in credit growth and digital investment initiatives.

Closely following is VietinBank with VND 78.694 trillion. This substantial reserve plays a pivotal role in sustaining VietinBank’s credit growth without compromising its capital adequacy ratio.

Despite being a private bank, Techcombank’s retained earnings surpass those of BIDV, showcasing its efficient business model, high profit margins, and sustainable profitability. Continuous accumulation of retained earnings enables Techcombank to maintain leading market equity, meet stringent capital safety standards, and support strategic expansion.

BIDV also maintains a robust accumulation, though its retained earnings growth has slowed due to increased provisioning for non-performing loans.

Major private banks continue to demonstrate their growing prominence with significant retained earnings. VPBank holds over VND 36.057 trillion, a crucial foundation during its credit portfolio restructuring. MBBank and ACB also report strong retained earnings of VND 23.860 trillion and VND 25.307 trillion, respectively, reflecting consistent profit growth over the years. These banks consistently achieve high ROE and robust capital generation without relying heavily on large issuances or foreign strategic investors.

Notably, Sacombank’s VND 34.051 trillion in retained earnings signals positive restructuring outcomes. Accumulating substantial retained earnings while managing non-performing loans and improving asset quality indicates Sacombank is on the right track.

HDBank, VIB, TPBank, MSB, and SHB also rank among banks with retained earnings exceeding VND 10 trillion, providing a solid financial base for growth and risk absorption.

Collectively, the top 10 banks hold over VND 450 trillion in retained earnings, accounting for more than 90% of the total retained earnings of the 27 listed banks.

In contrast, most mid-sized and smaller banks have accumulated only a few trillion dong or less. Banks like ABB, OCB, EIB, and BVB have relatively modest retained earnings, limiting their capital expansion potential. In an increasingly competitive environment, these banks may need to rely more on private placements to enhance their financial capacity.

The growing “wealth gap” in retained earnings among Vietnamese banks is becoming a pronounced trend. Banks with substantial retained earnings reserves can pursue more proactive growth strategies, particularly as Basel III standards are widely adopted and financial markets demand higher safety levels. Conversely, smaller banks face significant capital expansion challenges, especially if credit growth rebounds strongly in 2025–2026.

SSB Capital Increase Approved: SSI Set to Overtake TCBS, Reclaiming the Crown in Vietnam’s Securities Sector

Unlocking unparalleled growth, SSI’s chartered capital is poised to soar to 24.9 trillion VND through an offering to existing shareholders, cementing its position as the undisputed leader in Vietnam’s securities industry.

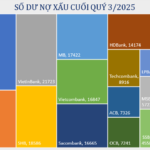

Will Bank Bad Debt Return to Safe Levels by Year-End?

Despite lingering risks, particularly in real estate and consumer sectors, the overall outlook remains positive as the year draws to a close. With credit growth sustaining its steady pace and legal frameworks for debt resolution improving, bad debt levels are likely to ease slightly by year-end, staying within manageable limits.

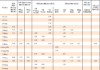

Customer Deposits Decline Across Multiple Banks

By the end of September 2025, total customer deposits across 27 listed banks reached over 12.26 quadrillion VND, reflecting a modest increase of nearly 207 trillion VND compared to June 2025. This marks the slowest quarterly growth rate observed in the past six quarters.