Interest Rates Soar to 13.5%

Recent updates from the Hanoi Stock Exchange (HNX) reveal successful corporate bond issuances, with interest rates exceeding 10% becoming more common. Notably, real estate companies are offering rates as high as 13.5%.

FiinGroup data highlights a surge in corporate bond issuances by real estate firms in October, totaling 32.7 trillion VND, a 2.5-fold increase from September and 14 times higher than the same period in 2024. This figure approaches the peak of December 2024 (32.9 trillion VND).

In the first 10 months, real estate companies issued over 107 trillion VND in bonds, reflecting growing capital needs. October saw new issuers like Thoi Dai Moi T&T (8.1 trillion VND), Hung Phat Invest Hanoi (7.7 trillion VND), TN Development (3 trillion VND), and TNI Nam Quang (1 trillion VND) entering the market.

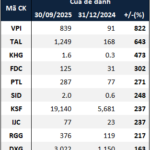

Recent bond issuances by real estate companies.

Notable deals include Khai Hoan Land Corporation’s 80 billion VND issuance at 13.5% interest for the first two periods, and Thai Son Construction Investment Corporation’s 4 trillion VND bond at 12.5% interest over two years.

While bond issuances rose in October, payment delays were also reported among real estate firms. Vietnam Investment Credit Rating (VIS Rating) emphasizes the need to monitor liquidity risks.

Despite reporting profits and maintaining 300 billion VND in cash at Q3’s end, Hoa Binh Construction Group (HBC) failed to repay 12.4 billion VND in principal for the HBCH2225002 bond on October 31.

“This indicates significant liquidity gaps. Accounting profit or cash balances on financial statements do not fully reflect a company’s actual payment capacity. Although HBC announced substantial upcoming projects, most began in Q3-Q4, limiting short-term cash flow while maintaining high liquidity pressure,” VIS Rating noted.

Proposed Transparency in Capital Use and Project Risks

The Ministry of Finance is seeking input on a draft decree regulating private corporate bond issuances domestically and internationally, replacing Decree 153/2020/NĐ-CP after five years.

The draft aims to enhance issuer accountability, clarify roles of service providers, and ensure proper documentation for private bond issuances.

For investors, it proposes that individual professionals commit in writing to understanding risks and accepting full responsibility for their investments.

The draft decree mandates detailed debt repayment plans for bond issuances.

It also requires bondholder representative contracts for issuances to individual investors or secured bonds, similar to public offerings.

To optimize capital, the draft allows companies to change capital use plans with approval from authorities and over 65% of bondholders, requiring public disclosure.

Regarding debt repayment, the Ministry proposes detailed plans for interest and principal payments, including source allocation, payment methods, amounts, and timelines. It also outlines asset handling procedures for secured bonds in case of payment defaults.

Interest Rates Remain Stable to Bolster Year-End Business and Production Growth

A stable macroeconomic environment, controlled inflation, and increased capital mobilization have empowered credit institutions to reduce costs and maintain competitive lending rates. This strategic financial landscape fosters robust growth in production, business, trade, and services, particularly during the year-end period.

Unlocking Housing Affordability: Addressing Root Causes is the Key to Sustainable Price Reductions

To reduce housing costs, transparency in expenses—especially land and administrative procedures—is essential. This clarity empowers regulatory bodies to adjust land price coefficients based on real data, rather than relying on rigid administrative measures.

“Real Estate Firms’ Reserves Surge 59% in Nine Months”

As of the end of September 2025, the total reserves of 104 real estate companies listed on the HOSE, HNX, and UPCoM exchanges surged by 59% compared to the beginning of the year, reaching nearly VND 213.4 trillion. Short-term cash holdings also rose by 26%, climbing to approximately VND 119.7 trillion.

Vingroup Plans to Issue VND 1.000 Billion in Bonds for Debt Restructuring

Vingroup is set to issue VND 1,000 billion in 36-month asset-backed bonds, aimed at restructuring its debt portfolio.