Recently, Mr. Lê Anh Quân, the authorized information disclosure representative of Ho Chi Minh City Securities Corporation (HSC, Stock Code: HCM, HoSE), issued a notice regarding insider stock transactions.

According to the announcement, Mr. Quân has registered to sell 350,000 HCM shares to restructure his investment portfolio. The transaction is expected to take place via order matching from December 2, 2025, to December 31, 2025.

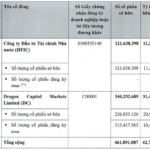

If successful, Mr. Quân’s HCM shareholdings will decrease from over 1.51 million shares to more than 1.16 million shares, reducing his ownership stake from 0.14% to 0.108% of HSC’s capital.

Illustrative image

Previously, during the trading session on October 29, 2025, Mr. Quân sold only 4,000 out of the 350,000 HCM shares he had registered earlier. The incomplete transaction was attributed to share prices falling below expectations.

Following this transaction, Mr. Quân’s ownership in HSC remained largely unchanged, decreasing slightly from nearly 1.52 million shares to over 1.51 million shares (0.14% ownership).

It is noted that Mr. Lê Anh Quân also serves as the Executive Director of the Communications Division at HSC and is the brother of Mr. Lê Anh Minh, Vice Chairman of HSC’s Board of Directors.

In other developments, HSC previously announced its receipt of Decision No. 397/QĐ-XPHC dated November 7, 2025, imposing administrative penalties.

According to the decision, HSC committed two administrative violations.

First, HSC was fined 65 million VND for failing to report within the legally mandated timeframe. Specifically, the company submitted delayed reports to the State Securities Commission (SSC) for the following documents: Financial Safety Ratio Report as of September 30, 2024; Notifications regarding the signing/termination of employment contracts with securities professionals, including Mr. Hồ Sỹ Hiệp, Ms. Huỳnh Thị Yến Nga, and Mr. Trần Văn Tuấn Kiệt.

Second, HSC was fined 60 million VND for failing to disclose information within the legally mandated timeframe. Specifically, the company delayed disclosing Resolution No. 36/2024/NQ-HĐQT dated August 9, 2024, which approved a credit limit with ACB exceeding 10% of the company’s total assets as reported in the audited 2023 financial statements.

For these two violations, HSC was fined a total of 125 million VND.

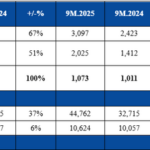

Regarding business performance, in Q3/2025, HSC recorded operating revenue of 1,665 billion VND, a 46% increase; pre-tax profit reached 550 billion VND, doubling year-on-year.

In terms of revenue structure, brokerage revenue surged 163% to 507 billion VND, margin lending revenue increased 34% to 642 billion VND, and proprietary trading revenue reached 502 billion VND, up 9%.

For the first nine months of the year, HSC’s operating revenue totaled 3,738 billion VND, a 20.7% increase compared to the same period last year. Consequently, pre-tax profit reached 1,073 billion VND, a 6% increase year-on-year.

HSC Securities Reports Q3 Profits Double Year-on-Year

HSC Securities (HOSE: HCM) has announced its Q3 2025 business results, reporting pre-tax profits of VND 550 billion. This performance underscores sustained growth across its core business segments.