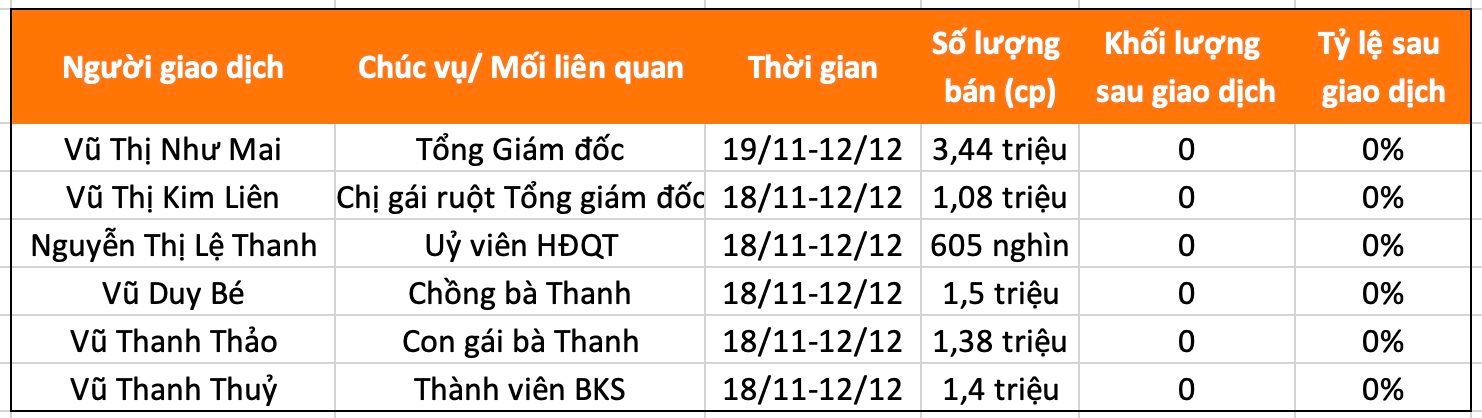

Ms. Vu Thi Nhu Mai, CEO of Sao Mai Viet Investment and Development JSC (stock code: UNI), has registered to sell her entire stake of over 3.4 million UNI shares, equivalent to 8.09% of the company’s capital. The transaction aims to balance her personal finances and is scheduled to take place from November 19 to December 12.

One day prior, several company executives and their relatives also initiated significant divestments.

Specifically, Ms. Vu Thi Kim Lien, Ms. Mai’s sister, registered to sell her entire stake in UNI, totaling over 1.08 million shares (2.54% of capital), also citing personal financial balancing. Her transaction is set for November 18 to December 12.

Simultaneously, Ms. Nguyen Thi Le Thanh, a board member, registered to sell her entire holding of 605,000 UNI shares, reducing her stake from 1.42% to 0%. Her husband, Mr. Vu Duy Be, and daughter, Ms. Vu Thanh Thao, also plan to divest their entire stakes of over 1.5 million and nearly 1.38 million shares, respectively.

Additionally, Ms. Vu Thanh Thuy, a member of the Control Board, registered to sell her entire holding of 1.4 million shares.

All transactions are aimed at personal financial balancing and will be executed via agreement or order matching on the exchange.

Established in 1993 in Ho Chi Minh City, Sao Mai Viet Investment and Development JSC initially focused on postal services, telecommunications, and fax machine distribution. After multiple capital increases and expansions, the company now operates in diverse sectors, including information technology, telecommunications, equipment maintenance, and real estate. On July 3, 2006, Sao Mai Viet was officially listed on the Ho Chi Minh City Stock Exchange under the code UNI.

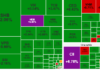

The recent wave of divestments comes amid no significant company announcements. However, UNI’s financial performance has been lackluster over the past decade. Prior to 2015, the company reported robust profits of tens of billions annually. Since then, revenue has shrunk significantly to below VND 1 billion, with profits ranging from millions to tens of millions. In 2023, the company recorded no revenue and reported a loss of VND 11 billion.

In Q3 2025, UNI achieved revenue of VND 2.45 billion, a substantial increase from previous quarters and over 12 times higher year-on-year. However, after-tax profit was only VND 22 million, down 24%. For the first nine months, revenue reached VND 3.3 billion, four times higher year-on-year, but after-tax profit was VND 99 million, compared to VND 314 million in the same period last year.

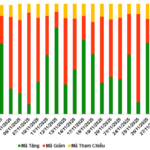

On the market, after a vibrant trading period in August, UNI shares have largely traded sideways, often with zero liquidity sessions. Compared to the beginning of the year, the stock price has risen by approximately 30%.

SSI to Offer Over 415 Million Shares at Half the Market Price

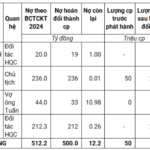

SSI is set to offer 415.18 million shares to its shareholders at a price of 15,000 VND per share, representing a 50% discount compared to the current market price.

TPBank Emerges as Vietnam’s Leading Strong and Stable Bank with Superior Financial Performance

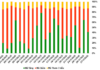

TPBank has solidified its position as a market leader, with CASA driving growth and expanded credit fueled by technological innovation. The bank’s consistent profitability is further bolstered by its optimized cost-to-income ratio and increasing non-interest income streams. Despite market pressures, TPBank maintains robust capital adequacy and liquidity, laying a strong foundation for sustainable growth.