On November 25, the State Securities Commission of Vietnam (SSC) announced that it has received all necessary documents for Vingroup’s (stock code: VIC) share issuance to increase its charter capital from equity. This move marks a significant step in the conglomerate’s ambitious capital expansion plan.

The SSC has requested Vingroup and related parties to comply with the provisions outlined in Article 11a of the Securities Law No. 54/2019/QH14, as amended by Law No. 56/2024/QH15, and Clause 1 of Article 6 in Decree No. 155/2020/NĐ-CP dated December 31, 2020, further amended by Clause 3b of Article 1 in Decree No. 245/2025/NĐ-CP dated September 11, 2025.

Vingroup is also required to disclose information and execute the share issuance in accordance with Article 69 of Decree No. 155/2020/NĐ-CP. This development propels billionaire Pham Nhat Vuong’s conglomerate closer to completing the largest share issuance in Vietnam’s stock market history.

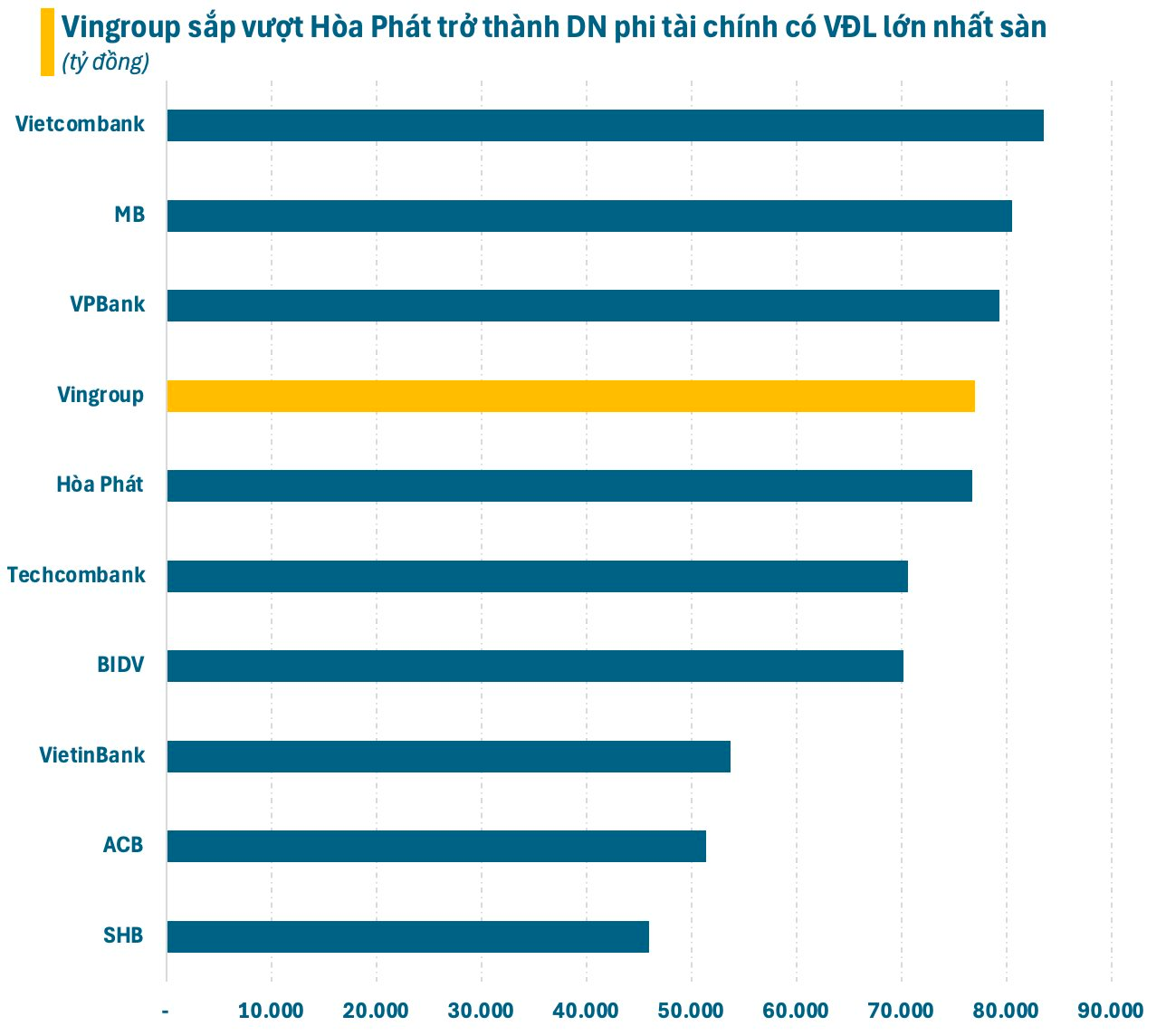

Under the plan, Vingroup will issue nearly 3.9 billion bonus shares at a 1:1 ratio (one new share for every share held). The issuance is scheduled for Q4, with the exact timing to be determined by the Board of Directors. Post-issuance, Vingroup’s charter capital will double to over VND 77,000 billion.

This capital increase will position Vingroup as Vietnam’s largest non-financial enterprise by charter capital, surpassing Hoa Phat. Only Vietcombank, MB, and VPBank will have higher charter capital than Vingroup post-issuance.

On the stock market, VIC shares are trading near their all-time high of VND 243,000 per share, a sixfold increase since the beginning of the year. Vingroup’s market capitalization has surged, peaking at over VND 950,000 billion.

This performance solidifies Vingroup’s dominance on the stock exchange, far outpacing its competitors. Vingroup is also the first Vietnamese company to reach market capitalization milestones of VND 600,000 billion, VND 700,000 billion, VND 800,000 billion, and VND 900,000 billion, and is poised to become the first trillion-dong enterprise.

In Q3 2025, Vingroup reported consolidated net revenue of VND 169,611 billion for the first nine months, a 34% year-on-year increase. Consolidated net profit reached VND 7,565 billion, 1.9 times higher than the same period in 2024, achieving 76% of the 2025 profit target.

As of September 30, 2025, Vingroup’s total assets stood at VND 1,087,870 billion, a 30% increase from December 31, 2024, marking the first time the conglomerate’s assets exceeded VND 1,000,000 billion.