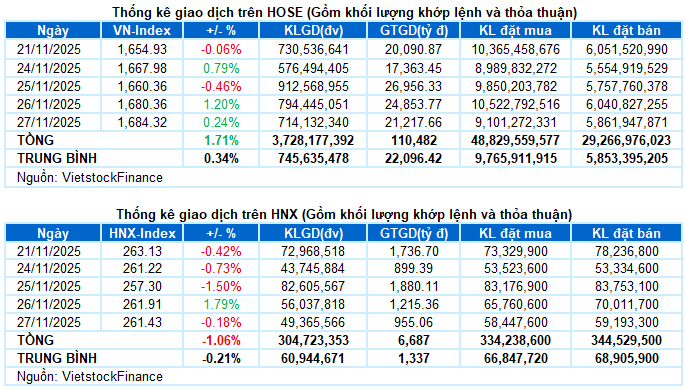

I. MARKET ANALYSIS OF THE BASE STOCK MARKET ON NOVEMBER 27, 2025

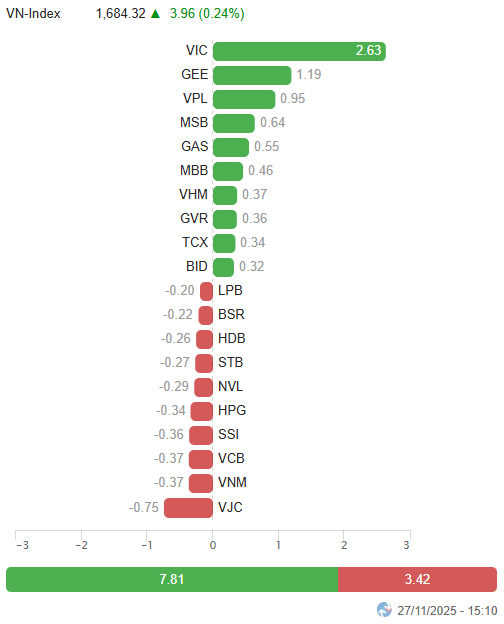

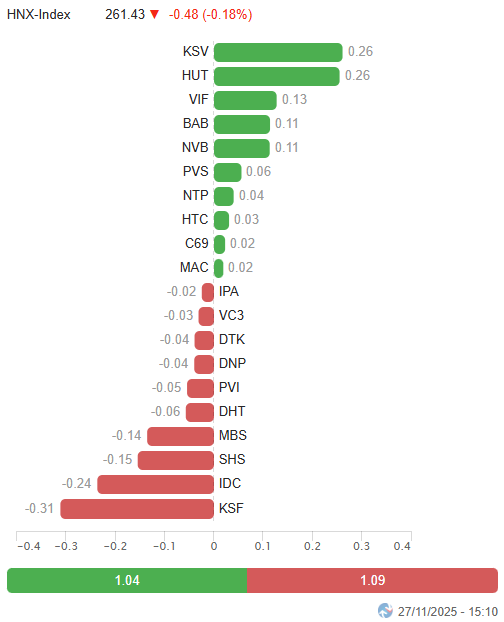

– Key indices showed mixed movements during the November 27 trading session. The VN-Index rose by 0.24%, reaching 1,684.32 points. In contrast, the HNX-Index dipped slightly by 0.18%, closing at 261.43 points.

– Trading volume on the HOSE decreased by 12.3%, totaling over 598 million units. The HNX also recorded nearly 47 million matched units, a 14.4% decline compared to the previous session.

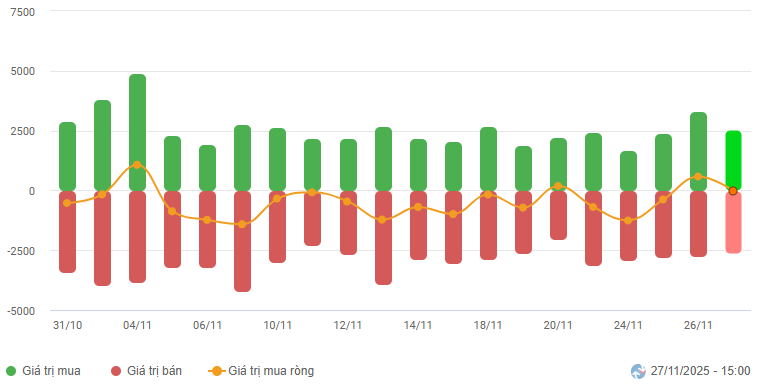

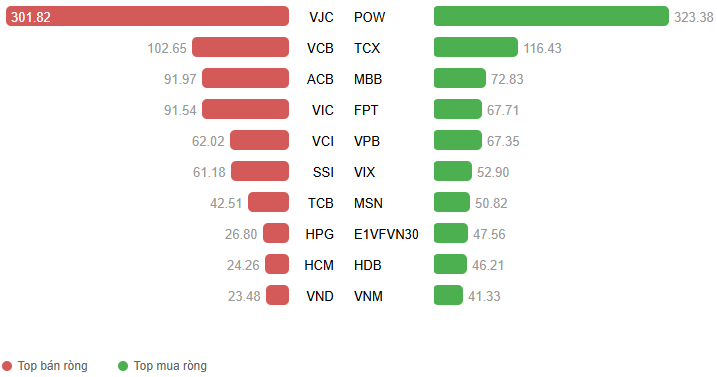

– Foreign investors net sold lightly, with a value of over 26 billion VND on the HOSE, but turned to net buying 6.6 billion VND on the HNX.

Foreign Investors’ Trading Value on HOSE, HNX, and UPCOM by Date. Unit: Billion VND

Net Trading Value by Stock Code. Unit: Billion VND

– Continuing the momentum from the previous session, the market opened on November 27 with a positive gap. The VN-Index quickly approached the 1,695-point mark within the first hour of trading. However, buying pressure gradually weakened, and market divergence returned, indicating a shift towards selective investing rather than the broad-based rally seen earlier. The VN-Index primarily fluctuated around the 1,685-point level for the remainder of the day, closing at 1,684.32 points, a modest 0.24% increase.

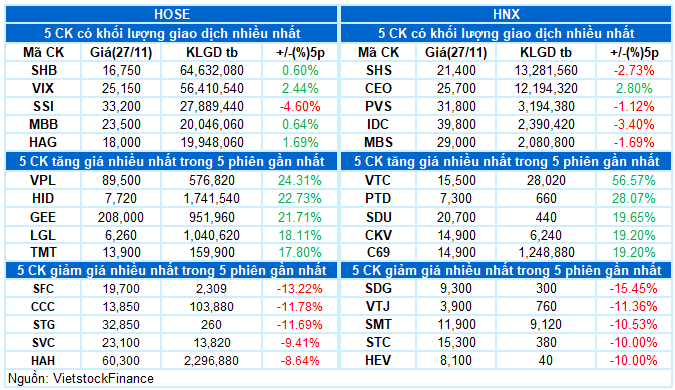

– In terms of influence, VIC remained the leading driver, contributing 2.6 points to the VN-Index. Following closely were GEE, VPL, and MSB, adding a combined 2.8 points. Conversely, VJC was the notable drag, subtracting 0.75 points from the index.

Top Stocks Impacting the Index. Unit: Points

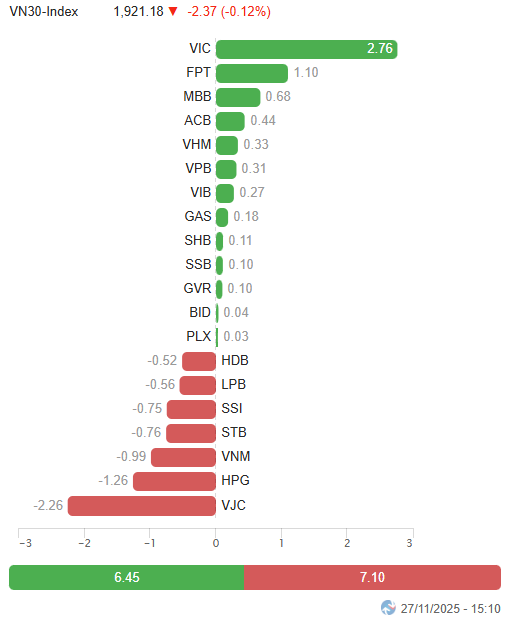

– The VN30-Index edged down by 2.37 points (-0.12%), settling at 1,921.18 points. The basket’s breadth was relatively balanced, with 13 gainers, 16 losers, and 1 unchanged stock. On the upside, GAS and GVR were the top performers, rising by 1.6% and 1.5%, respectively. Conversely, VJC and SSI faced significant profit-taking pressure, finishing at the bottom with declines of 2.8% and 2.4%, respectively.

Divergent trends dominated sector performance. Non-essential consumer goods were the standout sector, gaining over 1%, driven by strong contributions from VPL (+2.64%), PNJ (+3.44%), HUT (+2.38%), DGW (+1.61%), and HTM (+9.71%).

Other sector indices experienced mild fluctuations, with a mix of green and red. For instance, in the real estate and finance sectors, while several stocks maintained strong demand, such as VIC (+1.22%), VPI (+1.79%), KHG (+0.67%), CRE (+1.37%); VIX (+2.65%), MBB (+1.08%), TCX (+1.4%), VIB (+1.08%), OCB (+1.64%), and MSB hitting the upper limit, many others declined by over 1%, including NVL, DIG, DXG, TCH, HDC, NLG, SCR, IDC; SSI, STB, SHS, VCI, HCM,…

The communication services sector underperformed, dropping by 0.68%, weighed down by leading stocks such as VGI (-1.08%), CTR (-0.23%), and YEG (-1.22%). However, notable gains were seen in smaller stocks within the sector, including ABC, ICT, and VTC, following recent capital withdrawal announcements.

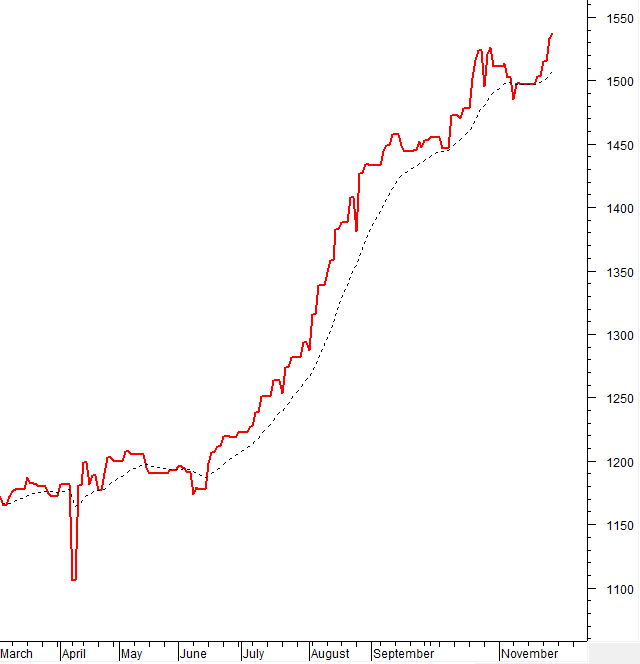

The VN-Index narrowed its gains, forming a Long Upper Shadow candlestick pattern, indicating increased profit-taking pressure as the index tested the September 2025 high (equivalent to the 1,695-1,711 range). Nonetheless, the short-term outlook remains positive, with the MACD indicator continuing its upward trend and crossing above the zero line.

II. PRICE TREND AND VOLATILITY ANALYSIS

VN-Index – Long Upper Shadow Candlestick Pattern Emerges

The VN-Index narrowed its gains, forming a Long Upper Shadow candlestick pattern, indicating increased profit-taking pressure as the index tested the September 2025 high (equivalent to the 1,695-1,711 range).

However, the short-term outlook remains positive, with the MACD indicator continuing its upward trend and crossing above the zero line.

HNX-Index – Testing the Middle Band of Bollinger Bands

The HNX-Index adjusted slightly after testing the Middle Band of Bollinger Bands. Trading volume has remained below the 20-day average for three consecutive weeks, with no signs of improvement, making a short-term breakout unlikely.

Currently, the MACD indicator is narrowing its gap with the Signal line. If buying signals re-emerge in upcoming sessions, the short-term outlook could improve.

Capital Flow Analysis

Smart Money Movement: The Negative Volume Index of the VN-Index is above the 20-day EMA. If this condition persists in the next session, the risk of a sudden downturn (thrust down) will be mitigated.

Foreign Capital Movement: Foreign investors net sold during the November 27, 2025 trading session. If this trend continues in upcoming sessions, market volatility may persist.

III. MARKET STATISTICS FOR NOVEMBER 27, 2025

Economic Analysis & Market Strategy Department, Vietstock Consulting Division

– 17:04 November 27, 2025

Vietnamese Billionaire Bags Billions Amid Fiery Stock Market Rally

Amidst a sea of red in the market and a VN-Index that plummeted by over 20 points, the fortunes of Vietnam’s top billionaires surged impressively. On November 25th, Phạm Nhật Vượng’s net worth soared by approximately $1.1 billion, while Nguyễn Phương Thảo’s wealth climbed by nearly half a billion dollars.

VN-Index Surges Over 20 Points on November 26th

The market is converging with multiple favorable factors: robust capital inflows, foreign investors returning to net buying, and a more positive investor sentiment.

Market Pulse 26/11: Foreign Investors Return to Strong Net Buying in Financial Sector, VN-Index Rebounds by 20 Points

At the close of trading, the VN-Index surged 20 points (+1.2%), reaching 1,680.36, while the HNX-Index climbed 4.61 points (+1.79%) to 261.91. Market breadth favored buyers, with 484 stocks advancing and 206 declining. Similarly, the VN30 basket saw green dominate, as 24 stocks rose, 5 fell, and 1 remained unchanged.