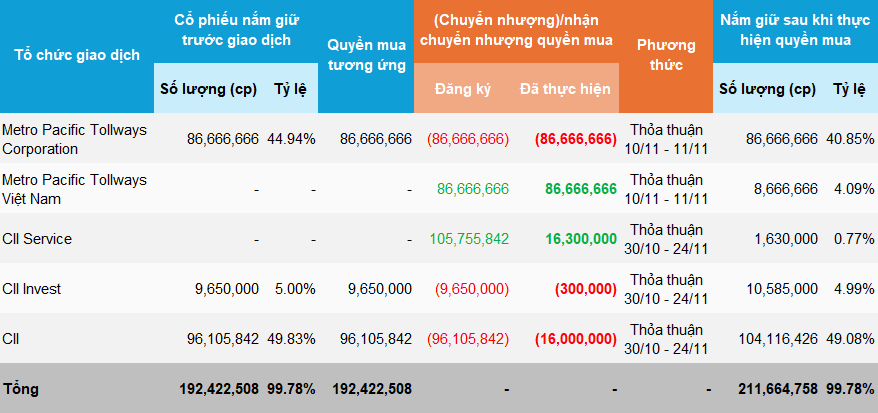

From October 30 to November 24, three institutional shareholders traded LGC warrant rights. Notably, all failed to fully execute their registered amounts due to time constraints.

Specifically, CII Service and Investment Company LLC (CII Service) acquired 16.3 million warrants out of nearly 105.8 million registered. Conversely, HCMC Infrastructure Investment JSC (HOSE: CII) and CII Trading and Investment Company LLC (CII Invest) transferred 300,000 and 16 million warrants, respectively, totaling the amount received by CII Service. Notably, both CII Invest and CII Service are subsidiaries of CII.

Regarding relationships, Mr. Nguyễn Văn Thành, Chairman of LGC’s Board of Directors, also serves as Chairman of CII Invest’s Members’ Council, Chairman of CII Service, and Deputy General Director of CII. Additionally, Mr. Lê Quốc Bình, a member of LGC’s Board of Directors, is the General Director of CII; Mr. Lê Trung Hiếu, LGC’s Financial Director, is CII’s Capital Management Director; and Mr. Nguyễn Duy Minh, Deputy General Director of LGC, is CII’s Infrastructure Construction Management Director.

If these parties exercise their warrants in the future, CII and CII Invest will hold over 104.1 million and nearly 10.6 million LGC shares, respectively, representing ownership stakes of 49.08% and 4.99%. Meanwhile, CII Service, currently holding no shares, could own over 1.6 million shares, or 0.77% of LGC’s capital.

Additionally, between November 10 and 11, two other institutions traded large volumes of LGC warrant rights. Metro Pacific Tollways Vietnam LLC acquired nearly 86.7 million warrants, while Metro Pacific Tollways Corporation (Philippines) transferred the exact same amount. Recently, Metro Pacific Tollways Vietnam exercised its warrants between November 17 and 21, acquiring nearly 8.7 million LGC shares.

Regarding relationships, three Philippine members of LGC’s Board of Directors are affiliated with these organizations. Mr. Jose Ma. Kamantigue Lim is also a Board Member of Metro Pacific Tollways Corporation; Mr. Luis Soriano Refion serves as Chairman and CEO of NLEX, a subsidiary of Metro Pacific Tollways Corporation; and Mr. Francis Gerard Elizaga Aberilla (also Deputy General Director of LGC) is Deputy General Director of NLEX.

Furthermore, Mr. Francis Gerard Elizaga Aberilla is the CEO of Metro Pacific Tollways Vietnam.

|

5 organizations recently transferred large volumes of warrants in LGC

Source: LGC, compiled by the author

|

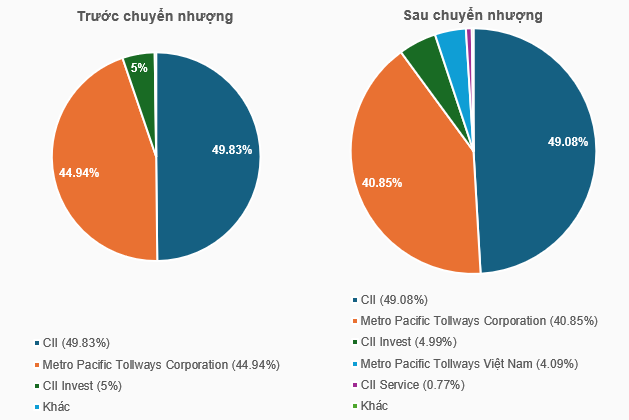

Regarding ownership structure, while the major shareholder group maintains a total ownership of 99.78% of LGC’s capital, the number of major shareholders is expected to decrease from 3 to 2, as CII Invest’s ownership will drop to 4.99% if it fully exercises its warrants.

Ownership structure at LGC before and after the warrant transfers – Source: LGC, compiled by the author

|

This offering was initiated by LGC in late October, with a record date of October 21, warrant transfers from October 30 to November 24, and registration and payment for purchases from October 30 to November 28.

According to the announced plan, the company is offering a total of nearly 19.3 million shares at a ratio of 10:1 (1 share entitles the holder to 1 warrant, and 10 warrants allow the purchase of 1 additional share). This is expected to increase the charter capital from nearly 1,929 billion VND to over 2,121 billion VND, equivalent to over 212.1 million shares.

At a price of 10,000 VND per share, the company expects to raise nearly 193 billion VND, which will be used entirely to repay a loan from BIDV West Saigon Branch.

On June 19, 2025, LGC’s Board of Directors approved a resolution to contribute 323 billion VND to Hiền An Bình Road Bridge LLC, financed by a credit line from BIDV West Saigon.

According to the Q3/2025 financial statement notes, this loan has a 6-month term (maturing on December 24, 2025) with an interest rate of 4.8-5% per year, secured by LGC’s deposit contract at BIDV West Saigon. As of September 30, 2025, the outstanding loan balance is 265 billion VND.

– 16:44 26/11/2025

The Top Shareholder: Unveiling the Largest Stakeholder of BVBank’s Vice Presidency

“Ms. Nguyen Thanh Phuong is the Vice-Chairwoman of the Board of Directors at BVB Bank (BVBank), a position that sees her hold almost 5% of the Bank’s shares. This makes her the largest individual shareholder, with a higher percentage of ownership than any of the other 8 individual shareholders who hold over 1% of BVBank’s capital.”

The Power Players: 11 Shareholders Control 35% of MSB’s Capital

The Vietnam Maritime Commercial Joint Stock Bank (MSB) has released an updated list of its significant shareholders, owning 1% or more of its charter capital. This list is based on data published by VSDC on June 28 and has been further refined with information provided by shareholders as of July 23.