Technical Signals of VN-Index

During the morning trading session on November 27, 2025, the VN-Index continued its upward trend, surpassing the 50-day SMA line.

The MACD indicator also rose above the zero threshold, indicating an improved and more positive short-term outlook.

Technical Signals of HNX-Index

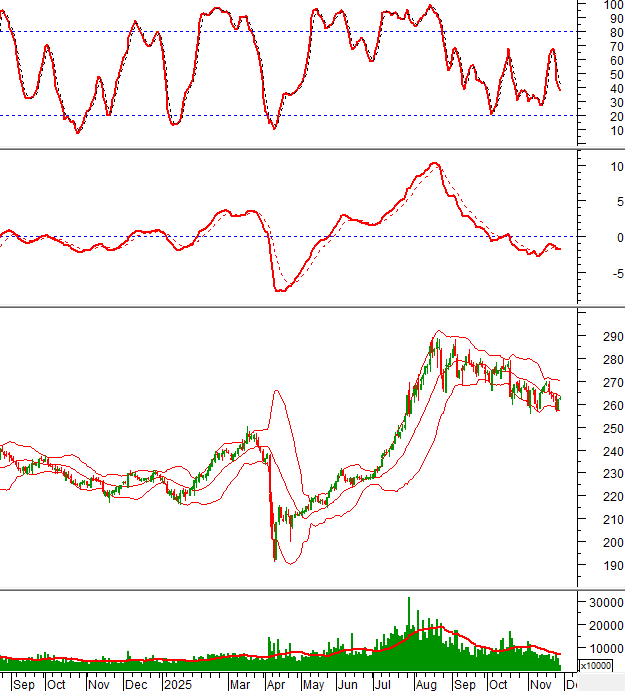

In the morning session on November 27, 2025, the HNX-Index is testing the Middle Band of the Bollinger Bands, showing a tug-of-war between buyers and sellers.

Trading volume remains below the 20-day average, making significant short-term breakthroughs unlikely.

MBB – Military Commercial Joint Stock Bank

On November 27, 2025, MBB shares rose, forming a small-bodied candlestick pattern as they retested the Middle Band of the Bollinger Bands, reflecting investor indecision.

Morning trading volume increased and is expected to exceed the average by session’s end.

The Stochastic Oscillator has issued a buy signal following a bullish divergence in the oversold region. If the indicator continues upward, breaking out of this zone in upcoming sessions, recovery prospects will strengthen.

VIX – VIX Securities Corporation

On November 27, 2025, VIX shares climbed, accompanied by rising volume expected to surpass the average by session’s end, signaling optimistic investor sentiment.

The MACD indicator is approaching the zero line after generating a buy signal, while the stock price has crossed above the Middle Band of the Bollinger Bands. Continued improvement in these technical signals would support a more sustainable short-term recovery.

(*) Note: This analysis is based on real-time data as of the morning session’s close. Signals and conclusions are for reference only and may change by the end of the afternoon session.

Technical Analysis Department, Vietstock Advisory Division

– 12:02 November 27, 2025

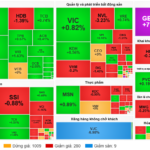

Vietstock Daily 28/11/2025: Is Market Polarization Returning?

The VN-Index trimmed its gains, forming a Long Upper Shadow candlestick pattern, signaling heightened profit-taking pressure as the index tests its September 2025 peak (around 1,695-1,711 points). Nevertheless, the short-term outlook remains positive, supported by the MACD indicator’s continued upward trajectory and its recent crossover above the zero line.

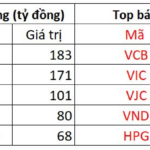

Vietnamese Billionaire Bags Billions Amid Fiery Stock Market Rally

Amidst a sea of red in the market and a VN-Index that plummeted by over 20 points, the fortunes of Vietnam’s top billionaires surged impressively. On November 25th, Phạm Nhật Vượng’s net worth soared by approximately $1.1 billion, while Nguyễn Phương Thảo’s wealth climbed by nearly half a billion dollars.