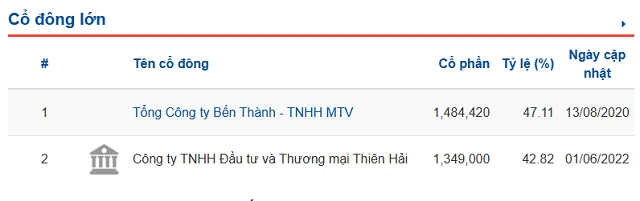

BSC is currently 47.1% owned by Benthanh Group, while Thien Hai Investment and Trading LLC holds 42.8%. Thien Hai became a major shareholder in 2022 after acquiring 1.35 million shares, replacing another large shareholder who sold nearly all their stake.

The company was established in 2003 through the merger of several trade, logistics, and seafood processing units under Benthanh Group. It transitioned to a joint-stock model in 2007 and listed on the HNX in 2011.

|

The 2025 annual general meeting report reveals BSC has only 72 shareholders, with two major institutional shareholders holding nearly 90% of the capital.

Source: Vietstock Finance

|

At its peak, BSC operated across three core pillars: trade and services, logistics, and property leasing. Its prime locations in Ho Chi Minh City’s central districts ensured steady revenue, notably from the Honda motorcycle dealership on Tran Hung Dao Street, warehousing services in District 4, and a chain of mini hotels and restaurants in former District 1. These segments drove peak revenue of VND 70 billion and annual profits of VND 3–4 billion between 2009 and 2011.

This performance was not sustained. From 2017 to 2020, profits hovered below VND 1 billion. In 2021, during the COVID-19 pandemic, profits plummeted to just VND 115 million, with revenue falling to VND 7.3 billion.

Recent years have seen a financial rebound. In 2023, BSC reported a profit of VND 2.6 billion. In the first three quarters of 2025, profits reached nearly VND 2 billion, up 15% year-on-year, driven by VND 11 billion in revenue—a 40% increase. This growth is attributed to surging trade services revenue, while property leasing remains a stable cash flow source.

| BSC’s recent profit trends show positive signs of recovery. |

BSC’s current operations are significantly scaled down compared to its listing 15 years ago. The company primarily leases stalls at Tam Binh Market, Binh Dien Market, and 75-77 Calmette Street (former District 1, Ho Chi Minh City). The Calmette property, leased from Ho Chi Minh City’s government until 2046, generates approximately VND 231 million in monthly rental income.

Beyond its core business, BSC installs solar energy systems for Transimex ecosystem entities and provides technical services such as surveillance cameras and cooling systems to affiliated partners.

Its largest investment is a 27.2% stake in the Vinh Loc Palace wedding venue project in former Binh Tan District, valued at over VND 21 billion. However, by Q3 2025, VND 6.4 billion had been provisioned for potential losses on this investment.

BSC is one of 24 Benthanh Group affiliates but holds a minor capital share, incomparable to core investments in brands like Savico (HOSE: SVC) or BenThanh Tourist (UPCoM: BTV).

BSC’s headquarters at 390 Nguyen Cong Tru, former District 1, Ho Chi Minh City – Image: Googlemaps

|

– 10:40 27/11/2025

Foreign Block Buys Nearly VND 600 Billion as VN-Index Surges: Which Stocks Were Scooped Up the Most?

Foreign investors’ trading activity has been a significant boost to the market, with a net buying value of approximately 579 billion VND. This influx of investment highlights their confidence in the market’s potential and serves as a positive indicator for future growth.

Affordable Housing Projects in Hai Phong and Ho Chi Minh City Now Accepting Applications

Beyond Hanoi, numerous social housing projects in other localities such as Ho Chi Minh City and Hai Phong have also started accepting registration applications.