Nam A Bank has launched a comprehensive support program for customers affected by natural disasters in Northern and Central Vietnam. For business clients, the bank offers a 2% annual interest rate reduction for the first three months, applicable to both new and existing customers. Additionally, all over-the-counter transaction fees for payment accounts (in VND and foreign currencies) are waived.

The bank also provides tailored financial solutions to help businesses stabilize capital, improve cash flow, and swiftly resume production and operations. These policies are effective until December 31, 2025.

For individual borrowers, Nam A Bank reduces lending rates by up to 2% annually, with a maximum loan limit of 85% of the collateral value. A grace period of up to 12 months on principal repayments is offered to help individuals stabilize their lives and rebuild their businesses. Loans for production capital, asset purchases, construction, home repairs, and personal consumption are eligible for these benefits. Existing borrowers enjoy a 1.0% interest rate reduction and up to 50% off early repayment fees. These individual customer policies are valid until February 13, 2026.

A Nam A Bank representative stated, “Aligned with our sustainable development goals, we integrate social responsibility into our business operations. Supporting communities through challenging times is a long-term commitment for us. Through timely and practical initiatives, we aim to alleviate financial burdens, helping customers recover and rebuild after natural disasters.”

Social responsibility is a core value in Nam A Bank’s business philosophy.

This program builds on Nam A Bank’s ongoing community initiatives, reflecting its commitment to societal well-being. The bank has allocated nearly 10 billion VND for storm and flood relief efforts, targeting affected communities. These initiatives will continue to expand, reinforcing Nam A Bank’s dedication to community support and responsibility.

SHB and Vietnam Chemical Group Sign Strategic Cooperation Agreement

The partnership between SHB and Vinachem marks a significant new chapter in the relationship between these two leading enterprises, while also driving sustainable, modern, and integrated socio-economic development.

Nam A Bank Unveils Three Green Finance Strategies to Attract Foreign Investment at the 2025 Autumn Economic Forum

At the 2025 Autumn Economic Forum held from November 25–27 in Ho Chi Minh City, themed “Green Transition in the Digital Era,” Nam A Bank actively participated as a key partner. The bank presented strategic proposals on green finance, aiming to unlock international capital flows and drive sustainable development.

Nam A Bank and GCPF Sign Memorandum of Understanding: Collaborating on Climate-Resilient Finance Framework from 2026

Nam A Bank (HOSE: NAB) and the Global Climate Partnership Funds (GCPF) have formalized a strategic partnership through a Memorandum of Understanding. This collaboration underscores their shared commitment to jointly explore and develop a new climate-resilient financing framework in Vietnam, with a potential focus on the agricultural sector.

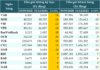

Skyrocketing Savings Rates: New Bank Disrupts the Market

Interest rates for terms ranging from 2 to 5 months at this bank have been increased to 4.75% per annum, the maximum rate permitted by the State Bank of Vietnam for deposits under 6 months.