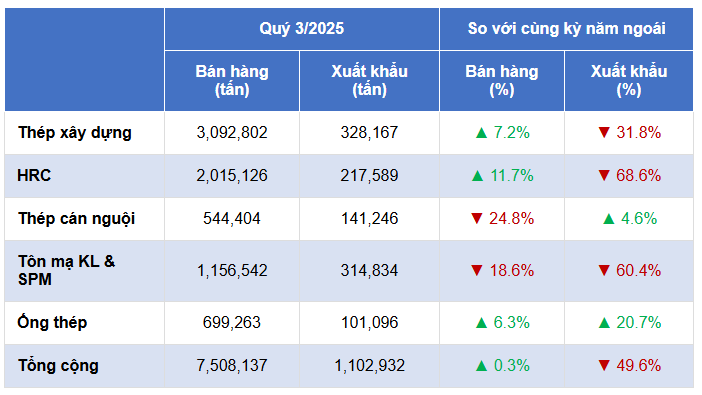

In Q3/2025, Vietnam’s steel industry experienced a slowdown, primarily due to challenges in the export channel. Companies shifted their focus to the domestic market, intensifying competition.

According to the Vietnam Steel Association (VSA), total finished steel sales in Q3 reached over 7.5 million tons, a modest 0.3% increase year-on-year. However, steel exports plummeted by nearly 50%, falling to approximately 1.1 million tons. Hot-rolled coils (HRC) and galvanized steel sheets saw the sharpest declines. These figures indicate stable domestic steel consumption but highlight significant export challenges due to reduced demand and trade barriers.

Steel Sales and Exports in Q3

Source: VSA

|

Amid this context, the steel industry’s performance showed a clear divide. Companies reliant on the domestic market fared well, while those dependent on exports struggled.

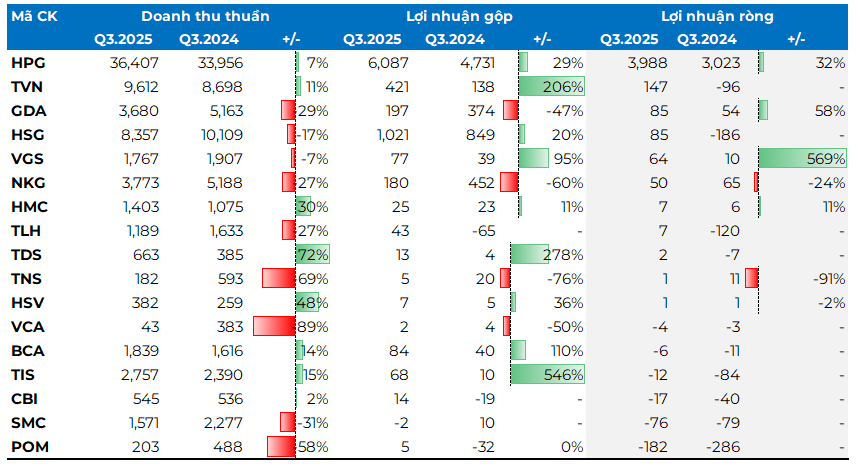

Hoa Phat (HOSE: HPG) maintained positive results, driven by contributions from the Dung Quat 2 plant and improved profit margins. In Q3/2025, the company reported net revenue of VND 36,407 billion and a net profit of nearly VND 4,000 billion, up 7% and 32% year-on-year, respectively.

During the quarter, the group produced 2.8 million tons of crude steel, a 14% increase from Q2 and a 35% surge compared to the same period last year. While sales of key steel products—including hot-rolled coils (HRC), construction steel, high-quality steel, and steel billets—dropped 4% quarter-on-quarter, they still rose 21% year-on-year to 2.5 million tons.

Vietnam Steel Corporation (VNSteel, UPCoM: TVN) also made significant strides in Q3/2025. With an 11% revenue increase, improved profit margins, and earnings from joint ventures, TVN turned a loss into a net profit of VND 147 billion.

Notably, Viet Duc Steel Pipe (VGS) reported a net profit 6.6 times higher than the previous year, reaching VND 64 billion, thanks to improved margins and earnings from joint ventures.

Q3/2025 Financial Results of Steel Companies

Unit: Billion VND

Source: VietstockFinance

|

Galvanized Steel Sector Hit Hard by Export Decline

Conversely, galvanized steel companies faced significant challenges as export channels weakened.

A prime example is Nam Kim Steel (HOSE: NKG), a leading galvanized steel producer with 42% of its revenue from exports in the first nine months of the year (down from 68% in 2025).

In Q3/2025, NKG recorded net revenue of over VND 3,770 billion, a 27% year-on-year decline. Net profit reached nearly VND 50 billion, down almost 24%. This was the company’s lowest quarterly profit this year and the fourth consecutive quarter of profit decline compared to the previous year.

Hoa Sen (HOSE: HSG) reported net revenue of VND 8,356 billion, a 17% year-on-year decrease. The company posted a net profit of VND 84 billion, an improvement from the VND 186 billion loss in the same period last year. However, this result was significantly lower than the previous quarter’s VND 273 billion profit.

Facing export challenges, Hoa Sen has focused on the domestic market. The company is actively expanding its Hoa Sen Home retail chain and investing VND 1,250 billion in land acquisition in Long Thanh.

Ton Dong A (GDA) saw a 58% surge in net profit to VND 85 billion, despite a 29% revenue decline. This result was attributed to a low base in Q3/2024, significant reductions in selling expenses, and a stronger focus on the domestic market compared to other industry players.

Pomina and SMC Continue Struggles

In the steel trading segment, Ho Chi Minh City Metal and Steel Trading (HOSE: HMC) reported an 11% increase in net profit to nearly VND 7 billion. Tien Len Steel extended its profit streak to the third consecutive quarter, albeit with a modest VND 7 billion profit.

Meanwhile, SMC Trading and Investment (HOSE: SMC) and Pomina Steel (UPCoM: POM) remained mired in losses.

In Q3/2025, SMC saw a 31% revenue decline, slight gross losses, and a net loss of VND 76 billion. This marked the fifth loss-making quarter in the past six. “Financial costs, operational management expenses, and provisions for receivables continued to weigh on performance,” SMC explained.

The company attributed the underwhelming results to proactive reductions in output for underperforming segments, particularly tube galvanizing production. Additionally, the slow recovery in the real estate market and ongoing financial restructuring efforts limited participation in high-margin construction projects. SMC is actively restructuring, recovering debts, and renegotiating with suppliers and customers.

Similarly, Pomina reported a net loss of over VND 180 billion, extending its losing streak since Q2/2022. The main causes were a 58% plunge in net revenue and a VND 160 billion debt burden.

According to management, the significant loss was due to the continued suspension of the Pomina 3 plant, incomplete recovery of other plants’ capacity, and high short-term interest expenses. In the first nine months, Pomina lost over VND 500 billion and had negative equity.

Pomina’s current challenges stem from its 2019-2020 decision to borrow for a blast furnace project. As of September 2025, the company had VND 1,730 billion in current assets, including only VND 22 billion in cash. Short-term liabilities exceeded VND 8,500 billion, with VND 5,200 billion in short-term loans and finance leases.

– 13:04 27/11/2025

Q3 Profits Surge for Shipping Operators Amid Vessel Disposal Boom

The Q3/2025 profit performance reveals a stark divergence among transportation sectors. While the container segment maintained its robust momentum and oil transportation showed signs of improvement, the offshore and bulk shipping sectors continued to face significant challenges, relying heavily on sporadic non-core income to stay afloat.