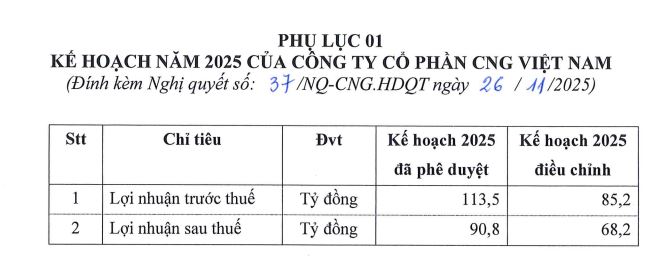

According to the Board of Directors’ resolution, CNG will adjust its 2025 business plan as follows: Both pre-tax and post-tax profits are reduced by 25%, to 85.2 billion VND and 68.2 billion VND, respectively.

|

Adjusted 2025 Business Plan of CNG

Source: CNG

|

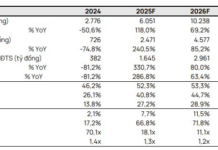

With the newly adjusted plan, CNG anticipates a 25% decrease in 2025 profits compared to the previous year’s performance, whereas the earlier target was to maintain profit levels.

In the first nine months of the year, CNG Vietnam has nearly reached its new target. Specifically, CNG Vietnam recorded revenue of 3,111.46 billion VND, a 26.5% increase year-on-year, with post-tax profit reaching 64.75 billion VND, a nearly 12% decline. Meanwhile, the gross profit margin improved from 8.1% to 8.4%.

Thus, CNG Vietnam has achieved 95% of its adjusted profit plan and over 71% of its initial 2025 post-tax profit target of nearly 91 billion VND set earlier this year.

| CNG‘s Profit Performance in Recent Years |

On the stock market, CNG shares are trading at 25,150 VND per share in the morning session of November 27, down nearly 17% since the beginning of the year. Average liquidity exceeds 100,000 shares per day.

– 11:03 27/11/2025

10 Months of Dull Performance in the Power Sector Stocks

Despite the VN-Index surging over 30% in 10 months and numerous blue-chip stocks hitting new highs, the power sector stocks have largely remained on the sidelines of the market’s exuberance. This isn’t surprising for a defensive sector that prioritizes stability over volatility. Yet, beneath this quiet surface lie compelling narratives worth the market’s attention.