Dat Phuong Joint Stock Company (Stock Code: DPG) recently submitted a document to the Ho Chi Minh City Stock Exchange (HoSE), disclosing unusual information regarding the implementation of a private placement of shares.

Specifically, the Board of Directors of Dat Phuong issued Resolution No. 51/NQ-ĐP-HĐQT, approving the execution of the private placement plan, which was previously endorsed by the Annual General Meeting (AGM) in Resolution No. 05/NQ-ĐP-ĐHĐCĐ on October 28, 2025.

According to the approved plan, Dat Phuong intends to offer nearly 17.8 million DPG shares at a price no less than 1.5 times the book value per share, based on the latest consolidated financial statements published before the Board’s resolution.

The company plans to sell these shares to a maximum of 20 professional securities investors with strong financial capabilities and the potential to contribute to the company’s business operations.

Illustrative image

The AGM authorized the Board to approve the specific list of professional securities investors and the number of shares allocated to each investor. The Board is also empowered to adjust the investor list based on actual negotiations and investor capabilities at any given time.

The private placement is expected to be executed in 2025 or 2026, pending approval from the State Securities Commission.

The Board will continue to offer shares to other eligible investors (if any) and redistribute any unsold shares to alternative professional securities investors at a price no lower than the initial offering price, ensuring compliance with approved investor criteria and safeguarding the interests of the company and its shareholders.

If shares remain unsold by the distribution deadline, they will be canceled, and the Board will formally conclude the offering.

The primary objectives of this private placement are to increase shareholders’ equity, enhance financial capacity for project investments, bolster working capital, and procure machinery and equipment for the company’s construction activities.

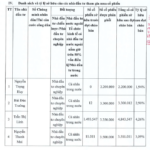

The proceeds from the offering are earmarked for the following purposes:

To address any capital shortfalls from the offering, the company will leverage additional funding sources, including internal capital, bank loans, and other financial resources. These measures will be reported to shareholders at the next Annual General Meeting.

In a separate development, the Board of Dat Phuong issued Decision No. 55/QĐ-ĐP-HĐQT, approving additional capital contributions and the acquisition of shares in a subsidiary.

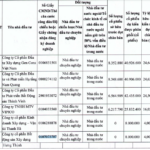

Specifically, Dat Phuong plans to exercise its right to purchase over 8 million shares in Kinh Dat Phuong, with a total capital contribution (at par value) of 80.3 billion VND. The company intends to use funds from the 2025 private placement to finance this additional capital injection into Kinh Dat Phuong.

The Board also approved the acquisition of 3.41 million shares owned by Mr. Phan Ngoc Long at a price of 11,400 VND per share, totaling nearly 38.9 billion VND.

Upon completion of the capital contribution and share acquisition, Dat Phuong will hold a total of 44,412,500 shares in Kinh Dat Phuong, representing 80.75% of its chartered capital.

Breaking News: CEO and Entire Leadership Team Liquidate All Company Shares

Every transaction is meticulously executed with the primary goal of achieving personal financial balance, utilizing either negotiated agreements or order matching on the trading platform.

Penalties for Private Stock Offering and Sale Violations Can Reach Up to 1.5 Billion VND

The Vietnamese government has issued Decree No. 306/2025/NĐ-CP, effective November 25, 2025, amending and supplementing several provisions of Decree No. 156/2020/NĐ-CP on administrative penalties in the securities and stock market sector. Notably, the decree introduces a significant fine ranging from VND 1 billion to VND 1.5 billion for offenses such as forging documents or providing false certifications to meet the conditions for offering or issuing shares.

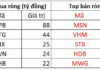

ROX Group Investors Eye 166 Million Individual Shares of SBSI in Potential Acquisition

SBSI is set to issue 166.1 million shares, catapulting its chartered capital by 5.8 times to a staggering VND 2,000 billion. Notably, all six investors participating in this offering share strong affiliations with the ROX Group.