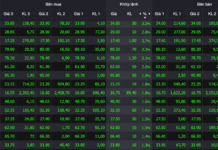

The stock market surged by 20 points, closing at 1,680 points. A sea of green dominated the floor, with over 240 stocks on HoSE gaining value. From the opening bell, buying pressure took control. Gone were the days of “green on the outside, red on the inside,” as today’s consistent inflow of capital reflected a more confident investor sentiment. With key sectors rallying in unison, investors can now cautiously bet on a new upward market trend.

The market awash with green.

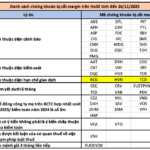

Among large-cap stocks, VPL led the market rally, hitting its ceiling price—marking its fourth consecutive day of gains and a nearly 20% surge in just a few days. VIC further bolstered the benchmark index. The Vingroup family continued to demonstrate its significant market influence.

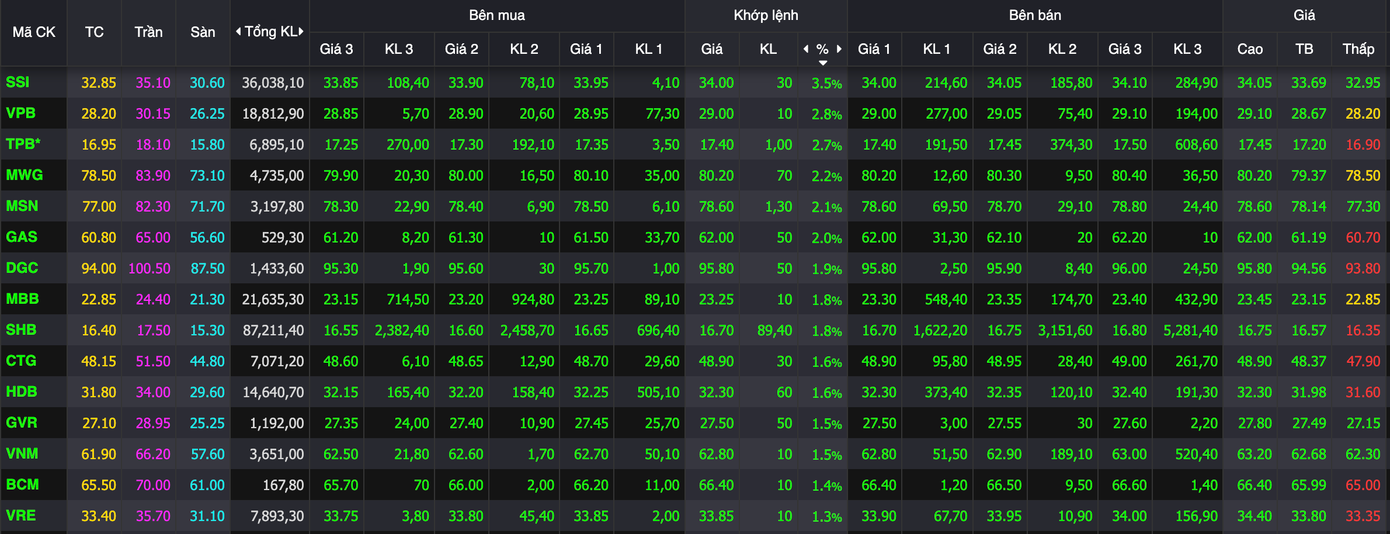

Banking stocks maintained their leadership role, attracting both domestic and foreign inflows. Green dominated VPB, TPB, EIB, MBB, and CTG, among others.

Securities firms saw a unanimous rise, with VIX hitting its ceiling, SSI up 3.5%, VCI up 3.3%, VND up 3.3%, and HCM up 2.48%. In real estate, capital flowed into both speculative and leading stocks. GEX hit its ceiling, while CII, DXG, CEO, PDR, DIG, DXS, NLG, and SCR all rose over 3%.

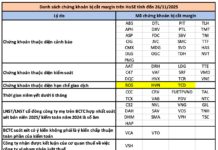

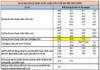

Notably, during the market recovery, trading activity from the Gelex group and related stocks stood out. GEX, GEE, and VIX all hit their ceilings, with GEE reaching 194,400 VND per share. A subsidiary of the Gelex ecosystem, GELEX Infrastructure JSC, was granted approval by the State Securities Commission to issue 100 million shares in its IPO.

If successful, GELEX Infrastructure is expected to raise 2.8 trillion VND. The capital will be used to increase the charter capital of Titan Hai Phong JSC, funding the “Investment and Business Project for Infrastructure in Tran Duong – Hoa Binh Industrial Zone (Zone A) – Phase 1” and restructuring the company’s finances.

At the close, the VN-Index rose 20 points (1.2%) to 1,680.36. The HNX-Index gained 4.61 points (1.79%) to 261.91, and the UPCoM-Index added 0.3 points (0.25%) to 119.22. Foreign investors turned net buyers, with inflows nearing 600 billion VND, adding another highlight to the session.

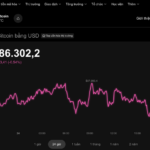

Today’s Crypto Market, November 24: What Secrets is Bitcoin Holding Before the End-of-November Deadline?

Analysts predict that if Bitcoin maintains its position above $92,000 this week, the likelihood of a recovery to the $105,000 – $110,000 range will become more apparent.

Where is the Stock Market’s Trading Focus Currently Directed?

The spotlight is now on sectors that have been attracting strong liquidity in recent sessions, including real estate, chemicals, and construction.