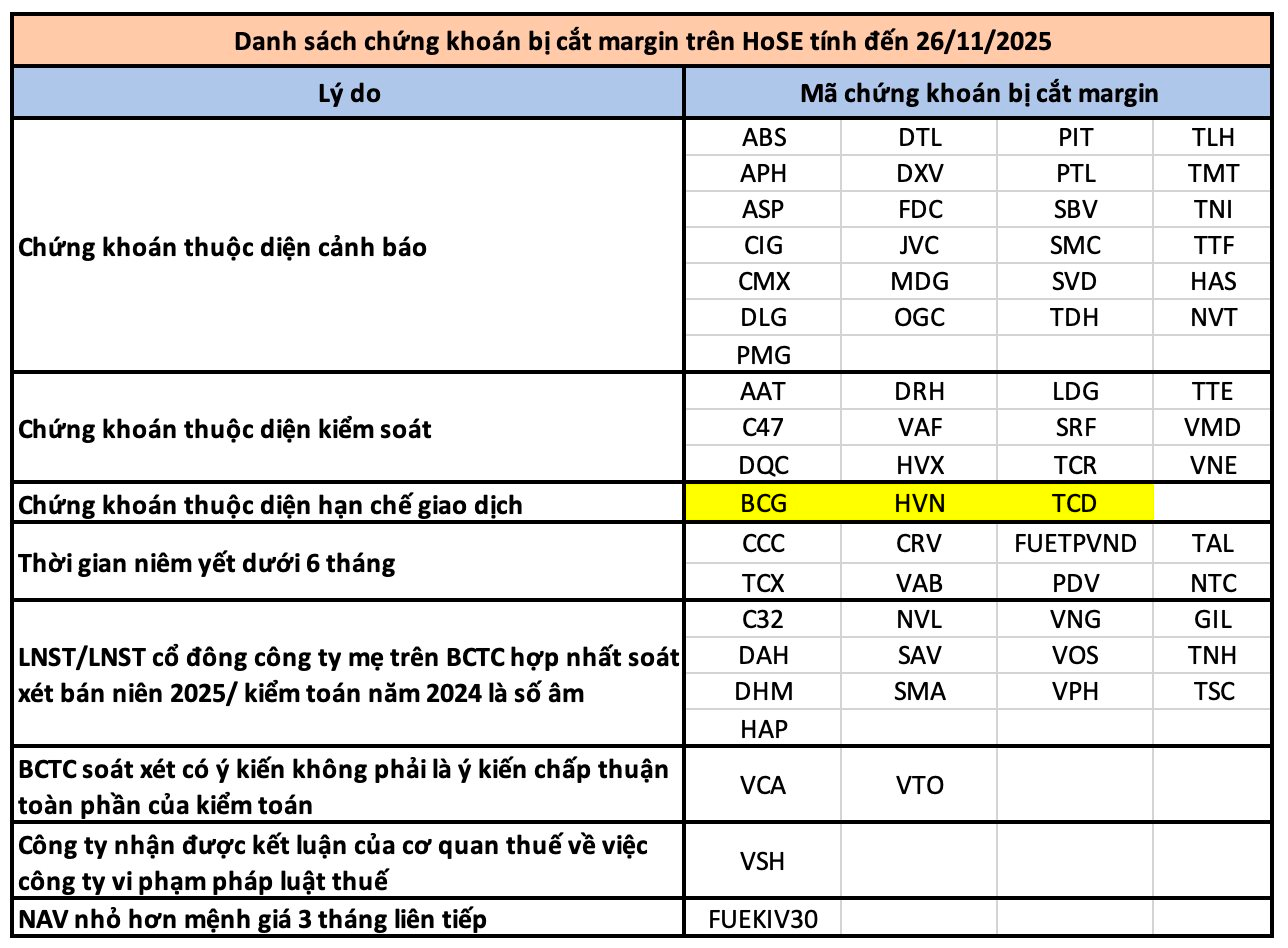

The Ho Chi Minh City Stock Exchange (HOSE) has recently updated its list of securities ineligible for margin trading. As of November 26, 2025, 65 stock codes have been removed from margin eligibility on HOSE.

Most notably, HOSE has reinstated VPL (Vinpearl Joint Stock Company) to the list of margin-eligible securities.

VPL officially listed and began trading on HOSE on May 13, 2025. Having been listed for over six months, the stock is not subject to any trading warnings, controls, or restrictions.

HOSE cites several reasons for removing securities from margin eligibility, including: being under trading warning/control/restriction; reporting negative after-tax profits with auditor qualifications; and being listed for less than six months.

Familiar stock codes on the list include BCG, HVN, NVL, LDG, OGC, TLH, and NVT, among others.

Under the regulations, investors are prohibited from using credit limits (financial leverage – margin) provided by securities companies to purchase these 65 stocks deemed ineligible for margin trading.

Official: Billionaire Pham Nhat Vuong’s Stocks Approved for Margin Trading

Stocks surged in response to the margin trading approval, rallying for five consecutive sessions and pushing the market capitalization past 158.7 trillion VND.

Market Pulse 26/11: VIC Weighs Down, VN-Index Narrows Gains

The VN-Index fluctuated around the 1,665-point mark during the final hours of the morning session. After peaking with a gain of over 15 points, the VN-Index narrowed its increase to approximately 7.3 points (+0.44%), closing the mid-session at 1,667.64 points. Similarly, the HNX-Index rose by 1.41%, reaching 260.92 points. Market breadth showed 382 advancing stocks, 223 declining stocks, and 996 unchanged stocks.