Within the framework of the international conference “Technological Breakthrough and Innovation – Shaping the Future Generation for Ho Chi Minh City” held in Ho Chi Minh City on the afternoon of November 27, the panel discussion on the three pillars of the International Financial Center (IFC) outlined a strategic vision for Vietnam.

Overview of the panel discussion on the afternoon of November 27, held at the Ho Chi Minh City Innovation and Startup Center (SIHUB)

|

Leading experts dissected the symbiotic relationship between the three foundational elements, emphasizing a consistent message: the legal framework (governance) must be reliable and transparent enough to attract international capital, and the banking system (cooperation) must be modern enough to manage and deploy that capital effectively.

Sharing project updates, Ms. Nguyen Truc Van, Director of the Center for Economic and Social Simulation and Forecasting (HIDS) and a member of the IFC project steering committee’s support team, stated that Ho Chi Minh City is in the final stages of preparation to launch the center, expected in December this year. A core organizational structure with key personnel is ready, along with a draft operating charter for the executive body. Membership criteria and an online registration portal are being developed for swift approval within 1-2 days.

Regarding infrastructure, the IFC has a clear three-phase roadmap: temporarily using the 6th floor of Innovation Hub, then moving to 8 Nguyen Hue Street, before constructing the official iconic building in Thu Thiem Urban Area.

To ensure strategic vision, an advisory board comprising international experts has been established, alongside memorandums of understanding with major partners like NASDAQ, Binance, and planned collaborations with TikTok.

Ms. Nguyen Truc Van, Director of the Center for Economic and Social Simulation and Forecasting (HIDS), speaking at the panel discussion

|

However, the most critical step in building investor confidence lies in the legal aspect. Ms. Truc Van emphasized that adopting “Common Law” and establishing a specialized court, along with allowing investors to choose international commercial arbitration, has become a strategic lever. This is seen as the key to addressing global investors’ long-standing concerns about dispute resolution mechanisms in Vietnam.

Once the legal foundation is established, the question arises: What unique advantages will Vietnam leverage to compete in an already crowded financial landscape?

From “Manufacturing Hub” to “Financial Gateway”

The path to IFC success lies not in replicating models like Singapore or Hong Kong, but in identifying and leveraging unique competitive advantages. Vietnam must transform its distinct strengths into an uncopyable identity, which was the focus of the discussion.

From a regional bank’s perspective, Mr. Fred Lim, Director of Digital Commercialization at Hong Leong Bank, highlighted two core competitive advantages unmatched by any regional financial center:

First, the manufacturing strength from the “China plus one” strategy has made Vietnam a crucial link in the global supply chain, something Singapore or Hong Kong lacks. Second, the IFC launch coincides with accelerating global production shifts, offering Vietnam deeper integration into the value chain.

Mr. Fred Lim, Director of Digital Commercialization at Hong Leong Bank

|

Combining these factors, Mr. Fred Lim outlined an ambitious strategic vision for Vietnam’s IFC as a “home factory to finance gateway,” reflecting its role as a center connecting manufacturing and capital flows.

This vision becomes sharper when paired with green finance potential. The manufacturing advantage presents a unique opportunity for Vietnam to become a financial hub for sustainable supply chains in the region. This involves not just funding factories but also creating a specialized financial ecosystem to support green transitions across the entire Vietnam-based supply chain.

However, turning this vision into reality is challenging. Mr. Lim warned that foreign financial institutions’ primary concern is the “lack of regulatory clarity” in the early stages. Building trust through a transparent IFC governing body capable of swift support and issue resolution is therefore critical.

Beyond manufacturing, Vietnam has another strategic “weapon” in its leading position in digital technology.

Riding the “Technology Wave”

Two trends reshaping global finance are digital assets and green finance. These are areas where Vietnam has exceptional potential to create unique competitive advantages for its IFC, rather than following traditional paths.

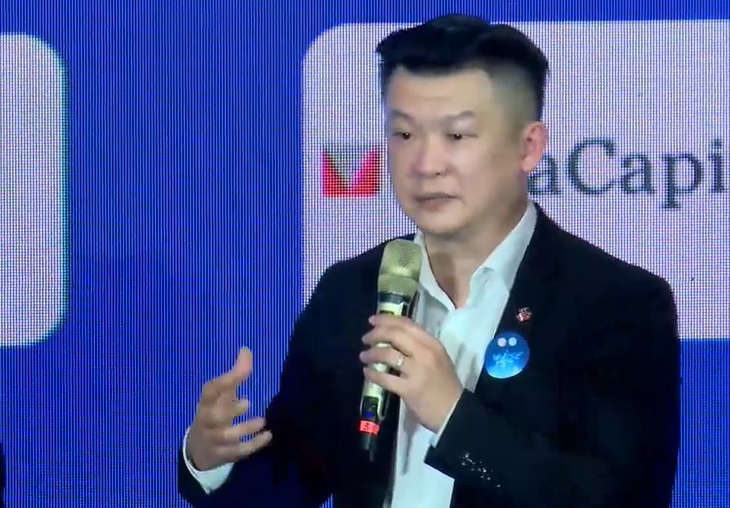

Mr. Tran Huyen Dinh, Chairman of the Fintech Application Committee, Vietnam Blockchain and Digital Asset Association

|

In digital assets, Mr. Tran Huyen Dinh, Chairman of the Fintech Application Committee, Vietnam Blockchain and Digital Asset Association, outlined pivotal legal advancements. The Digital Technology Industry Law, effective next year, defines digital and encrypted assets for the first time. More importantly, Resolution 05 allows a 5-year sandbox for encrypted asset transactions.

Mr. Dinh argued that Vietnam can operate dual mechanisms: a national legal framework and a special IFC regime allowing crypto companies registered here to trade with international clients. This leverages Vietnam’s global blockchain leadership, creating a uniquely attractive IFC.

Ms. Vuong Van Anh, Director of Strategy and Business Development at VinaCapital

|

In green finance, Ms. Vuong Van Anh, Director of Strategy and Business Development at VinaCapital, affirmed Vietnam’s vast potential to become the region’s “green capital hub.” This potential is built on enormous capital needs (over $300 billion, per World Bank, for climate adaptation), existing strengths in agriculture and renewable energy, and global sustainable investment trends.

To realize this potential, experts outlined specific requirements. Vietnamese companies seeking international green capital must meet six core ESG criteria:

– Transparency & International reporting standards;

– Governance with independent ESG-savvy members;

– Risk management systems including environmental and social factors;

– Strict legal compliance & Anti-corruption measures;

– Social responsibility with equality and community policies;

– Performance measurement via clear KPIs.

For digital assets, investors require a secure ecosystem, including standard custodial services, risk insurance, robust AML/KYC processes, and above all, a clear legal framework.

– 16:52 28/11/2025

THACO and VinSpeed Steal the Spotlight at High-Speed Rail Conference

The consultation meeting on the morning of November 27 revealed a stark divide: while some businesses demonstrated thorough preparation, committing to capital and timelines, others struggled to address questions about financial capacity, with some even lacking basic information in their submissions.

Ho Chi Minh City: Voters Petition to Cancel Nearly 30-Year-Old “Frozen” Urban Development Project

The Sing Việt Urban Area project, spanning over 28 years, has left residents frustrated as their concerns, voiced across multiple levels, remain unresolved.