HDBank has officially announced on the State Securities Commission’s portal and the Ho Chi Minh City Stock Exchange regarding the sale of Vietjet shares.

The Board of Directors of HDBank has adopted a resolution approving the plan to sell the Vietjet shares currently held by the bank. However, detailed information about the plan has not yet been disclosed.

HDBank plans to divest from Vietjet.

According to Vietjet’s first-half report, HDBank holds 6 million VJC shares, equivalent to 1.01% of Vietjet’s capital.

In 2023, HDBank previously divested from Vietjet multiple times to reduce non-core investments as per its earlier strategy. These divestments generated significant profits for HDBank, totaling approximately VND 1,500 billion from its Vietjet investment.

In terms of business performance, HDBank’s cumulative results for the first nine months show positive growth, with credit increasing by 22.6% and pre-tax profit exceeding VND 14,800 billion (up 17%).

Notably, HDBank is seeking shareholder approval for a 2025 dividend and bonus share plan totaling 30% (25% in stock dividends and 5% in bonus shares), maintaining its consistent high payout policy over the years.

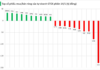

Vietjet Shares Plunge as Billionaire Nguyen Thi Phuong Thao’s Holdings Hit Floor

Profit-taking pressure has emerged as a key factor behind Vietjet’s sharp stock decline, following a more than twofold surge in its share price since the beginning of the year.

Vietjet Launches VND 1,000 Billion Bond Issuance

Vietjet has launched 10,000 corporate bonds under the code VJC12504, with a face value of 100 million VND per bond. This issuance totals a face value of 1,000 billion VND.