The Ministry of Finance has proposed a new decree to establish special mechanisms for the operations and financial management of Vietnam Electricity (EVN). This move aims to address practical challenges, streamline processes, and unlock the corporation’s resources, enabling greater autonomy and efficiency.

The proposed decree seeks to overcome limitations and inconsistencies arising from the implementation of Decree No. 26 and Decree No. 10, which currently govern EVN’s financial regulations and charter. These updates are essential to align with the evolving realities of EVN’s operations and the broader legal framework.

The Ministry of Finance has drafted a decree outlining special operational and financial management mechanisms for EVN.

The draft decree includes specific provisions for EVN’s capital mobilization and lending mechanisms. It proposes that the Prime Minister authorizes the State Bank of Vietnam to approve credit limits exceeding standard thresholds for EVN, its subsidiaries, and related entities. This authorization would facilitate borrowing for projects listed in the National Power Development Plan and provincial plans.

This proposal is grounded in the Credit Institutions Law and the anticipated surge in investment needs for the national power grid. EVN and its subsidiaries rely heavily on loans to fund their projects, but securing domestic credit often involves lengthy processes. The proposed mechanism aims to expedite approvals for exceptional cases where credit limits are exceeded.

Additionally, the decree addresses the revaluation of fully depreciated power assets held by EVN’s wholly-owned subsidiaries. It stipulates that the state capital representative at EVN will approve revaluation initiatives, with EVN’s Board of Directors overseeing the process. Any increases in asset value post-revaluation will be allocated to bolster the capital of the parent company and its subsidiaries, with regular reports submitted to the state capital representative.

Current legislation lacks clear guidelines on the authority and procedures for revaluing assets in wholly state-owned subsidiaries. Historically, EVN’s subsidiaries underwent asset revaluations under Decision 352/QĐ-TTg in 2011, highlighting the need for updated regulations.

EVN and its subsidiaries are currently under significant financial strain, with high debt-to-equity ratios approaching unsafe levels. Annual depreciation expenses total 69 trillion VND, including 58 trillion VND for long-term debt repayment and 11 trillion VND for net investment.

Securing sufficient equity for investments through 2035 poses a major challenge. Without increases in chartered capital, the debt-to-equity ratios of key subsidiaries (EVNNPT, EVNSPC, EVNNPC, EVNHN) would become unsustainable, jeopardizing their ability to raise capital for planned projects. The Ministry of Finance emphasizes that enabling asset revaluation and capital supplementation is crucial to strengthening EVN’s financial health.

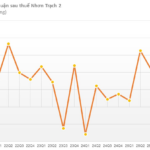

In its 2024 audited consolidated financial report, EVN reported a post-tax profit of over 7.2 trillion VND for the parent company, an improvement from previous periods. However, accumulated losses for the parent company and consolidated group stood at 44.8 trillion VND and 38.688 trillion VND, respectively, as of year-end 2024. EVN has proposed incorporating these losses into average electricity prices, a suggestion that has sparked public debate.

F88 Launches First-Ever Public Bond Offering with 10% Annual Interest Rate

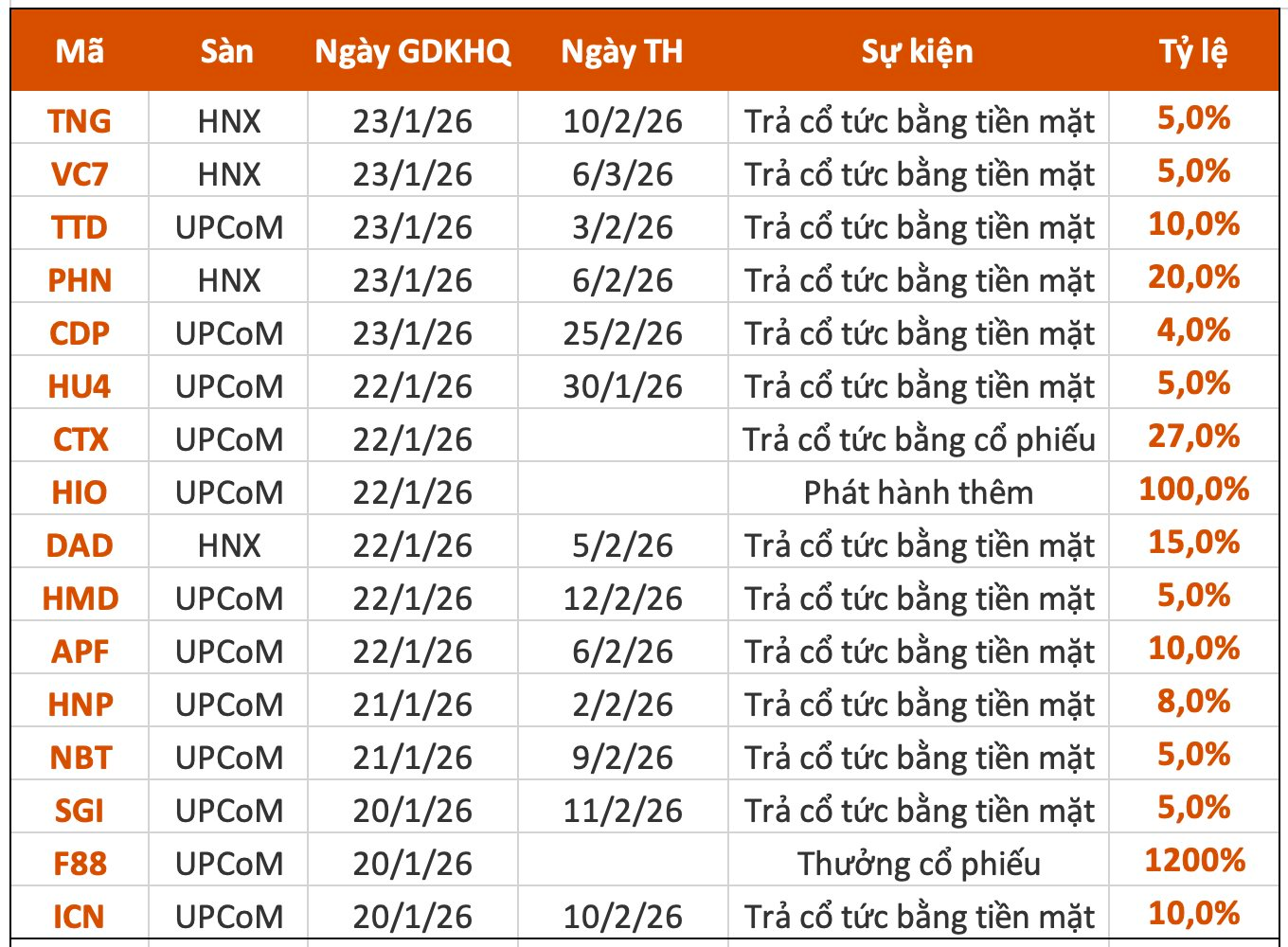

As a leading bond issuer with an impeccable track record of on-time payments and offering yields of up to 10% per annum, F88 Investment Corporation (UPCoM: F88) is now recognized for its highly attractive retail bonds. This positions the company to capture the attention of investors seeking both stability and competitive returns.

Interest Rates Remain Stable to Bolster Year-End Business and Production Growth

A stable macroeconomic environment, controlled inflation, and increased capital mobilization have empowered credit institutions to reduce costs and maintain competitive lending rates. This strategic financial landscape fosters robust growth in production, business, trade, and services, particularly during the year-end period.

National Housing Fund Operations: Government Releases Detailed Regulations

The Vietnamese government has recently issued Decree No. 302/2025/NĐ-CP, dated November 19, 2025, which provides detailed regulations on the National Housing Fund. This decree also outlines measures to implement Resolution No. 201/2025/QH15, passed by the National Assembly on May 29, 2025. The resolution pilots specific mechanisms and policies aimed at fostering the development of social housing.

Another Bank Hits the Ceiling on Savings Interest Rates Under 6 Months on November 19th

This bank has just significantly increased deposit interest rates for 3- to 5-month terms to the maximum level allowed by regulations, at 4.75% per annum.