Construction Corporation No. 1 – JSC (Stock Code: CC1, UPCoM) has recently announced a Board of Directors Resolution approving the organization of an Extraordinary General Meeting of Shareholders (EGM).

The meeting is scheduled for January 9, 2026, and will be held online to accommodate shareholders located remotely. The final registration date for shareholders to exercise their rights to attend and vote at the EGM is December 15, 2025.

During the meeting, CC1 will present several key proposals to shareholders, including amendments to the company’s charter, a capital increase plan, and the removal and election of new Board of Directors members for the 2021-2026 term. Candidates for the Board must submit their applications in accordance with legal requirements and the company’s charter.

Illustrative image

In other developments, CC1 recently disclosed that it has received Decision No. 4204/QĐXPHC dated November 20, 2025, from the Ho Chi Minh City Tax Department regarding administrative penalties for tax violations.

The company was found to have breached tax procedures as outlined in the Law on Tax Administration. Specifically, CC1 delayed submitting its tax declaration form (Form 05/KK-TNCN for personal income tax deduction) for November 2024, exceeding the deadline by 1 to 30 days.

This violation falls under Article 13, Clause 2, of Decree 125/2020/NĐ-CP dated October 19, 2020, which governs administrative penalties for tax and invoice violations. As a result, CC1 has been fined VND 3.85 million.

Additionally, the company is required to rectify the situation by paying late tax submission fees as stipulated in the Law on Tax Administration and its implementing regulations.

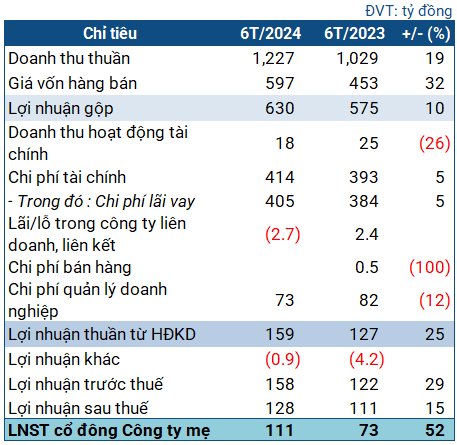

Regarding business performance, in the first nine months of 2025, CC1 reported net revenue of over VND 7,451 billion, a 26.2% increase compared to the same period in 2024. After-tax profit reached more than VND 182.2 billion, up 185.1% year-on-year.

As of September 30, 2025, CC1’s total assets stood at over VND 15,759.2 billion, a 5.8% decrease from the beginning of the year. Short-term receivables amounted to nearly VND 6,257.4 billion, accounting for 39.7% of total assets, while inventory was approximately VND 2,218.2 billion.

On the liabilities side, total debt was nearly VND 11,216.1 billion, down 7.8% from the start of the year. Loans and financial lease liabilities totaled over VND 6,003.4 billion, representing 53.5% of total debt.

Hoang Quan Real Estate Halts Plans to Issue 50 Million Shares for Debt Swap

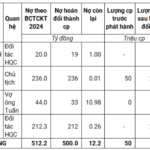

Recognizing the need to adjust and update information in its issuance registration profile, Hoang Quan Real Estate has temporarily halted its plan to issue 50 million shares to swap for VND 500 billion in debt.

IDICO Announces 15% Cash Dividend Advance Payment

IDICO Group (HNX: IDC) has announced the dividend payment for its shareholders, offering a 15% cash dividend for the first phase of 2025, equivalent to 1,500 VND per share. The ex-dividend date is set for December 3rd, and shareholders can expect to receive their payments starting from December 23rd.

Breaking News: CEO and Entire Leadership Team Liquidate All Company Shares

Every transaction is meticulously executed with the primary goal of achieving personal financial balance, utilizing either negotiated agreements or order matching on the trading platform.