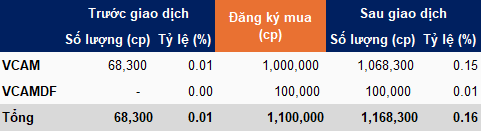

Specifically, VCAM—a member of Vietcap—announced its intention to purchase up to 1 million shares of VCI via order matching, with a long-term investment goal. This transaction is set to occur between December 2 and December 30. Previously, VCAM had registered to buy 68,300 shares of VCI from November 18 to December 17.

Simultaneously, VCAMDF, a fund managed by VCAM, has also registered to purchase a maximum of 100,000 shares of VCI. Both entities share the same trading method, investment purpose, and execution timeline.

In total, the VCAM group plans to acquire up to 1.1 million shares of VCI, potentially increasing their total holdings to nearly 1.2 million shares. This represents a 0.16% stake in the company’s charter capital.

|

Group members registered to acquire up to 1 million shares of VCI

Source: VietstockFinance

|

Based on the closing price of 33,750 VND per share on November 28, the group is estimated to invest approximately 37 billion VND. This long-term investment move by two Vietcap ecosystem members comes as VCI shares have been consistently “bottoming out” recently. Since peaking at around 48,000 VND per share in early September, VCI has dropped by 30%.

| VCAM and VCAMDF register purchases amid VCI‘s continuous “bottoming out” |

Established in 2006, Bản Việt Securities Investment Fund Management (VCAM) is headquartered at HM Town Building, 412 Nguyễn Thị Minh Khai, Bàn Cờ Ward, Ho Chi Minh City. As of September 30, 2025, VCAM operates with 22 employees.

VCAM’s primary activities include establishing and managing securities investment funds, entrusted investment portfolios, and providing securities investment advisory services in Vietnam. In addition to VCAMDF, the company manages two other funds: the Bản Việt Balanced Investment Fund (VCAMBF) and the Bản Việt Bond Investment Fund (VCAMFI). It also oversees entrusted investment portfolios.

As of September 30, 2025, VCAM’s total assets reached nearly 251 billion VND, a 13% increase from the beginning of the year. This includes approximately 183 billion VND in short-term financial investments, with over 83 billion VND allocated to listed stocks (notable holdings include HVN, MBS, VIC, VIB, TPB…) and nearly 99 billion VND in unlisted stocks, specifically the three funds under management.

Another notable point is that the company manages entrusted investment portfolios totaling over 184 billion VND, a 57% increase from the start of the year. These portfolios are primarily allocated to listed stocks, with nearly 137 billion VND, and the remainder, approximately 48 billion VND, in unlisted stocks.

On the same day as VCAM’s investment decision, Vietcap’s Board of Directors passed a resolution to secure a credit loan from foreign banks totaling up to 250 million USD (approximately 6,600 billion VND at current exchange rates). This includes a framework agreement for up to 120 million USD with the option to increase the limit by an additional 130 million USD.

In other notable personnel developments, on November 27, Vietcap announced the appointment of Mr. Bùi Vũ Hoàng Tuyên—Chief Legal Officer and Head of Governance—as the Authorized Information Disclosure Officer, replacing his predecessor, Mr. Đoàn Minh Thiện. This decision takes effect from December 1 until further notice.

– 17:46 28/11/2025

VCI Sets Private Placement Price at VND 31,000, Attracting Foreign Institutions Willing to Invest Hundreds of Billions

The Board of Directors of Vietcap Securities Corporation (HOSE: VCI) has recently passed a resolution to issue 127.5 million private placement shares, aiming to increase its charter capital to VND 8,501 billion. The offering has attracted significant interest, with 69 investors, including both institutions and individuals, expressing their intent to purchase tens of millions of shares.

VCI Approves Private Placement of Up to 127.5 Million Shares, Anticipating 10-20% Profit Surge in Annual Plan

On the afternoon of November 7thOn the afternoon of November 7th, Vietcap Securities Corporation (HOSE:On the afternoon of November 7th, Vietcap Securities Corporation (HOSE: VCI) held an extraordinary shareholders’ meeting to discuss and vote on a private placement plan, the establishment of an overseas subsidiary, and amendments to the company’s charter. During the meeting, shareholders expressed keen interest in theOn the afternoon of November 7th, Vietcap Securities Corporation (HOSE: VCI) held an extraordinary shareholders’ meeting to discuss and vote on a private placement plan, the establishment of an overseas subsidiary, and amendments to the company’s charter. During the meeting, shareholders expressed keen interest in the company’s business prospects and changes in executive leadership.