Credit Growth Reaches Nearly 14% in 9 Months

The State Bank of Vietnam reports that as of September, credit growth across the banking system has surged to nearly 14% compared to the end of 2024, significantly outpacing the 9.11% recorded in the same period last year. Third-quarter financial reports highlight robust credit growth across most banks.

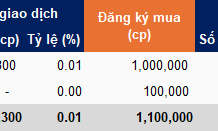

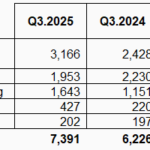

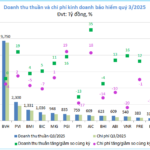

BIDV leads with outstanding loans exceeding VND 2,230 trillion, an 8.8% increase since the beginning of the year, equivalent to a VND 180 trillion rise. VietinBank saw a 15.6% growth, reaching nearly VND 1,990 trillion. Vietcombank achieved VND 1,630 trillion, a 12.5% increase.

Among private banks, MB tops customer lending with VND 931.5 trillion by September-end, a nearly 20% rise year-to-date. VPBank’s credit growth is strong, with outstanding loans nearing VND 900 trillion.

Strong credit growth across multiple banks.

Techcombank’s credit grew by 21.4%, with personal loans up 16% and corporate loans by 22.2%.

ACB’s third-quarter outstanding loans reached VND 669 trillion, a 15.2% increase year-to-date, outpacing the industry average. Corporate lending remains the primary growth driver at 20%. VIB’s credit hit nearly VND 373 trillion, up 15%; HDBank saw a 22.6% rise.

By early November, several banks announced depleted credit limits, deferring new loans to next year.

Drivers of Credit Growth

At a recent economic forum, Mr. Phan Như Ánh, CEO of MB Bank, noted that MB’s strategy focuses on retail and SME clients, allocating 50-60% of its credit growth to these segments annually.

MB targets large enterprises, prioritizing manufacturing, import-export, and key sectors. It has launched products to boost credit growth among retail clients and exporters.

In an interview with Tiền Phong, Dr. Lê Xuân Nghĩa, a policy advisor to the Prime Minister, stated that this year’s projected 18% credit growth is normal, reflecting post-COVID-19 economic recovery. Last year’s GDP, though high, did not surpass pre-pandemic 2019 levels.

Dr. Lê Xuân Nghĩa, Policy Advisor to the Prime Minister.

Dr. Nghĩa added that despite new U.S. tariffs, export growth remains strong, with impacts likely more pronounced next year. The real estate market’s recovery, after stagnation in 2021-2023, is driving demand.

He attributed credit growth to resolved administrative and legal bottlenecks, thanks to National Assembly Resolutions 171 and 98. The government is also addressing stalled projects, boosting credit demand.

Dr. Nghĩa dismissed concerns over real estate credit growth, noting its market size and economic ripple effects. As the economy rebounds to pre-2019 levels, real estate’s strong recovery is natural.

He highlighted that lending rates are rising due to inflation and exchange rate pressures, not credit demand. Banks’ depleted limits are cyclical, with rates expected to ease next year.

Strategic Partnership Signed Between Funding Societies Vietnam and Nam A Bank

On November 7th, Funding Societies Vietnam, a member of the Funding Societies Group – Southeast Asia’s leading financial platform for small and medium-sized enterprises (SMEs), signed a Memorandum of Understanding (MoU) with Nam A Commercial Joint Stock Bank – An Dong Branch. This partnership aims to pursue foreign currency funding for Vietnamese SMEs.

Unveiling the Financial and Banking Industry’s Rising Stars of 2025

In a year marked by significant shifts in the banking sector, the distinguishing factor among financial institutions lies in their strategic choices, risk management approaches, and ability to capitalize on growth opportunities. From the leadership demonstrated by major banks to the remarkable advancements of dynamic players, the market has witnessed several notable highlights.

Credit Surges and Liquidity Pressures

Capital mobilization has lagged behind debt growth as a prevailing trend among banks since the beginning of the year. According to the Q3-2025 financial reports, deposits across 27 listed banks rose by a mere 10.2% compared to the start of 2025. Strikingly, 21 of these banks recorded higher growth rates in outstanding loans than in customer deposits.

Dong Thap: Surpassing Budget Targets, Attracting Investment, and Creating Over 55,000 Jobs

Amidst prevailing challenges, Đồng Tháp has emerged as a beacon of economic and social vitality. The province’s state budget revenue for the first 11 months of 2025 has already surpassed the annual target, while robust investment inflows, a surge in newly established businesses, and the creation of over 55,000 jobs underscore its remarkable progress.