In Q3/2025, phone and electronics distributors and retailers experienced mixed business performances amid sluggish market consumption. The intense competition was evident as Hnammobile, a long-standing phone chain in Ho Chi Minh City, announced its closure in October.

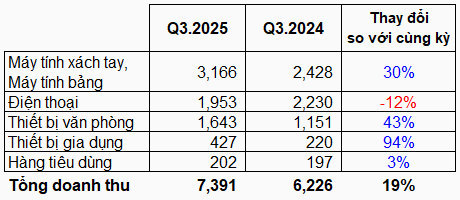

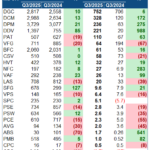

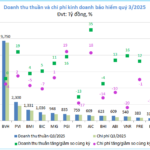

Digiworld (HOSE: DGW), a major distributor with flagship brands like Xiaomi and Apple, saw its phone segment revenue drop 12% to VND 1.95 trillion due to weak demand and heightened competition in the sub-VND 10 million price range. However, strong growth in laptops, office equipment, and home appliances, driven by new partnerships, boosted Digiworld’s total revenue by 19% to nearly VND 7.4 trillion.

Petrosetco (HOSE: PET), with a limited product portfolio, reported a 3% revenue decline in the quarter.

|

Digiworld’s Q3/2025 Revenue

Unit: Billion VND

Source: Digiworld Reports

|

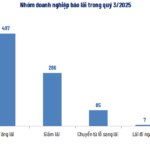

Amid fierce competition, only retail giants with robust resources and distinct strengths gained market share.

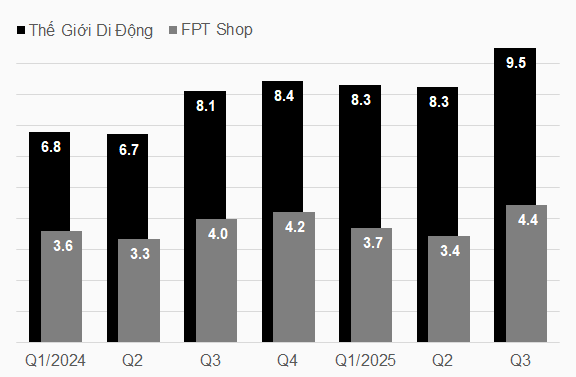

The World Mobile Group’s (HOSE: MWG) phone chain achieved Q3 revenue of VND 9.52 trillion, up 17% year-on-year. FPT Shop, under FPT Retail (HOSE: FRT), recorded over VND 4.4 trillion, a 11% increase. These results were partly fueled by Apple’s early iPhone launch in Vietnam this year.

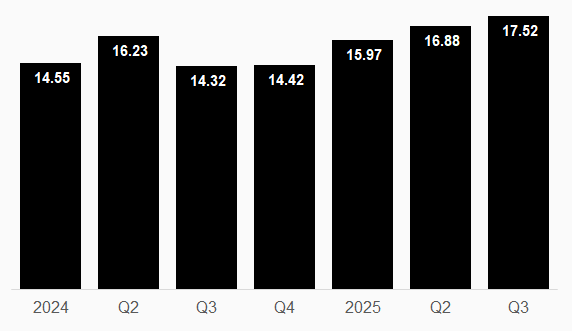

In electronics, MWG’s Dien May Xanh reported Q3 revenue of VND 17.5 trillion, a 22% rise.

|

Revenue of Leading Phone Chains (2024-2025)

Unit: Trillion VND

Source: MWG, FPT Retail Reports

|

|

Dien May Xanh Revenue (2024-2025)

Unit: Trillion VND

Source: MWG Reports

|

Intense Competition in the Auto Sector

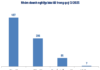

Economic consumption challenges were also reflected in auto distributors’ performance.

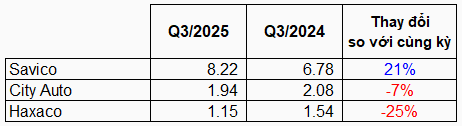

In Q3/2025, Haxaco (HOSE: HAX), distributor of Mercedes and MG, and City Auto (HOSE: CTF), Ford distributor, saw revenues fall 25% and 7%, respectively. Haxaco reported its second consecutive quarterly loss, while City Auto barely broke even.

Haxaco attributed the decline to reduced spending on luxury vehicles and aggressive discounts across segments. Competitors also launched new models with deep incentives to attract buyers.

Savico (HOSE: SVC) posted 21% revenue growth to over VND 8.2 trillion, but profits stemmed mainly from investment sales, with shrinking gross margins and rising operational costs.

|

Revenue of Listed Auto Companies

Unit: Trillion VND

Source: Financial Reports of Savico, City Auto, Haxaco

|

– 14:32 28/11/2025

Q3 2025 Aviation Outlook: Airline Growth Stalls, Services Diverge Sharply

The Vietnamese aviation market in Q3/2025 concluded with contrasting business results among different enterprise groups. ACV reported a significant profit surge, driven by a wave of international passengers, while airlines faced declining profits. The inauguration of Terminal 3 at Tan Son Nhat Airport has reshaped the aviation service landscape.

Ho Chi Minh City Real Estate Boom: Flood of Listings, But Crowded Market Doesn’t Guarantee Sales

As the year draws to a close, the real estate market enters its peak season, unsurprisingly flooding the scene with a wave of new projects. Yet, in an era where savvy buyers reign supreme, a bustling marketplace no longer guarantees sales success.