According to the State Bank of Vietnam (SBV), the purpose of issuing this Decree is to ensure a balance between the rights and legitimate interests of both borrowers and lenders. It aims to establish a comprehensive and balanced approach to the regulations on the seizure of collateral for non-performing loans, minimizing the impact on people’s daily lives, production, and labor. This approach contributes to social stability while respecting the principle that “Individuals and legal entities establish, perform, and terminate their civil rights and obligations based on freedom and voluntary commitment and agreement. All commitments and agreements that do not violate legal prohibitions or social morality are enforceable among the parties and must be respected by others,” as stated in Article 3, Clause 2 of the Civil Code No. 91/2015/QH13.

The Decree consists of 8 articles outlining the conditions for the seizure of collateral for non-performing loans as per Point đ, Clause 2, Article 198a of the Law on Credit Institutions No. 32/2024/QH15, amended and supplemented by Law No. 96/2025/QH15. It applies to credit institutions, foreign bank branches, state-owned organizations with 100% charter capital involved in debt trading and handling, and relevant agencies, organizations, and individuals.

The Decree is designed to ensure that when seizing collateral such as a sole residence or primary or sole means of labor, credit institutions must allocate a financial reserve. This reserve enables the guarantor to maintain their livelihood and cover essential living expenses for themselves and their family.

This Decree will take effect from December 1, 2025.

According to Mr. Nguyễn Đức Lệnh, Deputy Director of the State Bank of Vietnam (SBV) Branch in Zone 2, Decree 304/2025/NĐ-CP provides specific regulations on the conditions for seizing collateral for non-performing loans, particularly when the collateral is a sole residence or primary or sole means of labor. For such cases, the secured party must allocate a financial reserve for the guarantor, as stipulated in Article 4 of the Decree.

Mr. Lệnh emphasizes that these regulations are comprehensive, balancing the practical need for collateral seizure in credit activities with humanitarian considerations and the requirements of a socialist-oriented market economy.

First, legal provisions on seizing collateral for non-performing loans not only enable credit institutions to proactively manage and recover debts, facilitating capital circulation and enhancing banking efficiency, but also foster a sense of responsibility among borrowers. Borrowers are encouraged to use loan funds effectively and for their intended purposes, ensuring economic benefits and timely repayment.

Thus, the legalization of Resolution 42 on handling collateral for debt recovery, along with the specific provisions of Decree 304, will positively impact non-performing loan management, credit expansion, and capital efficiency across the economy.

Second, the seizure of collateral for non-performing loans, with specific conditions for sole residences or primary means of labor, reflects a humanitarian approach. It supports borrowers in distress, contributing to social security while maintaining legal effectiveness and achieving the broader goals of collateral seizure.

Mr. Lệnh advises credit institutions to focus on communication, consultation, and guidance for borrowers to ensure understanding and compliance. Grasping the legal framework for loan guarantees, collateral seizure, and debt recovery is crucial for citizens and borrowers. It not only promotes legal compliance and effective policy implementation but also maximizes the role of credit in the economy through responsible borrowing and repayment practices.

– 11:28 28/11/2025

Enhancing Market Stability Mechanisms for Gold

To date, eight commercial banks have met the required capital criteria to be licensed for gold production, import, and export activities.

Governor of the State Bank of Vietnam Nguyễn Thị Hồng and Deputy Governor Phạm Thanh Hà Awarded First-Class Labor Orders

On November 24, 2025, the State Bank of Vietnam (SBV) will host the 9th National Emulation Congress of the Banking Sector and the Conference to Review the 5-Year Implementation of the National Strategy on Gender Equality, Women’s Advancement, and the “Proficient in Banking, Exemplary at Home” Movement (2021–2025) in Hanoi. This prestigious event underscores the sector’s commitment to fostering excellence, equality, and progress within the banking industry and beyond.

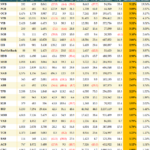

Q3 Non-Performing Loan Coverage Ratio Continues to Improve

The non-performing loan coverage ratio of the banking system continued its recovery trend in Q3. Effective management of bad debts has provided banks with additional time to rebuild their buffers following the previous sharp decline. Each bank implements distinct provisioning policies based on its strategic direction, leading to varying approaches in provisioning across different groups.

Central Bank Maintains Net Injection Pace in Open Market Operations

Amidst heightened overnight interbank transaction volumes from November 10–17, the State Bank of Vietnam (SBV) sustained its fifth consecutive week of net injections into the open market operations (OMO) arena.

Will Bank Bad Debt Return to Safe Levels by Year-End?

Despite lingering risks, particularly in real estate and consumer sectors, the overall outlook remains positive as the year draws to a close. With credit growth sustaining its steady pace and legal frameworks for debt resolution improving, bad debt levels are likely to ease slightly by year-end, staying within manageable limits.