On November 28, 2025, at the Melia Hanoi Hotel, VIX Securities Corporation (stock code VIX – HOSE) held its 2025 Extraordinary General Meeting of Shareholders.

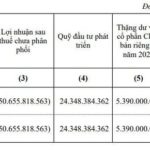

The meeting unanimously approved key resolutions, including the adjustment to increase the 2025 business plan compared to the plan previously presented at the Annual General Meeting. The specific adjusted plan includes pre-tax profit of VND 6,500 billion and post-tax profit of VND 5,200 billion, a 433% increase over the plan approved by the Annual General Meeting.

In addition to the plan increase, another notable resolution passed was the capital increase plan, offering additional shares to existing shareholders at a ratio of 10:6. The expected number of additional shares to be issued is 918,857,914. The offering price is VND 12,000 per share. The total expected proceeds from the offering are VND 11,026,294,968,000. After the capital increase, the new expected capital is VND 24,500 billion.

The proceeds from the offering will be used to supplement operating capital to contribute to VIX Crypto Asset Exchange Joint Stock Company and enhance proprietary trading capabilities and margin lending activities.

The capital increase at this time is essential to help the company seize market opportunities and strengthen its core business activities, meeting the needs of a continuously growing customer base and anticipating market upgrade opportunities.

Furthermore, the meeting approved the removal and replacement of one Board of Directors member for the 2025-2030 term. Specifically, the meeting approved the resignation of Mr. Truong Ngoc Lan as a Board member. The reason is to focus on fulfilling his role as CEO, separating the management role of the Board from the executive role of the CEO. Mr. Truong Ngoc Lan will continue to serve as CEO and legal representative of VIX Securities. The newly elected member is Mr. Phan Duc Linh, who has over 20 years of experience in technology and management.

In addition to the approved resolutions, the Company’s Board also addressed shareholder questions during the meeting. Regarding the feasibility of achieving the adjusted plan in the current market context, the Board representative expressed the Board and management’s commitment to achieving the plan approved at the meeting. Additionally, when asked about the Company’s participation in the digital asset market and its preparations, the Board representative confirmed that VIX will participate and has selected a technology partner to enter this market.

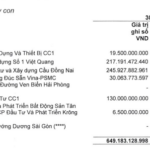

Consecutive Capital Injection Denials by CC1 for Subsidiary and Affiliated Companies

Leading construction conglomerate No. 1 Corporation – JSC (UPCoM: CC1) is demonstrating a clear strategic shift in its portfolio restructuring by halting further capital injections into several subsidiaries, despite their recent establishment.

Brokerage Firm’s Stock Surges to Upper Limit Ahead of Extraordinary Shareholder Meeting

Previously, VIX experienced a steep decline, with its price plummeting from nearly 40,000 VND per share (on October 16th) to below 23,000 VND per share (by November 25th). This represents a staggering loss of almost 74% in value within just over a month.

Dual Momentum: SHB’s Capital Raise Strategy and Foreign Investment Attraction Opportunities

SHB’s upcoming capital increase strategy is poised to propel the bank into the top 4 private banks by charter capital, solidifying its competitive edge through enhanced financial strength. Additionally, SHB is anticipated to join the FTSE Russell global equity index basket once Vietnam achieves its upgrade to emerging market status. These dual catalysts collectively fuel SHB’s potential for exceptional growth in the foreseeable future.