GTD shares of Thuong Dinh Shoe Joint Stock Company (GTD) continued to surge dramatically on November 27th, extending their consecutive winning streak to seven sessions. The stock price climbed to VND 30,000 per share, marking a staggering 154% increase in less than two weeks and reaching its highest level in five years. However, trading volume remained lackluster, with only a few hundred shares changing hands in each session.

In response to the sharp rise, Thuong Dinh Shoe issued a statement affirming that its production and business operations remain normal, with no unusual events impacting the stock price. The company attributed the surge to market supply and demand dynamics, emphasizing that it has taken no actions to influence the stock’s trading price.

The stock’s remarkable rally followed the announcement by Hanoi People’s Committee regarding its plan to divest from the company. On December 16, 2025, the committee will hold a public auction to sell its stake in Thuong Dinh Shoe Joint Stock Company.

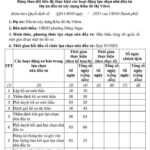

The auction will offer over 6.38 million shares, representing 68.67% of the company’s charter capital, at a starting price of VND 20,500 per share. If successful, the divestment could generate more than VND 130.9 billion for the committee.

Acquiring over 65% of the company’s capital would grant the investor controlling interest, enabling them to shape the company’s strategy and future direction.

Thuong Dinh Shoe traces its roots back to Workshop X30 under the Military Supply Department of the General Logistics Department, established in 1957 to produce hard hats and rubber sandals for the military. By 1985, the company expanded into exports, shipping products to Eastern European (former) and European Union markets. In the early 1990s, Thuong Dinh became a symbol of Vietnam’s footwear industry, with its iconic two-stripe canvas shoes and plastic soles beloved by generations of Vietnamese, from students and workers to athletes.

However, the golden era was short-lived. As the domestic market was flooded with cheaper, more diverse imported products, Thuong Dinh lost its competitive edge. Slow innovation in design, technology, and market strategy made it difficult for the company to maintain its appeal amid rapidly changing consumer preferences, leading to a significant decline in performance.

Over the past decade, Thuong Dinh Shoe has reported profits in only three years. According to the 2024 audited consolidated financial report, the company recorded net revenue of nearly VND 79 billion, a slight 2% decrease from 2023. After deducting taxes and fees, the company reported a net loss of nearly VND 13 billion in 2024, 2.6 times higher than the VND 5 billion loss in 2023. As of December 31, 2024, accumulated losses reached over VND 67 billion.

Notably, despite its poor financial performance, the company owns a prime 3.6-hectare plot of land at 277 Nguyen Trai, housing its factory and headquarters. The land boasts a wide frontage along Nguyen Trai Street, close to the Cat Linh – Ha Dong railway station (approximately 100 meters), and adjoins residential areas and major projects like Golden Tower and Rang Dong. This is one of the few remaining clean land plots in the inner city, earmarked for relocation of industrial facilities from the city center.

Recently, the Hanoi People’s Council approved a plan to develop the site into a mixed-use project featuring commercial housing, offices, services, and a K-12 school. Thuong Dinh Shoe will serve as the developer, with a projected investment of VND 1.6 trillion, aiming to complete relocation and construction by 2030.

Hà Nội Seeks to Divest from Once-Iconic Shoe Brand, Sparking Stock Market Speculation

Starting at an initial price of 20,500 VND per share, the Hanoi People’s Committee stands to generate a minimum revenue of 130.9 billion VND should the entire lot of shares be successfully auctioned.

Hanoi Accelerates Progress on 7,000 Billion VND Urban Development Project Delayed for 15 Years

The Hanoi People’s Committee has tasked the Dong Ngac Ward People’s Committee with inviting bids for the Vibex Urban Area Investment and Construction Project. This international open tender will follow a single-stage, single-envelope bidding process, commencing in Q4/2025.