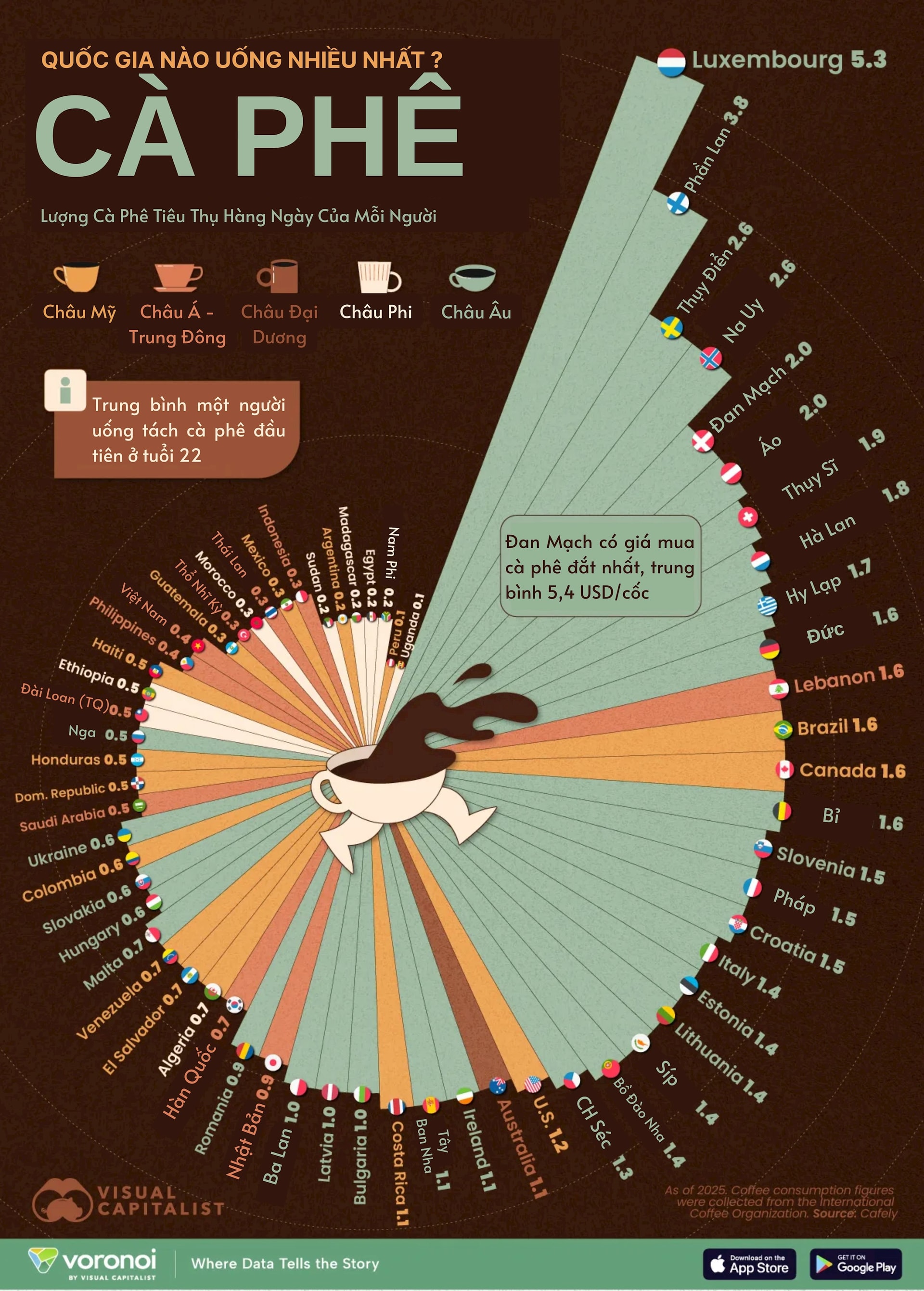

The global coffee market continued its steady growth in 2025, yet consumption habits vary significantly across countries, reflecting cultural nuances, income levels, and local coffee traditions.

Latest data from Cafely reveals that while Northern Europe leads in per capita consumption, major emerging markets—even top coffee-producing nations—consume far less.

Europe Dominates Per Capita Coffee Consumption

Northern Europe remains the world’s coffee consumption hub. Luxembourg tops the list with an average of 5.31 cups per person daily, far surpassing other major economies.

This dominance is partly driven by its large expatriate workforce, nearly half its population, whose coffee consumption is included in Luxembourg’s totals. The average coffee price here is $3.60 per cup, approximately 95,000 VND.

Finland and Sweden, renowned for their deep-rooted coffee cultures, follow closely behind. All top 10 global coffee-consuming nations are European, highlighting a blend of longstanding traditions and high consumer spending power.

Major Economies Show Lower Per Capita Consumption

Despite being large coffee markets in total volume, major economies like the U.S., Japan, and Brazil exhibit modest per capita consumption. Americans average 1.22 cups daily, ranking 24th globally. Coffee prices here reach $4.69 per cup, among the highest globally, trailing only Denmark ($5.40) and Switzerland ($5.00).

Japan, despite its thriving coffee culture and popularity of canned coffee, consumes less than one cup daily. Brazil, the world’s largest coffee producer, ranks 18th with 1.58 cups per person daily.

Vietnam’s Modest Consumption

As a leading global coffee producer, Vietnam’s per capita consumption is just 0.42 cups daily, ranking 48th out of 65 nations.

Experts note that Vietnamese coffee preferences align with traditional methods like phin-filtered or specialty brews, contrasting Europe’s daily high-frequency consumption. This creates a distinct model: lower frequency but a focus on quality experiences.

Lowest Global Consumers

At the bottom of the rankings, nations where tea or other beverages dominate show minimal coffee consumption. India ranks last with 0.02 cups daily—equivalent to one cup every seven weeks. Several African and South Asian countries also average under 0.3 cups daily, reflecting preferences for tea, cocoa, or traditional drinks.

This latest data underscores that while coffee is a global commodity, consumption habits remain deeply influenced by local culture, income, and traditions. Coffee businesses expanding into new markets must consider not only consumption volume but also how consumers experience and spend on each cup.

Today’s Coffee Prices (Nov 23): A Week of Turbulence

Coffee prices today have dipped compared to mid-week levels, yet remain higher than last weekend’s closing figures.

Asian Rice Export Prices Under Pressure as Weak Demand Meets Rising Supply

Export rice prices from India and Vietnam remained stable this week, while Thai rice prices experienced a slight decline due to reduced demand and ample supply.