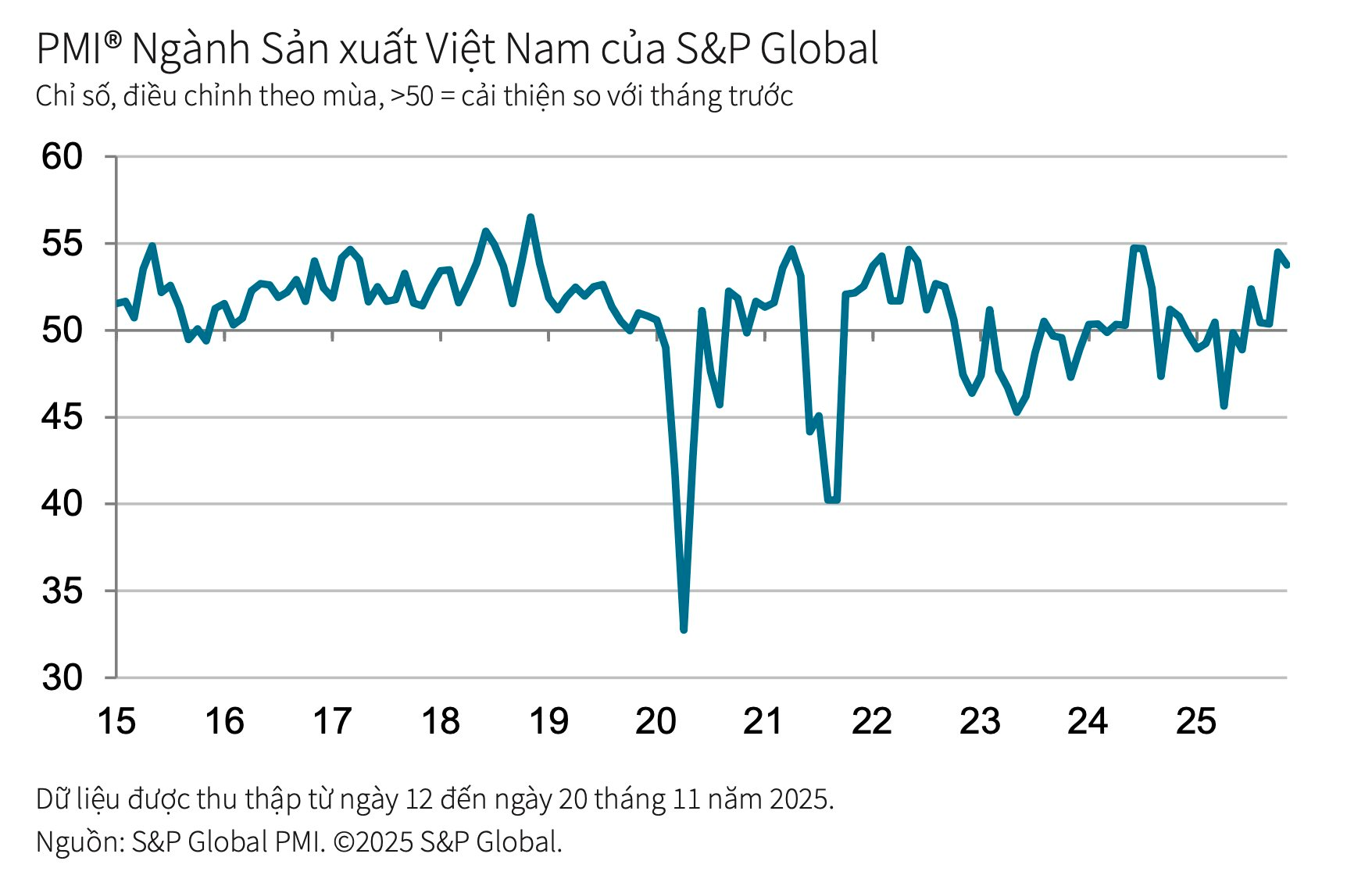

The Purchasing Managers’ Index (PMI) for November stood at 53.8, slightly lower than October’s 54.5 but firmly above the 50-point threshold. This indicates continued improvement in business conditions and marks the fifth consecutive month of recovery in the manufacturing sector.

According to S&P Global, both output and new orders continued to rise in November, albeit at a slower pace compared to the previous month.

Notably, new export orders accelerated, reaching their fastest growth rate in 15 months, driven by improved demand from mainland China and India. This signals a gradual recovery in external demand, providing a boost to manufacturing growth towards the year-end.

Adverse weather conditions in November, including heavy rainfall and storms, were identified as the primary obstacles to production. Many businesses reported disruptions in supply chains, leading to the longest delivery times since May 2022. Delayed raw material deliveries hindered factories’ ability to complete orders on time, resulting in a further accumulation of backlogs at the fastest rate since March 2022.

Despite these challenges, companies proactively expanded their workforce. Employment rose for the second consecutive month, recording the strongest increase in nearly 18 months. Most firms hired additional full-time staff to manage higher workloads and offset production delays.

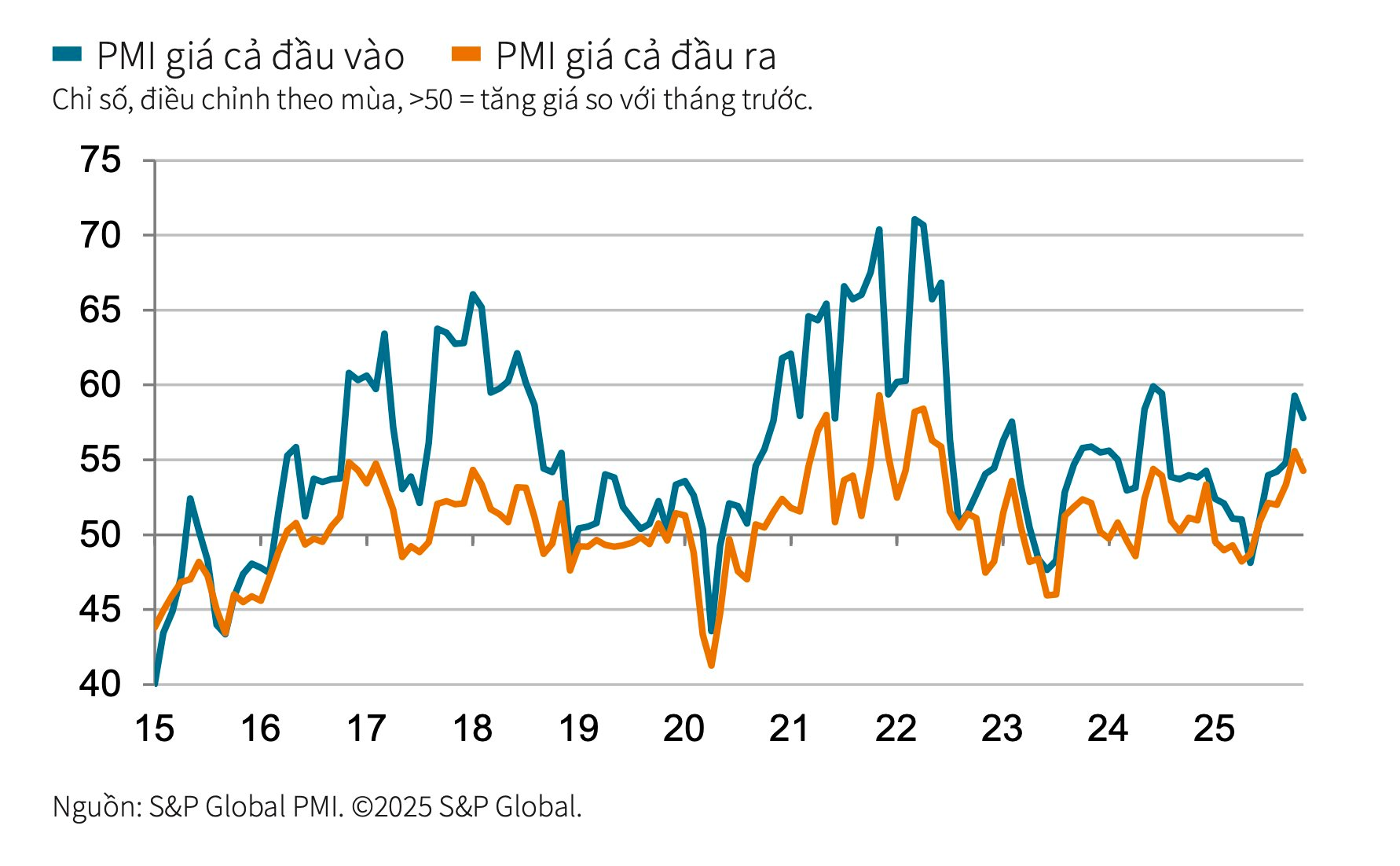

Storm-related disruptions also led to a sharp rise in input costs due to constrained supply. Raw material prices increased at the second-fastest rate since July 2024. In response, many businesses raised selling prices to offset higher costs, although the rate of output price inflation eased compared to October.

Purchasing activity expanded for the fifth month in a row, reaching a four-month high. Stocks of inputs rose slightly, reflecting expectations of improved production in the coming period. Conversely, finished goods inventories declined as some companies utilized existing stocks to fulfill orders due to delayed new supplies.

The outlook for the manufacturing sector remains positive. Nearly half of surveyed businesses anticipate higher output in the coming year, with optimism reaching a 17-month high. Expectations of improved demand, particularly for export orders, and hopes for more stable weather conditions are key drivers of this positive sentiment.

Andrew Harker, Economics Director at S&P Global Market Intelligence, noted that the strong growth seen in October was “largely sustained” in November.

“Despite storm-related disruptions, Vietnam’s manufacturing sector demonstrates a robust recovery foundation and holds potential for continued growth in the coming months as companies catch up on delayed projects,” the expert commented.

November 2025 PMI: Vietnam’s Manufacturing Sector Sustains Growth Despite Storm Disruptions

The S&P Global Vietnam Manufacturing Purchasing Managers’ Index (PMI) registered 53.8 in November, slightly down from October’s 54.5 but still signaling a robust improvement in manufacturing business conditions. This marks the fifth consecutive month of strengthening production conditions.

Unleashing New Momentum: Propelling Vietnam’s Supporting Industries to Take Flight

Vietnam currently boasts over 6,000 active supporting industry enterprises, yet they meet only about 10% of the domestic demand for manufacturing components and parts. Experts emphasize the need for selective foreign direct investment (FDI) and stronger linkages with local businesses to enhance production capabilities.

Record-High FDI Disbursement Achieved in the First 10 Months Over the Past 5 Years

According to data from the General Statistics Office and the Ministry of Finance, Vietnam’s realized foreign direct investment (FDI) in the first 10 months of 2025 reached an estimated $21.3 billion, marking an 8.8% increase compared to the same period last year. This represents the highest FDI disbursement for the 10-month period in the past five years, underscoring foreign businesses’ confidence in Vietnam’s investment policies and business environment.

Who is the Largest ‘Eagle’ Investor in Vietnam Today?

Vietnam has attracted over $31.5 billion in foreign direct investment (FDI) in the first 10 months, according to data from the General Statistics Office and the Ministry of Finance. Singapore emerged as the largest investor, contributing $3.76 billion, which accounts for 26.7% of the total newly registered capital.