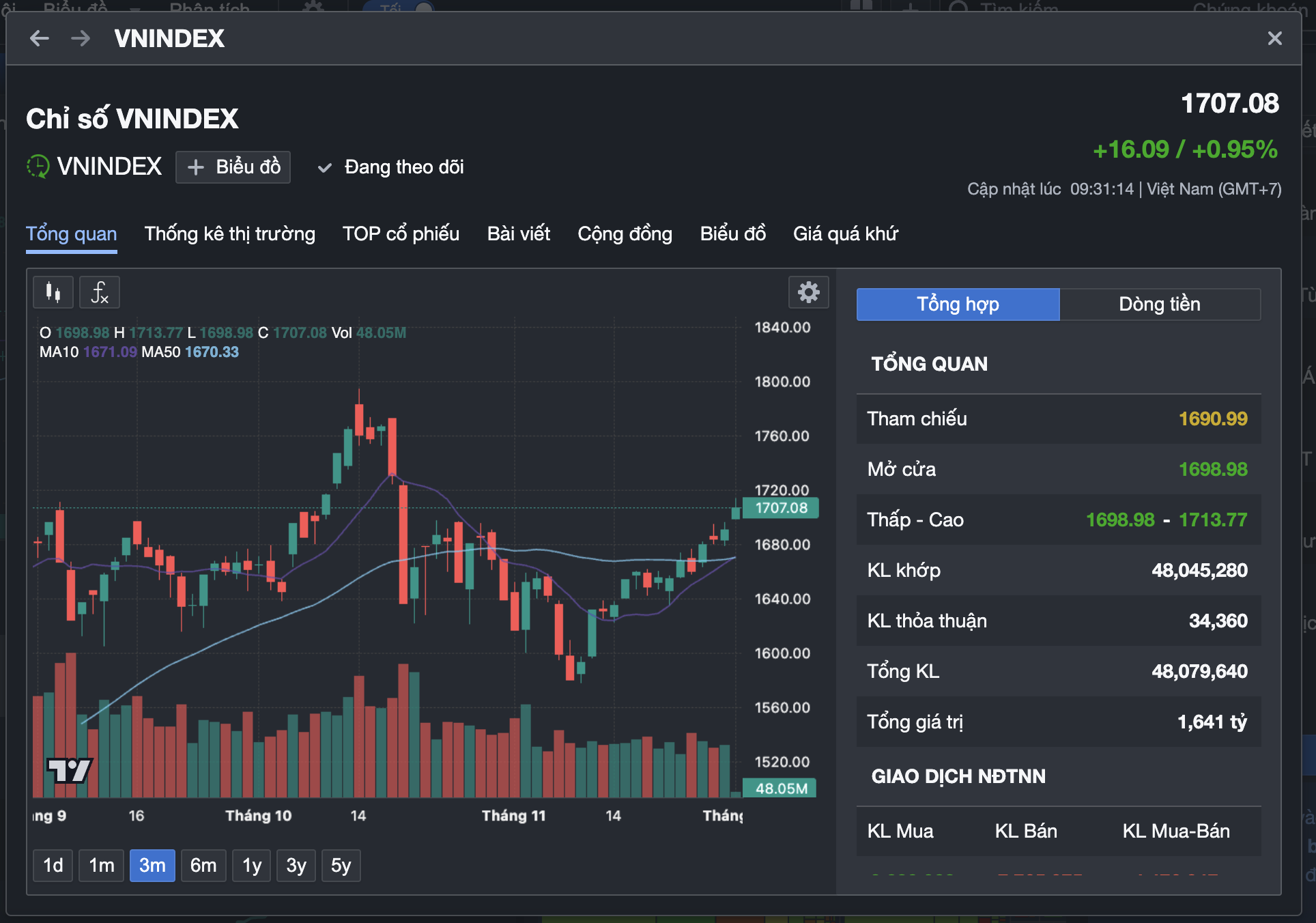

As the new trading week commenced on December 1st, the VN-Index surged by over 16 points, reaching 1,707 points, catching many investors off guard. This marked the highest level for the index since mid-October. However, sentiments were mixed among investors across various forums and groups.

Mr. Truong Nam, an investor holding stocks in securities, real estate, and banking sectors, shared that upon hearing the VN-Index surpass 1,700 points, he immediately checked his portfolio, only to find none of his stocks had increased in value.

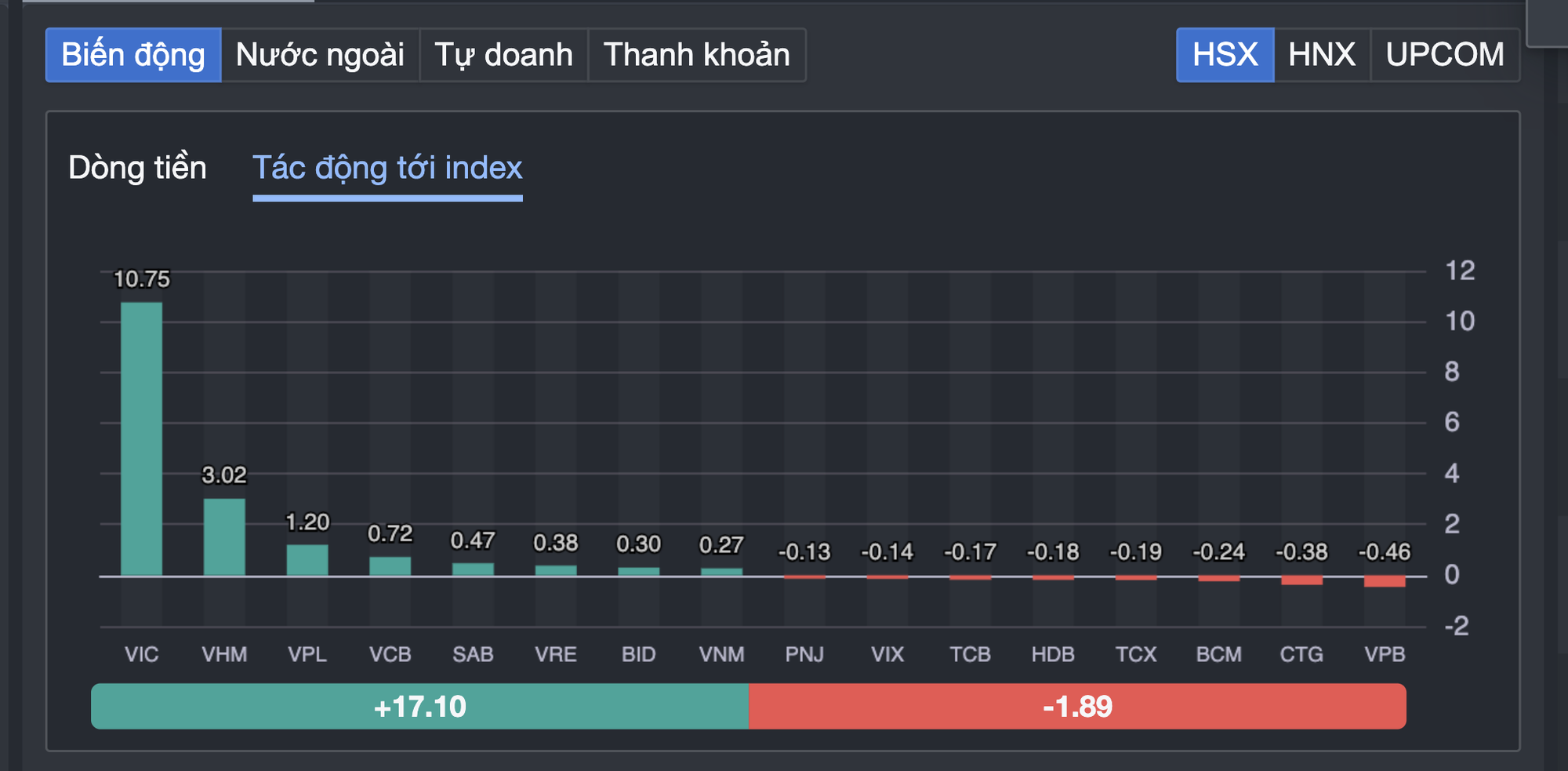

“Unless you’re holding Vingroup stocks like VIC, VHM, VRE, or a few other large-cap stocks, your portfolio likely hasn’t improved, despite the overall index hitting its highest point in over a month,” Mr. Nam remarked.

By 9:40 AM on December 1st, the VN-Index had risen by more than 14 points, with VIC contributing over 10.2 points. Other stocks like VHM, VPL, VCB, SAB, and VJC added between 0.42 to 2.37 points.

The rally was primarily driven by large-cap stocks within the VN30 basket, propelling the index well above the 1,930-point mark.

VN-Index surpasses 1,700 points

Expert Nguyen Thai Hoc from Pinetree Securities analyzed the “green shell, red core” trend of the VN-Index, which persisted from the previous week, as the index was primarily supported by Vingroup stocks.

Last week alone, despite the VN-Index gaining over 36 points, the trio VIC – VPL – VHM contributed nearly 40 points, while the rest of the market largely moved sideways and continued to accumulate. Low liquidity reflected cautious sentiment, particularly as capital flow remained concentrated in a few large-cap groups.

“Retail investors have been net sellers for two consecutive weeks, yet the VN-Index maintained its upward momentum and held above 1,700 points. This week, the index is likely to continue its sectoral divergence. For investors seeking new opportunities, consider allocating a small portion of capital, focusing on stocks with positive price movements, strong fundamentals, and attracting capital inflows, particularly in energy, consumer, real estate, chemical, and technology sectors,” Mr. Hoc advised.

Analysts from MBS Securities noted that the VN-Index recovered for three consecutive weeks, closing November with a 3.2% gain, despite the market being in a low-information phase with thin liquidity.

Historically, December tends to see higher market probabilities, with the past two years showing positive returns. Combined with seasonal factors, the market is expected to turn positive in the latter half of December as supportive information converges.

The rally was primarily driven by Vingroup stocks, including VIC, VHM, VPL, and VRE

Is the Stock Market Set for a Breezier December?

The VN-Index concluded November with its second consecutive weekly gain, edging closer to the 1,700-point milestone. However, weak liquidity and a zigzagging upward trend indicate cautious investor sentiment. As we enter the final month of the year, the market is anticipated to turn more positive, yet significant volatility remains likely due to heightened pressure from portfolio rebalancing and NAV (net asset value) closures.

Vietstock Daily 02/12/2025: Is Market Volatility Here to Stay?

The VN-Index extended its rally for a fourth consecutive session, surpassing the psychological threshold of 1,700 points. However, intense tug-of-war dynamics during the session, coupled with trading volumes remaining below the 20-day average, suggest lingering investor hesitation. The index is likely to experience further volatility around the September 2025 peak (1,695–1,711 range) in upcoming sessions.

Market Pulse 12/01: Foreign Investors Resume Net Selling of Bluechips, VN-Index Struggles at 1,700 Points

At the close of trading, the VN-Index climbed 10.68 points (+0.63%) to reach 1,701.67, while the HNX-Index dipped 2 points (-0.77%), settling at 257.91. Overall market breadth leaned bearish, with 379 decliners outpacing 314 advancers. The VN30 basket showed a more balanced performance, with 16 gainers and 14 losers.