KIS Vietnam Securities Corporation has announced that on December 8, 2025, it will finalize the shareholder list to execute the rights issue for existing shareholders. The company plans to offer 78.9 million shares for sale.

The rights issue ratio is set at 100:20.9878, meaning shareholders holding 100 shares will be entitled to purchase an additional 20.9878 shares. The offering price is VND 10,000 per share, with no transfer restrictions on the issued shares.

The transfer period for purchase rights will run from December 9, 2025, to December 18, 2025. Shareholders can register and pay for the shares from December 9, 2025, until 3 PM on December 23, 2025.

Shareholders may transfer their entire purchase rights once during the registration period, up to five days before the registration deadline. The recipient of the transferred rights cannot retransfer them. The company will manage these transfers to ensure the number of shareholders post-issuance does not exceed 100.

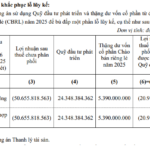

With the offering price of VND 10,000 per share, KIS Vietnam expects to raise over VND 789 billion. Approximately 75.6% of this amount, or VND 596.4 billion, will be allocated to supplement margin lending and advance payment for stock sales. The remaining 24.4%, or VND 193 billion, will be used to bolster proprietary trading activities.

Upon completion of this offering, KIS Vietnam’s chartered capital will increase from VND 3,762 billion to over VND 4,551 billion.

This issuance plan was recently approved by shareholders through a written consent process conducted from November 5 to November 15, 2025.

In other developments, KIS Vietnam has announced the resignation of Ms. Nguyễn Thị Cẩm Phương, a member of the Supervisory Board. Ms. Phương, who has served on the board since April 2024, cited personal reasons for her resignation, effective November 28, 2025.

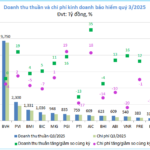

Regarding business performance, KIS Vietnam reported VND 1,927 billion in operating revenue for the first nine months of 2025, a 4.3% increase year-on-year. Proprietary trading contributed the most to revenue, with over VND 303 billion, followed by lending revenue at VND 248 billion and brokerage revenue at VND 209 billion.

Operating expenses for the period rose by 5.6% to VND 1,273 billion. As a result, pre-tax profit reached VND 472 billion, a 4.6% increase compared to the same period last year.

For 2025, KIS Vietnam aims to achieve a pre-tax profit of VND 750 billion, with 63% of this target already realized.

Established in December 2010, KIS Vietnam is a joint venture between Korea Investment & Securities (KIS Korea), the Vietnam Textile and Garment Group, and other shareholders. Initially, KIS Korea held a 48.8% stake, which has since increased to 99.8%.

Hà Ly

Non-Life Insurance Enters a Season of Profit Boom

The non-life insurance market has just concluded its most spectacular quarter of the year. Numerous companies have seen profits surge exponentially, with some not only breaking even but also securing substantial gains.

LDP Chairman Persists in Divestment Ahead of $280 Billion Capital Increase

During the period from November 27 to December 25, Mr. Pham Trung Kien, Chairman of the Board of Directors of Lam Dong Pharmaceutical Joint Stock Company (HNX: LDP), registered to sell 809,600 shares with the purpose of restructuring his investment portfolio.

CRV Group’s Stock Price Drops 25% from Peak as Entrepreneur Do Huu Ha Finalizes Rights Offering for 16.8 Million Shares

CRV Real Estate Group Joint Stock Company (CRV) announces a rights issue to existing shareholders, offering an opportunity to invest in the company’s latest venture, the Hoàng Huy New City – II project. This strategic move aims to secure funding for the development, ensuring its successful execution.