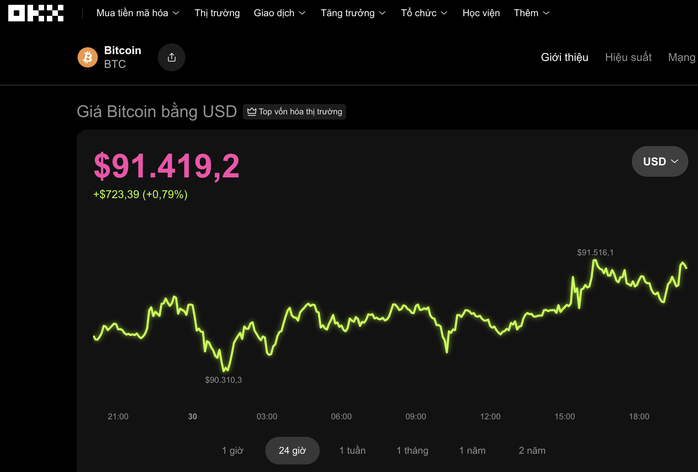

On the evening of November 30th, the cryptocurrency market witnessed a slight upward trend. Over the past 24 hours, according to data from the OKX exchange, Bitcoin rose by more than 0.7%, reaching $91,419.

Several other cryptocurrencies also saw gains, with Ethereum increasing by nearly 1% to $3,020; BNB rising by over 0.5% to $880; and Solana climbing by more than 0.4% to $137. Notably, XRP declined by 0.6%, dropping to $2.10.

Amidst this market recovery, Cointelegraph cited an analysis by expert Timothy Peterson, who suggested that Bitcoin’s outlook remains uncertain.

He noted that this year’s trends resemble the downturn of 2022. Since its most recent peak, Bitcoin has fallen by 36%, precisely when many anticipated a strong market upswing.

Bitcoin is currently trading at $91,419. Source: OKX

As we enter the final month of 2025, positive signals remain elusive. Based on historical data, Peterson highlighted a high correlation between current price movements and the 2022 bottom: approximately 80% by day and nearly 98% by month. If the previous pattern repeats, Bitcoin may only see a significant recovery from Q1 2026.

According to Peterson, November was among Bitcoin’s worst-performing months since 2015. Market history indicates that when November sees a decline, December often follows suit, though the drop may be less severe.

Despite Peterson’s cautious forecast, analysts believe that improvements in macroeconomic sentiment could still boost the market by year-end.

Citing data from Bloomberg and JPMorgan, the Kobeissi Letter reported that U.S. equity funds are attracting substantial capital inflows.

Since late 2024, approximately $900 billion has flowed into stocks, with $450 billion coming in the last five months alone. In contrast, other investment channels have only seen about $100 billion, indicating a strong shift toward the stock market.

Conversely, positive signs are emerging for the cryptocurrency market. During Thanksgiving week, Bitcoin-focused funds saw an additional $220 billion in inflows, while Ether-focused funds attracted $312 million, suggesting that institutional selling pressure may be easing.

Digital Treasury Firms Struggle Amid Market Sell-Off

Amidst a market downturn that has wiped out $1 trillion from the cryptocurrency sector, companies holding digital assets are liquidating their portfolios in a desperate bid to stabilize plummeting stock prices. The once-booming trend of crypto asset treasuries is now unraveling as widespread sell-offs force firms to reevaluate their strategies.