I. MARKET DYNAMICS OF WARRANTS

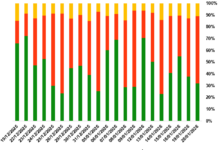

By the close of trading on December 2, 2025, the market recorded 96 advancing issues, 147 declining issues, and 31 unchanged issues.

Market Breadth Over the Last 20 Sessions. Unit: Percentage

Source: VietstockFinance

Source: VietstockFinance

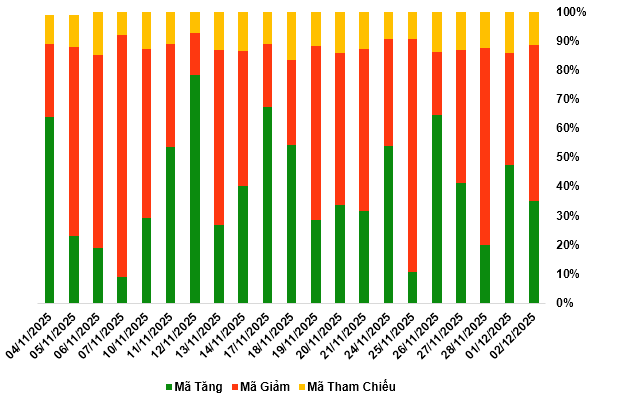

During the December 2, 2025 session, sellers regained control, driving most warrant prices downward. Notably, the top gainers included CVHM2510, CVHM2511, CVHM2512, and CVRE2511.

Source: VietstockFinance

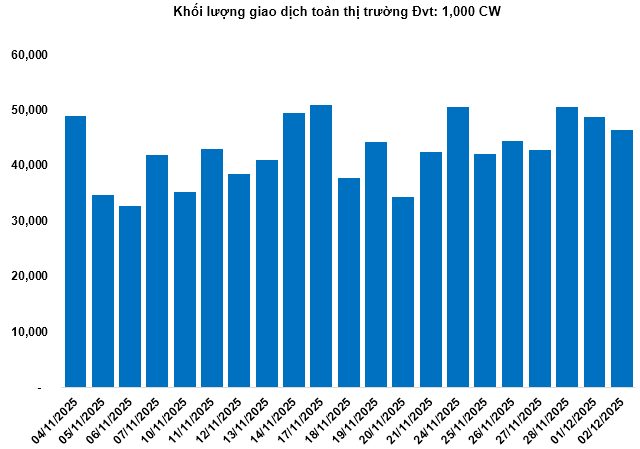

Total market volume on December 2 reached 46.47 million CW, down 4.6%; trading value hit 79.43 billion VND, up 6.05% from December 1. CSTB2528 led in volume with 4.14 million CW, while CSTB2514 topped trading value at 7.97 billion VND.

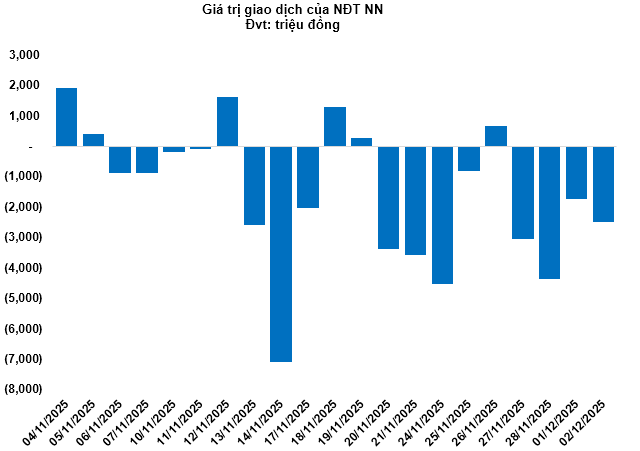

Foreign investors continued net selling on December 2, totaling 2.48 billion VND. CSHB2513 and CHPG2518 saw the highest net outflows.

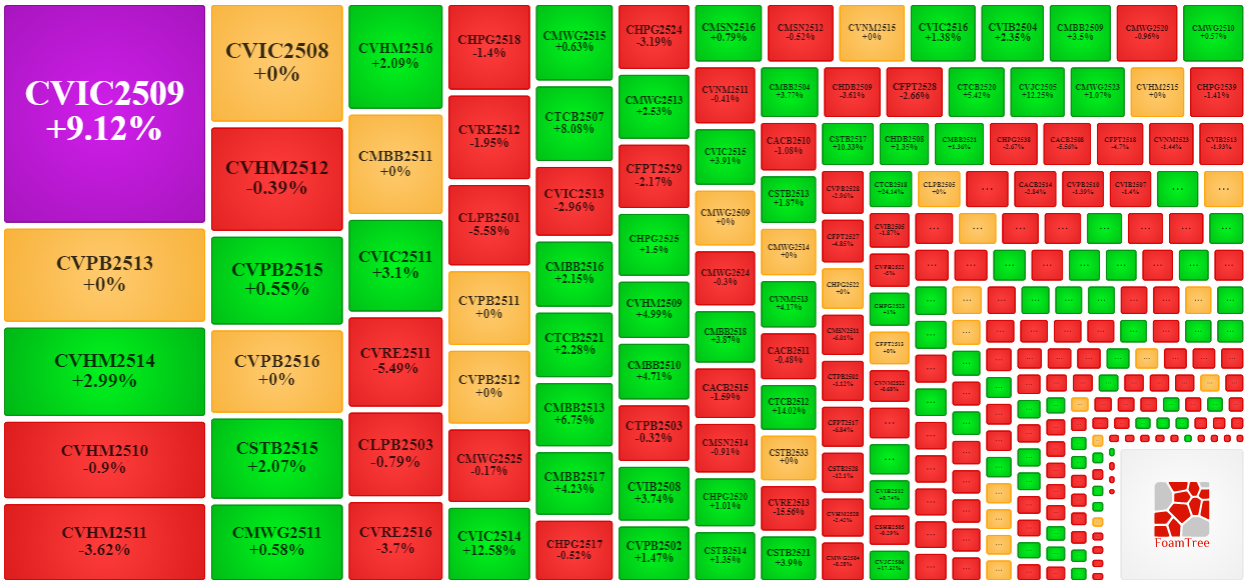

Securities firms SSI, ACBS, VND, and HCM are the leading issuers of warrants in the market.

Source: VietstockFinance

Source: VietstockFinance

II. MARKET STATISTICS

Source: VietstockFinance

Source: VietstockFinance

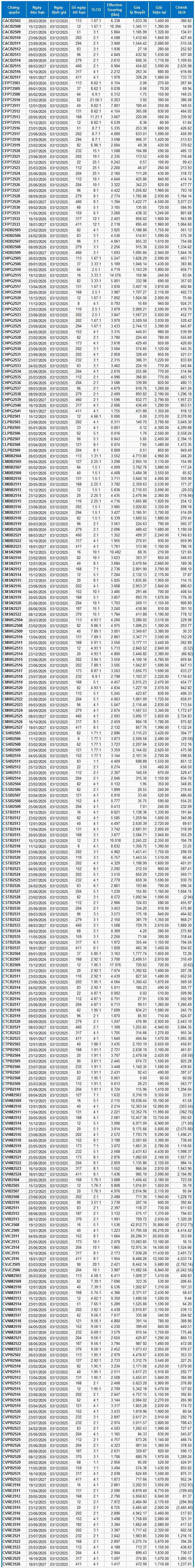

III. WARRANT VALUATION

Using a valuation method effective from December 3, 2025, the fair prices of actively traded warrants are as follows:

Source: VietstockFinance

Note: Opportunity costs in the valuation model are adjusted for the Vietnamese market. Specifically, the risk-free rate (government treasury bills) is replaced by the average deposit rate of major banks, adjusted for warrant maturities.

According to the valuation, CVIC2508 and CVJC2506 are the most attractively priced warrants.

Warrants with higher effective gearing exhibit greater volatility relative to their underlying assets. Currently, CTCB2509 and CHPG2515 have the highest effective gearing in the market.

Economic Analysis & Market Strategy Division, Vietstock Consulting Department

– 18:58 December 2, 2025

Shark Money Trail 12/02: Foreign Investors Surge Back, Proprietary Traders Lightly Unwind Positions

The VN-Index continued its upward trajectory as foreign investors recorded their strongest net buying activity in nearly a month, with significant focus on VJC and other blue-chip stocks. In contrast, proprietary trading firms bucked the trend, posting slight net selling, primarily in HPG and STB.

Soaring Land Prices Drive Up Housing Costs, Exacerbating Social Welfare Pressures – Insights from Mr. Nguyen Quoc Hiep

In early 2026, a new land price schedule will officially take effect nationwide, replacing the old one and capturing significant attention from both citizens and businesses. Experts suggest that if land prices rise, it will directly impact housing costs and potentially influence the entire economy.

Vietstock Daily 03/12/2025: Strengthening the Upward Momentum

The VN-Index extended its winning streak to a fifth consecutive session, closely tracking the Upper Band of the Bollinger Bands. Trading volume surpassed the 20-day average, while both the Stochastic Oscillator and MACD maintained their upward trajectories following buy signals, reinforcing a positive short-term outlook.