Vietcap is set to issue non-convertible, non-warrant-accompanied, and unsecured bonds. On the same day, the Board of Directors (BOD) approved the registration and implementation documents for the offering.

Recently, on November 26th, the BOD resolved to secure a credit loan from foreign banks totaling up to $250 million. This includes a $120 million framework agreement with an option to increase the limit by an additional $130 million.

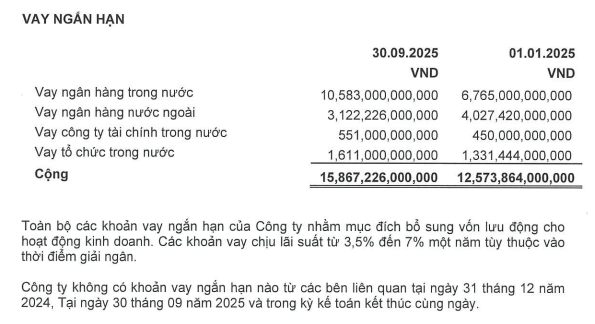

As of September 30, 2025, Vietcap’s total short-term debt stands at over VND 15.867 trillion, a 26% increase since the beginning of the year. The majority of this debt, VND 10.583 trillion (up 56%), is owed to domestic banks, with the remainder borrowed from foreign banks, domestic financial institutions, and companies.

The company stated that all short-term loans are intended to bolster working capital for business operations, with interest rates ranging from 3.5% to 7% per annum, depending on the disbursement date.

Source: Vietcap’s Q3/2025 Financial Report

|

In addition to debt financing, Vietcap plans to raise capital through equity by issuing 127.5 million private placement shares, increasing its charter capital to VND 8.501 trillion in 2025 and Q1/2026.

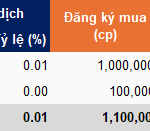

The offering attracted 69 investors, including institutions and individuals seeking to purchase tens of millions of shares. Darasol Investments Limited led with 12.2 million shares, nearly 10% of the offering, valued at over VND 378 billion.

Dragon Capital’s funds acquired 10 million shares, raising their stake from 3.1% to 3.83%. Insurance firms such as Manulife (Vietnam) and Prudential Vietnam, along with Eastspring Investments, also participated.

Among individual investors, Mr. Nguyễn Tấn Minh and Mr. Lê Danh Tài each purchased 11.5 million shares, investing approximately VND 357 billion each. This will increase their stakes to 2.07% and 2.12%, respectively.

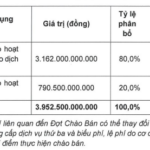

At VND 31,000 per share, the company expects to raise nearly VND 3,923 billion, fully allocated in 2026. Eighty percent will fund margin activities, and the remaining 20% will support proprietary trading.

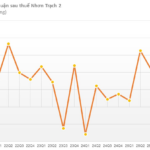

The offering price is close to VCI’s current market price of VND 34,000 (as of December 2nd). The stock has been on a downward trend, dropping 30% since its September peak.

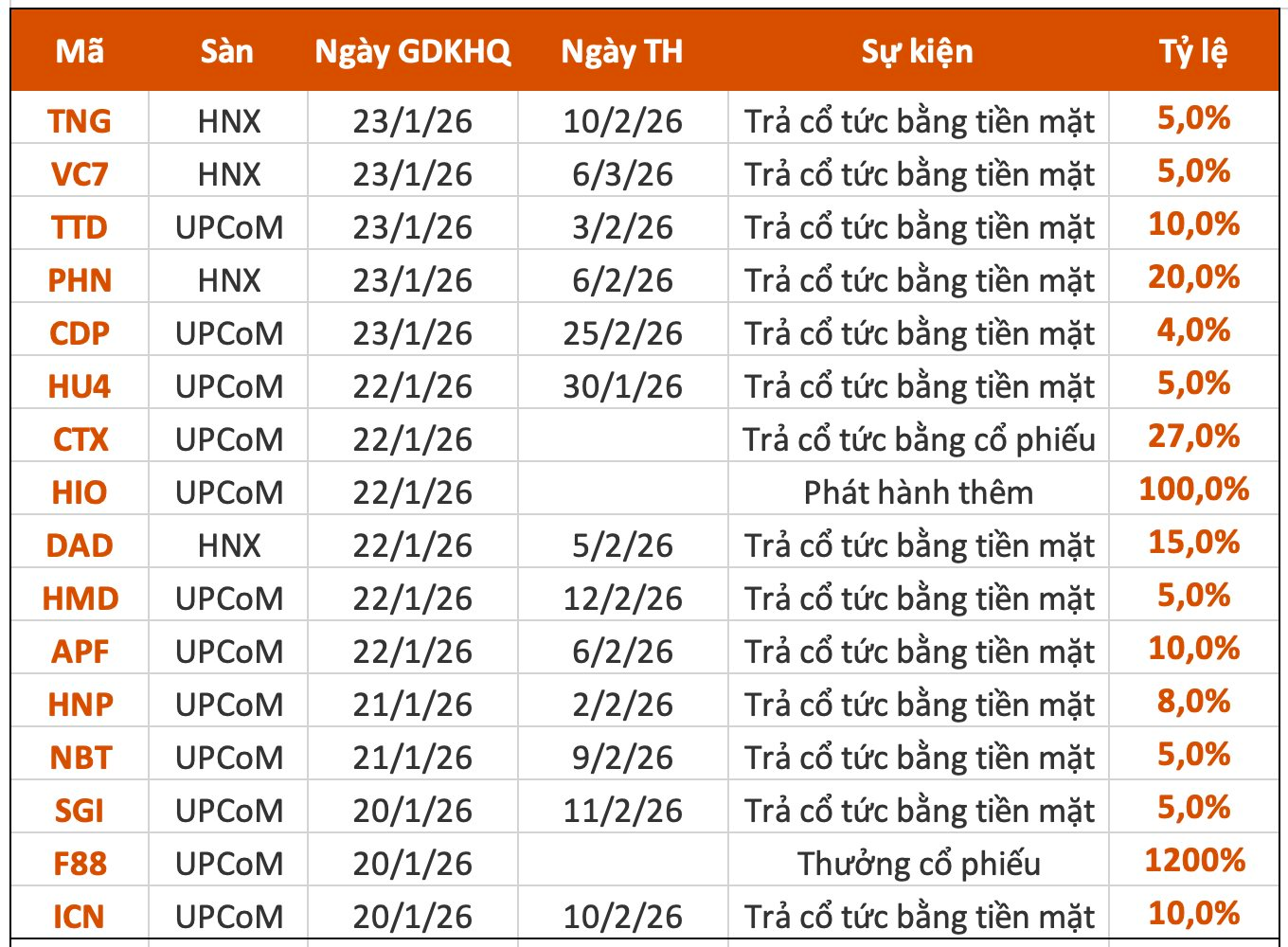

Amid the sector’s challenges, two affiliates—VCAM and VCAMDF—registered to buy 1.1 million shares collectively.

| VCI Stock Continues to “Bottom Out” |

– 09:41 03/12/2025

VCI Sets Private Placement Price at VND 31,000, Attracting Foreign Institutions Willing to Invest Hundreds of Billions

The Board of Directors of Vietcap Securities Corporation (HOSE: VCI) has recently passed a resolution to issue 127.5 million private placement shares, aiming to increase its charter capital to VND 8,501 billion. The offering has attracted significant interest, with 69 investors, including both institutions and individuals, expressing their intent to purchase tens of millions of shares.