On the afternoon of December 1st, during a seminar introducing investment opportunities in HPA shares by Hoa Phat Agricultural Development Joint Stock Company (HPA), a subsidiary of Hoa Phat Group (HPG) led by billionaire Tran Dinh Long, Chairman of HPG’s Board of Directors, the question of why HPA’s initial public offering (IPO) price was set at 41,900 VND per share—nearly double that of its parent company HPG—was addressed.

Within just a decade of its establishment, HPA has risen to become one of Vietnam’s top 10 pig farming enterprises, ranking 13th in animal feed production. It leads in supplying clean chicken eggs in Northern Vietnam and holds the top market share for whole Australian beef cattle in the country.

Mrs. Pham Thi Hong Van, CEO of HPA, attributed this success not to rapid expansion but to the industrial corporate culture and the philosophy of “conquering oneself before conquering the market,” inherited from its parent company, Hoa Phat. HPA’s integrated Feed-Farm model ensures a closed production chain, from animal feed (Feed) to farming (Farm). By controlling both feed and breeding sources—which account for 70% of farming costs—HPA maintains strict oversight over production costs and product quality.

HPA’s CEO presenting at the seminar

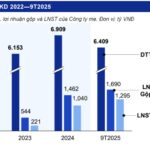

Mrs. Van reported that in the first nine months of 2025, HPA’s after-tax profit reached 1,295 billion VND. The after-tax profit margin stood at 15.1% in 2024, with a return on equity (ROE) of 56.4% and a return on assets (ROA) of 31.7% for the same period. By 2030, HPA aims to achieve revenues exceeding 12,000 billion VND and after-tax profits of 1,750 billion VND, maintaining an ROE above 25%.

Regarding the Food segment, Mr. Nguyen Viet Thang, Chairman of HPA’s Board of Directors and CEO of Hoa Phat Group, noted that while HPA has succeeded with its Feed-Farm (2F) model, completing the Feed-Farm-Food (3F) model remains a challenge. The Food segment (slaughtering and processing) has yet to be fully developed due to distribution and branding hurdles.

The IPO aims to strengthen financial capacity, restructure capital, and, most importantly, expand production and business operations. HPA seeks partners to develop the Food segment, focusing on supermarket and agent distribution channels. The company is committed to a robust rollout of the Food segment, ensuring success and full control over the supply chain to consumers.

Investors can register to purchase HPA shares from November 24th to December 15th, 4 PM, through Vietcap Securities Corporation. Share allocation will occur on December 16th and 17th, with payment due by December 24th. HPA plans to announce the offering results between December 25th and 30th, issue share ownership certificates in January 2026, and list on HoSE.

Hoà Phát Agriculture Declares 38.5% Cash Dividend; No White Chicken Farming or Southern Egg Sales Yet

On the afternoon of December 1st, Hoa Phat Agricultural Development Joint Stock Company (HPA) hosted an investment opportunity seminar, announcing the public offering of 30 million shares at a price of VND 41,900 per share. The company is expected to list on the Ho Chi Minh City Stock Exchange (HOSE) in early 2026.