Over a month after the record-breaking 95-point drop on October 20, Vietnam’s stock market has rebounded to the 1,700-point milestone, led by the familiar powerhouse Vingroup (stock code: VIC). Shares of billionaire Pham Nhat Vuong’s conglomerate have surged to a new peak of VND 269,900 per share, a staggering 6.66-fold increase since the beginning of the year.

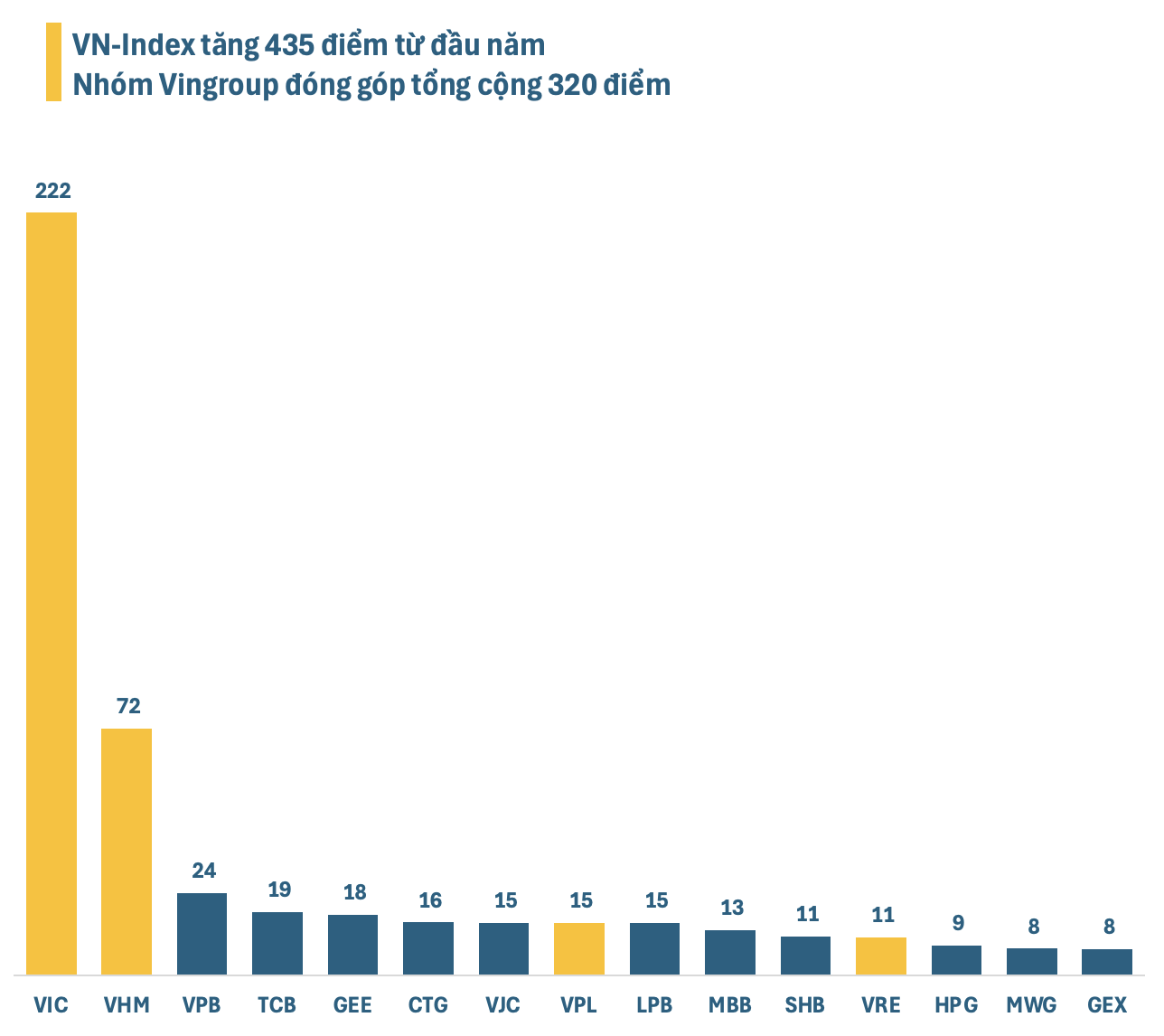

With its remarkable rally, VIC alone has contributed 222 points to the VN-Index year-to-date. Collectively, the “Big Four” of Pham Nhat Vuong’s empire—VIC, VHM, VPL, and VRE—have added 320 points to the index. Notably, the VN-Index has risen by only 435 points during this period.

Top contributors to the VN-Index since the start of the year

Beyond Vingroup, shares of Vimhomes (stock code: VHM) and Vincom Retail (stock code: VRE) have also doubled, surging 160% and 100% respectively since January. Vinpearl (stock code: VPL) has surpassed its previous peak, climbing 40% since its mid-May IPO.

Fueled by this year’s rally, Vingroup has become Vietnam’s first and only company to surpass a market capitalization of VND 1,000 trillion. Vinhomes ranks third on the HoSE with a valuation exceeding VND 434 trillion. Vinpearl recently hit a new record of over VND 182 trillion, while Vincom Retail, the group’s youngest member, stands at nearly VND 80 trillion.

Collectively, the Vingroup family’s market cap now exceeds VND 1,700 trillion, accounting for nearly a quarter of the HoSE’s total value. This dominance gives Pham Nhat Vuong’s stocks significant influence over the VN-Index, making the index less reflective of the broader market’s performance.

Despite the VN-Index surpassing 1,700 points, many large-cap stocks remain at 1,500 or even 1,200 points. Shares in banking, securities, and real estate sectors have dropped 20-30% from recent highs. This disparity limits market-wide optimism, even as the VN-Index approaches its previous peak.

This imbalance may not persist, as many undervalued blue-chip stocks present attractive entry points. Bottom-fishing capital is expected to re-enter soon, with historical data showing a high probability of December gains. MBS’s recent report suggests that seasonal factors and converging positive news will drive market optimism in the latter half of December.

Longer term, Petri Deryng, head of PYN Elite Fund, has raised the VN-Index target to 3,200 by 2028, based on projected 18-20% annual profit growth. Deryng highlights favorable macroeconomic policies boosting Vietnam’s economic growth and corporate earnings.

Dragon Capital shares this optimism, citing strong fundamentals for continued growth in 2025-2026. Profits of 80 tracked companies are expected to grow 21.3% in 2025 and 16.2% in 2026, outpacing expectations. Valuations remain attractive, with 2025 and 2026 forward P/E ratios at 12.5-13x and 11x, respectively—lower than regional peers despite superior earnings growth.

Additionally, Vietnam’s upgrade from frontier to emerging market status promises significant re-rating potential, as large foreign inflows could catalyze a new growth cycle.

Blue-Chip Stock Code Unexpectedly Hit by Strong Net Selling from Securities Firm’s Proprietary Trading on December 2nd

Proprietary trading desks at securities firms reversed their position, shifting to net selling with a total value of 64 billion VND.