Recently, Tien Phong Plastic Joint Stock Company (Tien Phong Plastic, Stock Code: NTP, HNX) issued an official announcement regarding the receipt of Decision No. 3486/QĐ-CT dated November 10, 2025, from the Tax Department, imposing administrative penalties for tax violations identified during a tax audit.

According to the decision, Tien Phong Plastic was found to have made incorrect tax declarations resulting in underpayment, as well as using illegal invoices.

Additionally, the company faced aggravated circumstances due to repeated administrative violations, including multiple instances of incorrect declarations that did not lead to underpayment of value-added tax across several tax periods, and the use of multiple illegal invoices.

Illustrative image

For these violations, Tien Phong Plastic was fined nearly 1.5 billion VND in administrative penalties. The company is also required to rectify the situation by paying the outstanding tax amount of approximately 7.1 billion VND to the state budget.

Furthermore, the company must pay late payment fees totaling nearly 1.7 billion VND. These late fees are calculated up to October 28, 2025, and Tien Phong Plastic is responsible for calculating and paying additional late fees from this date until the actual payment of the tax arrears and penalties into the state budget as per regulations.

In total, Tien Phong Plastic is obligated to pay over 10.2 billion VND in tax-related penalties and arrears to the state budget.

Previously, Tien Phong Plastic also announced receiving Decision No. 421/QĐ-XPHC from the Hai Phong Port Area 2 Customs Department, imposing administrative penalties.

Specifically, the company was found to have made incorrect tax declarations leading to underpayment during a customs inspection of cleared goods.

As a result, the company was fined nearly 88.1 million VND but was not required to rectify the situation, as the outstanding tax amount had already been paid according to payment voucher No. 122370 dated October 10, 2025.

Regarding business performance, in the first nine months of 2025, Tien Phong Plastic recorded net revenue of over 4,869 billion VND, a 27.1% increase compared to the same period in 2024. After-tax profit reached over 790 billion VND, up 52.2% year-on-year.

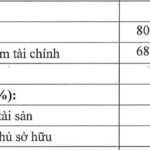

As of September 30, 2025, the company’s total assets increased by 7.9% from the beginning of the year to over 6,920 billion VND. This includes short-term financial investments of 2,679 billion VND, accounting for 38.7% of total assets, and inventory of over 1,327 billion VND, representing 19.2% of total assets.

On the liabilities side, total payables stood at over 2,891 billion VND, a 5.2% increase from the beginning of the year. Short-term loans and finance leases amounted to nearly 1,984 billion VND, making up 68.6% of total liabilities.

Phú Mỹ Tops Urea Market Share, Aims for Billion-Dollar Revenue

PetroVietnam Fertilizer and Chemicals Corporation (PVFCCO – Phu My, HOSE: DPM) is entering a strategic acceleration phase. Building on its leadership in the domestic urea market, the company aims to expand into the chemicals and petrochemicals value chain, with a focus on green products such as clean ammonia and hydrogen.

G Kitchen Chain Owner Reports 2.5x Surge in Half-Year Profits

According to its periodic financial report submitted to the Hanoi Stock Exchange (HNX), Greenfeed Vietnam JSC recorded a significant surge in profits during the first half of 2025. However, the company’s total liabilities also saw a notable increase during the same period.

PAP Sets Private Placement Price at VND 13,610 per Share, Half of Market Value

The Board of Directors of Phuoc An Port Petroleum Investment and Exploitation Joint Stock Company (UPCoM: PAP) has set the private placement price at VND 13,610 per share, nearly half the market price of VND 26,500 per share. The entire offering of 125 million shares is expected to be fully subscribed by 11 investors, with only one individual becoming a major shareholder post-transaction.