By the end of November, the VN-Index reached 1,690.99 points, marking a 3.13% increase compared to the end of October. Conversely, the banking sector index declined by 1.91% to 958.48 points, according to VietstockFinance data.

Market Capitalization Plummets for the Third Consecutive Month

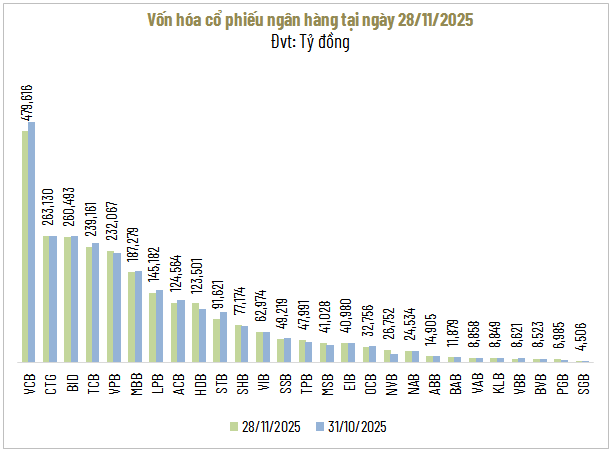

As of the session on November 28th, the total market capitalization of the banking sector stood at over 2.6 million billion VND, shedding an additional 28 trillion VND (equivalent to 1.1%) compared to the end of October. This marks the third consecutive month of decline.

Source: VietstockFinance

|

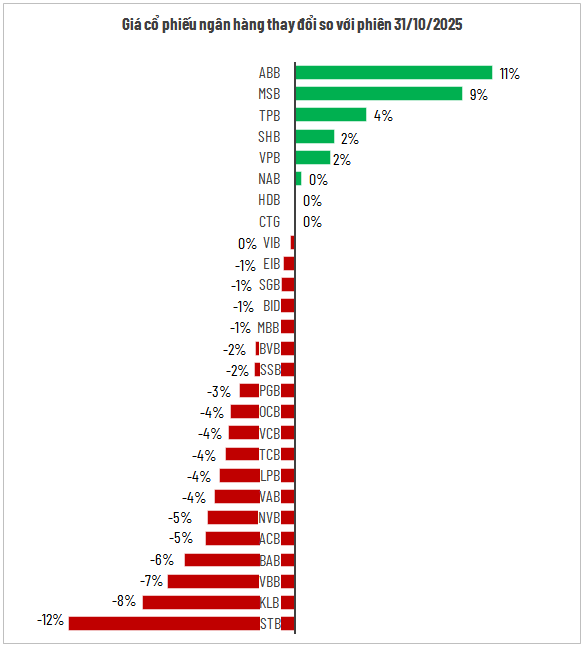

The downward trend in stock prices continued to erode market capitalization. Among state-owned banks, VCB dropped by 4%, BID by 1%, while CTG remained relatively stable. Private banks experienced deeper adjustments, with declines of up to 12%, while the strongest performers only managed an 11% increase, insufficient to offset the overall trend.

Source: VietstockFinance

|

Liquidity Hits a 5-Month Low

Source: VietstockFinance

|

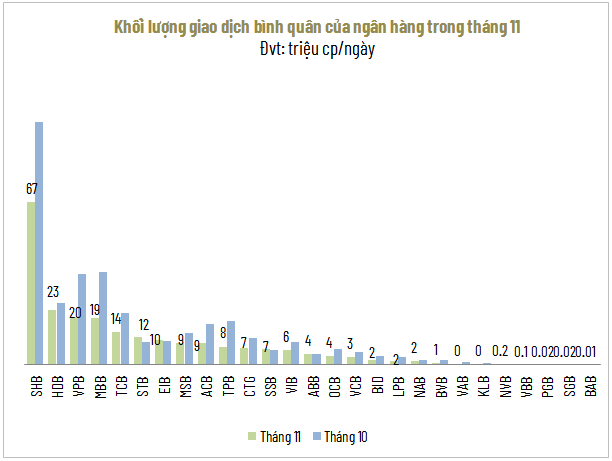

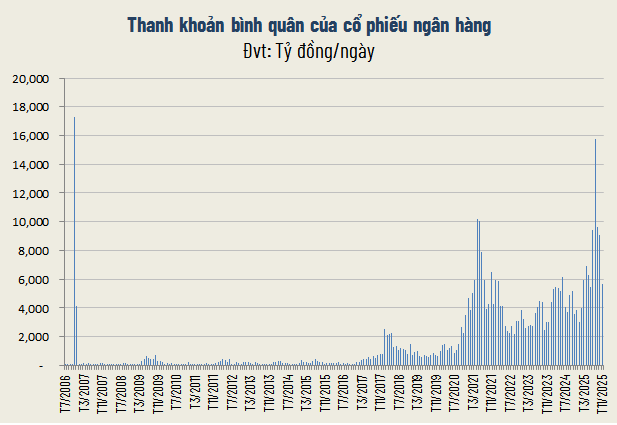

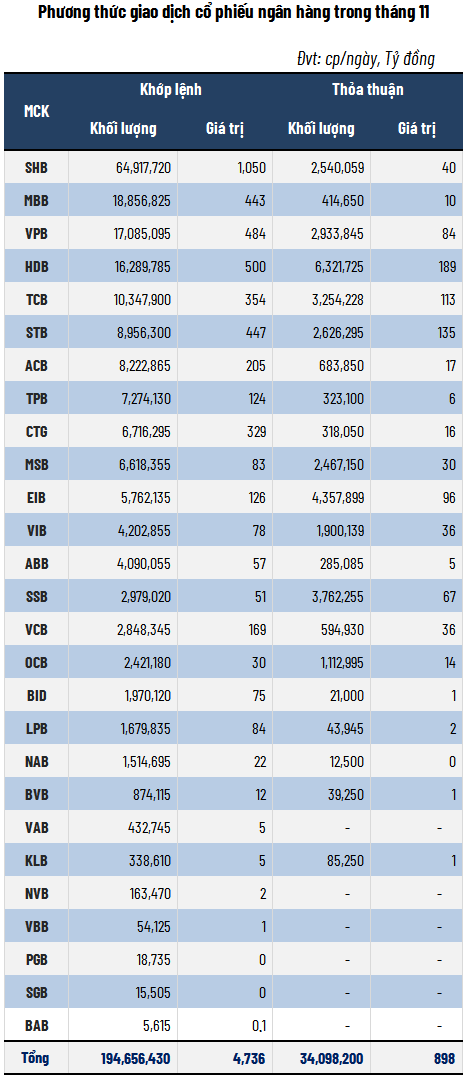

The lackluster performance of banking stocks was further exacerbated by dwindling liquidity. In November, the average trading volume was only 229 million shares per session, a 34% decrease from the previous month. The average trading value plummeted by 38% to 5,635 billion VND per session, the lowest level in five months.

Source: VietstockFinance

|

The decline in liquidity was widespread across various market capitalization groups. The most significant drop reached 70% (NVB), while the strongest performer only managed a 22% increase (SGB).

SHB maintained its lead in the sector with an average of 67 million shares traded per session, despite a 33% decrease. In contrast, BAB remained the least liquid stock, with fewer than 6,000 shares traded daily, down by 44%.

Source: VietstockFinance

|

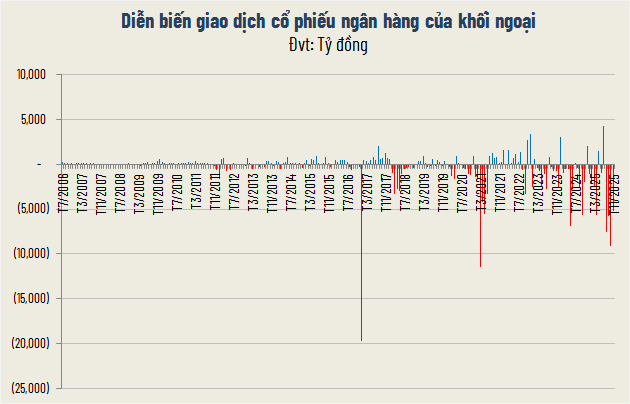

Foreign Investors Scale Back Selling Pressure

Source: VietstockFinance

|

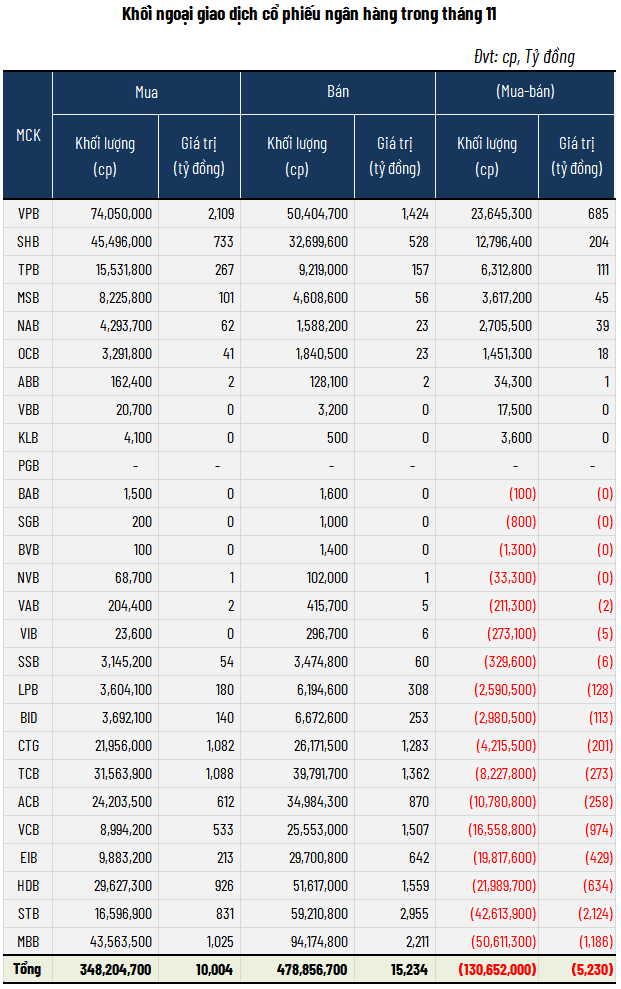

Foreign investors have been net sellers of banking stocks for four consecutive months, offloading nearly 131 million shares (equivalent to 5,230 billion VND). However, this represents the lowest net selling level in the past eight months.

Source: VietstockFinance

|

MBB and STB faced the most significant selling pressure, with a combined value exceeding 3,300 billion VND. Conversely, VPB, SHB, and TPB attracted hundreds of billions of VND in net buying.

– 19:00 02/12/2025