The Board of Directors of Becamex Industrial Development and Investment Corporation (Becamex Group, Stock Code: BCM) issued Resolution No. 73/NQ-HĐQT on December 1, 2025, regarding the capital increase for Becamex Binh Phuoc Infrastructure Development Joint Stock Company (Becamex Binh Phuoc).

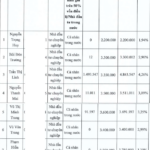

Accordingly, the Becamex Group’s Board of Directors agreed to subscribe for an additional 36 million shares of Becamex Binh Phuoc at a price of VND 10,000 per share, totaling VND 360 billion in capital contribution.

The capital contribution is to be completed by December 31, 2025, at the latest. Following this, Becamex Binh Phuoc’s chartered capital will exceed VND 2,698 billion.

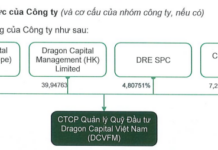

Becamex Group’s shareholding in Becamex Binh Phuoc will then surpass 107.9 million shares, representing 40% of the chartered capital.

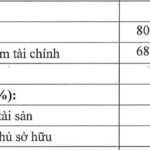

The Board also approved a capital increase for Becamex Binh Dinh Joint Stock Company by subscribing for an additional 8 million shares at VND 10,000 per share, totaling VND 80 billion in additional capital.

After this contribution, Becamex Binh Dinh’s chartered capital will reach VND 790 billion. Becamex Group’s shareholding in Becamex Binh Dinh will be 31.6 million shares, equivalent to 40% of the chartered capital.

Illustrative image

Previously, Becamex Group announced a Board of Directors Resolution approving the plan for issuing and utilizing proceeds from the second private bond offering in 2025.

Becamex Group plans to issue up to 20,000 bonds with a face value of VND 100 million each, raising a total of VND 2,000 billion.

These bonds are non-convertible, unsecured, and asset-backed, issued in the domestic market.

The bonds will be issued in book-entry form, with a maximum of 5 tranches. Each tranche will have a term of 3–5 years, and the issuance is scheduled from October to December 2025.

The bond issuance aims to restructure the company’s debt and fund investment programs and projects throughout 2025.

Specifically, Becamex Group intends to use the proceeds to repay principal and interest on existing bank loans.

Additionally, the company plans to invest in its two affiliated companies, Becamex Binh Phuoc and Becamex Binh Dinh, to increase their chartered capital and support their investment projects.

According to the bond issuance results disclosed to the Hanoi Stock Exchange (HNX) and Ho Chi Minh City Stock Exchange (HoSE), from November 10–11, 2025, Becamex Group successfully issued 6,600 bonds under the code BCM12503 in the domestic market.

With a face value of VND 100 million per bond, the total issuance value is VND 660 billion, with a 3-year term maturing on November 10, 2028.

Vingroup Issues VND 1,000 Billion in Bonds with 12% Annual Interest Rate

Vingroup has launched 10,000 corporate bonds under the code VIC12511, with a face value of 100 million VND per bond, totaling an issuance value of 1 trillion VND.

ABBank Surpasses Targets with Pre-Tax Profit of VND 3.4 Trillion in 11 Months, Nearly Doubling Annual Plan

An Binh Commercial Joint Stock Bank (ABBank, UPCoM: ABB) reported pre-tax profits of VND 3.4 trillion in the first 11 months of 2025, nearly doubling its annual target.