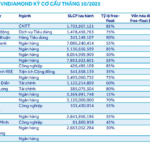

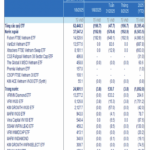

MarketVector Indexes will announce the Vietnam Local Index constituent review results on December 12, 2025, effective from December 19, 2025. This index is tracked by the VanEck Vietnam ETF, which currently manages total assets of $573.41 million, equivalent to VND 15,144 billion.

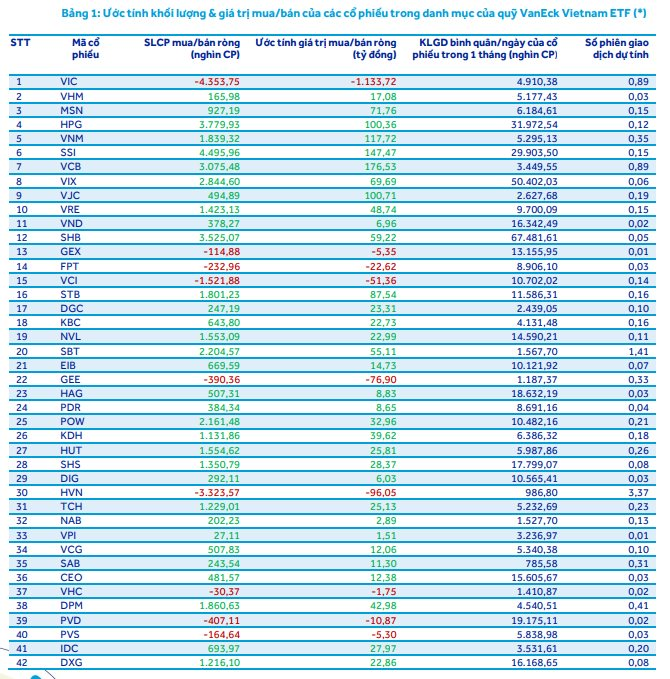

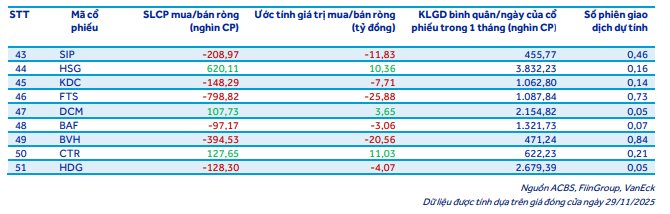

In a recent report, ACBS Securities forecasts that the Q4/2025 index rebalance will not involve adding or removing stocks but will adjust the weights of existing constituents.

The estimated total trading value for this rebalance is approximately VND 3,000 billion, including both buy and sell transactions. Notably, VIC’s weight will significantly decrease from 15.5% to 8%, the maximum limit for a single stock. Conversely, VCB’s weight is expected to increase from 3.8% to 5%.

In terms of specific trades, VIC is expected to be the most heavily sold stock, with a value of approximately VND 1,134 billion, equivalent to nearly 4.4 million units. HVN follows with over 3.32 million shares sold.

On the buying side, VCB leads with a net purchase value of nearly VND 176 billion. SSI is also bought by the fund for around VND 147 billion, equivalent to 4.5 million shares. Additionally, VNM, HPG, and VJC are among the heavily bought stocks, with each valued at over VND 100 billion.

According to ACBS, most rebalancing trades are expected to be completed within a single session. Exceptions include HVN, which may take approximately 3.4 sessions, and SBT, requiring around 1.4 sessions to complete.

Vincom Retail Surges to Upper Limit Following Announcement of Massive 4.5 Trillion VND Dividend Payout

Stock prices surged to 32,100 VND per share, marking the highest level in over three years since April 2022.

The Ultimate Guide to Online Security: Protect Yourself from the Latest Scams

“Vietnam’s Foreign Trade Joint Stock Bank, better known as Vietcombank, has issued a warning about a scam involving fraudulent recruitment for a social welfare project under the guise of the reputable bank’s name. This cunning scheme has prompted Vietcombank to alert the public about this deceptive employment con.”

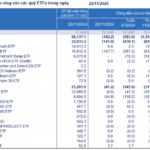

The Great ETF Exodus: A Triple Retreat

Vietnam-focused equity ETFs witnessed outflows of over VND 583 billion last week, marking a significant surge in withdrawal activity with triple the amount compared to the previous week’s outflows.