The anticipated market upgrade is poised to usher in a new growth cycle for Vietnam’s stock market, mirroring the trajectories of Qatar, UAE, Pakistan, and most recently, Kuwait, during their respective upgrade phases. As passive and active capital flows from international funds begin to surge, stocks meeting liquidity and scale criteria are typically prioritized for investment, serving as secure and efficient destinations for substantial capital inflows.

Beneficiary stocks have already signaled positive momentum

Among the 28 stocks recently forecasted to enter the FTSE Global All Cap index, four banking stocks—VCB, STB, SHB, and EIB—are featured. According to a report by BSC (BIDV Securities), only SHB and EIB retain foreign ownership room exceeding 20%, with SHB leading at 26%. This advantage positions these stocks to benefit significantly from the market upgrade.

For years, SHB has consistently ranked among the top banking stocks in liquidity, boasting a large volume of free-float shares—a critical factor for inclusion in indices like FTSE Russell and MSCI. Its high trading volume enables SHB to meet technical criteria for liquidity and market value, enhancing its eligibility for emerging market-tracking ETF portfolios. These funds typically favor large, transparent, and financially stable stocks with robust trading activity—qualities embodied by SHB.

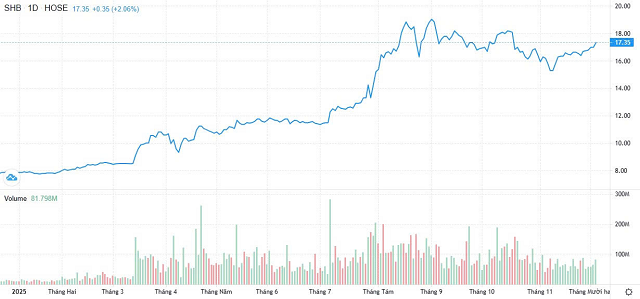

In Q3/2025, SHB maintained its market liquidity leadership, with trading volumes averaging around 100 million shares per session, including multiple sessions of net foreign buying. Year-to-date, SHB shares have surged 80% in value. Dividends further bolster SHB’s appeal to investors: last year, the bank distributed an 18% dividend, paid in both cash and stock. This consistent dividend policy, ranging from 10% to 18% annually, has been a longstanding feature.

Performance of SHB stock since the beginning of the year

|

By the close of the session on 03/12/2025, SHB shares rose 2%, trading at 17,350 VND per share, and maintained liquidity leadership with over 81 million matched units. Foreign investors net purchased 6.5 million shares, underscoring the bank’s appeal.

In the first nine months of 2025, SHB reported pre-tax profits of 12,235 billion VND, a 36% increase year-on-year, achieving 85% of its annual target. Capital adequacy ratios exceeded both SBV regulations and international standards, with CAR surpassing 12%, significantly above the 8% minimum required by Circular 41/2016/TT-NHNN.

As of 30/09/2025, SHB’s total assets reached 852,695 billion VND, a 14.1% increase from the end of 2024, surpassing the 2025 annual target. This sets the stage for achieving the 1 million billion VND asset milestone by 2026. Customer loans stood at 607,852 billion VND, up 17% year-to-date, reflecting stable capital absorption and strong market competitiveness. The bank remains aligned with national growth objectives, actively increasing lending in key sectors.

SHB continues to expand its service ecosystem, accelerate digital transformation, enhance risk management in line with international standards, and optimize asset quality.

Anticipated continued ascent

Recent macroeconomic policy shifts—notably the potential removal of credit limits—coupled with increased public investment and infrastructure development, are creating significant growth opportunities for the banking sector. These factors are expected to drive a new, more sustainable and dynamic growth phase compared to previous cycles.

The National Assembly is actively discussing the removal of credit limits, with a clear roadmap for implementation—a highly positive signal. Eliminating credit limits will allow for more flexible credit growth but will also require banks to strengthen financial capacity, risk management, and asset quality control to ensure systemic safety.

From a stock market perspective, banking stocks will directly benefit from heightened profit expectations, particularly those with strong financial foundations and high capital adequacy ratios.

Beyond credit policies, the macroeconomic landscape is bolstered by public investment and national infrastructure projects. As these initiatives accelerate, capital demand from construction, materials, logistics, and related sectors will surge, presenting significant credit supply opportunities for banks.

In summary, current policy changes and socioeconomic conditions are paving the way for a highly promising growth phase in the banking sector. With more flexible credit growth and substantial capital demand from infrastructure and reconstruction projects, banks are well-positioned to thrive. This will be a critical foundation for sustainable growth and reinforce the sector’s role as the economy’s lifeblood.

The upgrade of Vietnam’s stock market will serve as a powerful catalyst, propelling large-cap stocks to new heights. Among these, banking stocks—especially those with superior liquidity, scale, and sustainable development strategies—are expected to attract international capital from the outset.

The growing interest from foreign funds underscores the appeal of banking stocks. Once Vietnam’s upgrade is formalized, SHB is well-positioned to surge—not only in market capitalization but also in its regional influence as a leading bank.

– 06:58 04/12/2025

VN-Index Surges Past 1,700 Points, Yet Investor Portfolios Continue to Shrink

Amidst the market’s deceptive “green exterior, red core” dynamics, the majority of investors find their accounts lingering in the red, underscoring the prevailing challenges in navigating such volatile conditions.

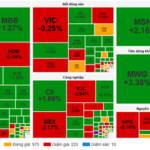

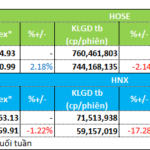

Market Pulse 03/12: Foreign Investors Maintain Net Buying, Capital Flows Back to Financial Sector

At the close of trading, the VN-Index surged by 14.71 points (+0.86%), reaching 1,731.77 points, while the HNX-Index climbed 0.8 points (+0.31%) to 267.61 points. Market breadth favored the bulls, with 461 stocks advancing and 236 declining. Similarly, the VN30 basket saw green dominate, as 19 stocks rose, 9 fell, and 2 remained unchanged.

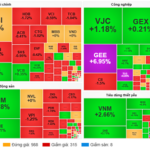

Market Pulse 12/01: Foreign Investors Resume Net Selling of Bluechips, VN-Index Struggles at 1,700 Points

At the close of trading, the VN-Index climbed 10.68 points (+0.63%) to reach 1,701.67, while the HNX-Index dipped 2 points (-0.77%), settling at 257.91. Overall market breadth leaned bearish, with 379 decliners outpacing 314 advancers. The VN30 basket showed a more balanced performance, with 16 gainers and 14 losers.