On the evening of December 2nd, the National Assembly Standing Committee held its 52nd session to discuss the explanations, feedback, and revisions for three draft laws: the Law on Personal Income Tax (amended), the Law on Tax Administration (amended), and the Law Amending and Supplementing Certain Articles of the Law on Public Debt Management.

Deputy Minister of Finance Cao Anh Tuan.

In the report on the absorption and explanation of opinions from National Assembly deputies and the review opinions of the Economic and Financial Committees on the draft Law on Personal Income Tax (amended), the Government revised the content regarding personal income tax on business income.

Regarding the adjustment of the revenue threshold exempt from tax, the Government proposed raising it from 200 million VND/year to 500 million VND/year. Simultaneously, the 500 million VND/year threshold is also the deductible amount before tax is applied based on revenue.

For example, in the case of a household or individual distributing or supplying goods with an annual revenue of 1 billion VND and unable to determine costs, they would only be required to pay personal income tax on the amount exceeding 500 million VND, at a tax rate of 0.5%. This means the tax payable would be (1,000 – 500) x 0.5% = 2.5 million VND/year.

Applying this revenue threshold, as of October, out of over 2.54 million regular business households, approximately 2.3 million are expected to be exempt from tax (accounting for about 90% of the total 2.54 million business households). According to tax authority estimates, the total tax reduction (including both personal income tax and value-added tax) is approximately 11,800 billion VND.

Additionally, the Government added a provision for business households or individuals with annual revenue between 500 million VND and 3 billion VND, applying tax calculation based on income (revenue minus expenses) to ensure tax collection aligns with the nature of income tax. A tax rate of 15% will be applied, similar to the corporate income tax rate for entities with revenue under 3 billion VND/year.

Accordingly, all business households and individuals will pay tax based on actual income; higher income means higher tax, lower income means lower tax, and no income means no tax.

Therefore, the Government believes that the revenue threshold exempt from tax will no longer significantly impact taxable business households and individuals. Only in cases where business households or individuals cannot determine expenses will tax be paid based on a percentage of revenue.

Regarding the adjustment of the revenue threshold exempt from tax, the draft Law authorizes the Government to submit to the National Assembly Standing Committee for adjustment in line with tax management for business individuals.

Furthermore, the draft Law stipulates that individuals engaged in real estate leasing with annual revenue exceeding 500 million VND will only apply the tax calculation method based on a percentage of revenue. Consequently, they will not need to determine expenses, offset income (if leasing more than one property), or file annual tax returns.

Maintaining the highest personal income tax rate at 35%

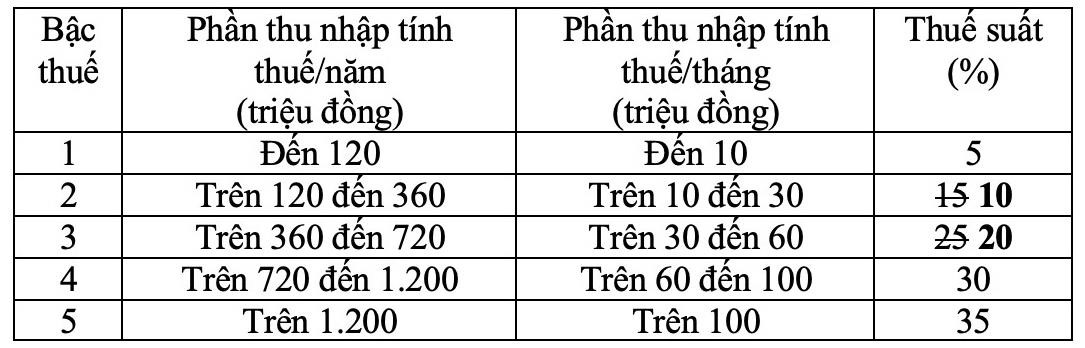

In the new draft Law, the Government revised the progressive tax rate table, adjusting two tax brackets by reducing the 15% tax rate (in bracket 2) to 10% and the 25% tax rate (in bracket 3) to 20%.

Specifically, with this new tax table, all individuals currently paying tax in these brackets will see a reduction in their tax obligations compared to the current tax table.

Moreover, the new tax table also addresses abrupt increases in certain brackets, ensuring a more reasonable tax structure.

Regarding the highest tax rate in the progressive tax table for personal income tax from salaries and wages, the 35% rate in bracket 5 remains.

Proposed progressive tax table in the draft Law.

The Government considers this proposal reasonable, as it represents an average tax rate, neither too high nor too low compared to other countries globally and within the ASEAN region.

Are Holiday and Tet Bonuses Subject to Personal Income Tax?

Anticipated by many, holiday and Tet bonuses bring joy, but understanding when they’re subject to personal income tax, which amounts are exempt, and how in-kind rewards are regulated is essential.

When Capital Gains Tax Applies to Real Estate Transfers: Essential Information

The Ministry of Finance has announced that once sufficient digitized land data is linked to the VNeID system, it will gradually implement income tax collection on real estate transfer income, accurately reflecting its true nature. However, tax policies are not considered the primary or most effective tool to curb real estate speculation.

Implementing a $500 Million Revenue Tax Exemption Threshold: 90% of Businesses Exempt from Taxation

The Ministry of Finance has proposed an increase in the tax-exempt revenue threshold for small businesses, a move that could significantly benefit household enterprises. This initiative aims to alleviate the tax burden on smaller operations, fostering growth and financial stability within the sector.