One of the most notable wage policies set to take effect from January 1, 2026, is the adjustment of the minimum wage for employees under labor contracts.

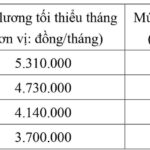

From January 1, 2026, workers will receive a 7.2% increase in the minimum wage.

This wage adjustment not only improves income for employees but also positively impacts other policies, including social insurance (SI), health insurance (HI), and unemployment insurance (UI).

Consequently, contribution levels will increase, leading to higher benefits for various schemes such as sickness, maternity, work-related accidents and illnesses, retirement, survivors’ pensions, and unemployment.

In the public sector, the current base salary for calculating wages for civil servants and public employees is set at 2.34 million VND per month, as per Decree 73/2024/NĐ-CP.

Recently, the National Assembly approved the Resolution on the Central Budget Allocation Plan for 2026. The total budget for wage reform is 57.470 trillion VND, with the government authorized to make adjustments if conditions permit.

Additionally, according to Deputy Prime Minister Phạm Thị Thanh Trà, the Ministry of Home Affairs has 33 decrees to issue by the end of 2025, including two decrees adjusting the base salary. The Deputy Prime Minister has instructed agencies to complete the dossiers by November and submit them to the Government no later than December 10, 2025. Thus, there is a strong possibility of positive developments in public sector wage policies in 2026.

Furthermore, teachers in public educational institutions are also likely to receive salary adjustments from 2026, as the Ministry of Education and Training is currently seeking feedback on a draft decree on teacher wage policies (expected to take effect from January 1, 2026).

According to the proposed draft, teachers’ salaries will be calculated using the formula:

|

Salary effective from January 1, 2026 |

= |

Base salary |

x |

Current salary coefficient |

x |

Special salary coefficient |

The special salary coefficient is proposed to range from 1.15 to 1.3 times the current salary coefficient, depending on the individual.

Implementing Regional Minimum Wage Increases Effective January 1, 2026

The government has outlined specific criteria for those eligible for regional minimum wage increases in Decree No. 293/2025/NĐ-CP, effective January 1, 2026.

Critical Reminders for Pensioners and Social Insurance Beneficiaries Regarding December 2025 Pension Disbursement

Local Social Insurance (LSI) agencies have finalized the December 2025 pension payment plan, adhering to the procedures outlined in Decision 2222/QD-BHXH of 2025. LSI offices across provinces and cities will disburse pensions and social insurance allowances through two methods: direct deposit into personal bank accounts and cash payments via authorized payment service providers.