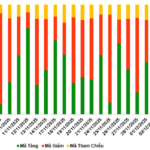

The green hue also appeared on other key indices, with the HNX-Index rising 2.64 points to 262.31 and the UPCoM-Index climbing 0.78 points to 120.94.

Market-wide liquidity reached VND 28,906 billion, with HOSE alone accounting for over VND 26,537 billion. Thus, the market continues to show improvement in both index levels and liquidity.

| Market continues its recovery trend |

|

Source: VietstockFinance

|

Across capitalization groups, the increase was remarkably uniform, with Large Cap up 0.54%, Mid Cap up 0.57%, and Small Cap up 0.58%, while Micro Cap outperformed with a 1.62% rise.

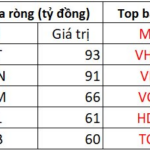

Similar to the morning session, the banking sector continued to lead the market with several stocks posting impressive gains, most notably MBB up 4.68%, followed by HDB up 2.17%, ACB up 1.84%, TPB up 1.44%, TCB up 1.43%, and STB up 1.01%.

With these positive results, the banking sector contributed 5 out of the top 10 stocks with the highest gains for the VN-Index today. The remaining 5 were also notable industry leaders: HPG, VPL, HVN, MWG, and FPT.

| Top stocks impacting the VN-Index on December 4, 2025 |

Today’s positivity also extended to the securities sector, with widespread gains. Notable performers included VIX up 3.09%, SHS up 2.8%, VND up 1.58%, SSI up 1.39%, HCM up 1.32%, and VCI up 1.15%…

Among other large-cap sectors, real estate saw VIC, VHM, and VRE narrow their declines from the morning session, significantly reducing their negative impact on the market. By the end of today’s session, VIC was down only 0.89%, taking 2.06 points off the VN-Index, followed by VHM down 1.5%, reducing the index by 1.45 points.

Despite the declines in these “super pillars,” the real estate sector closed with a slight 0.34% decrease, thanks to many other constituent stocks, including DXG up 3.23%, DIG up 2.97%, TCH up 2.22%, PDR up 2.03%, and CEO up 1.54%…

Beyond the pressure from the Vingroup sector, other large-cap stocks also recorded notable impacts on the market, such as MSN down 0.87%, VNM down 1.86%, and VJC down 3.74%.

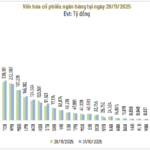

As mentioned, the market is continuing its improvement trend in both index levels and liquidity. Today, foreign investors also showed support with a net buy of nearly VND 1,086 billion, marking the third consecutive net buying session and the fifth in over a week.

However, today’s buying was almost entirely focused on MBB, with nearly VND 1,002 billion, equivalent to over 42 million shares. This was recorded as a matched order transaction by foreign investors. Following was HPG with a net buy of nearly VND 161 billion, and VIC with nearly VND 126 billion.

On the net selling side, VHM led with nearly VND 123 billion, followed by MSN with nearly VND 86 billion, and VIX with nearly VND 68 billion.

| MBB dominates foreign trading today |

Morning Session: Banks and Securities Soar, but VN-Index Remains in the Red

Despite key sectors like banking and securities performing well in the morning session, the VN-Index closed the midday break in the red, down 1.88 points to 1,729.89. This reflects continued pressure from Vingroup stocks since the opening.

Most sectors gained in the morning session, with 17 sectors recording increases. Commercial and professional services led with a 2.33% rise, supported by VEF up 3.57%, TLG up 2.52%, and VGV up 4.28%.

Next were three sectors with 1% gains: hardware and equipment (up 1.98%), financial services (up 1.08%), and energy (up 1%). Other notable sectors included raw materials (up 0.89%), software and services (up 0.81%), and credit institutions (up 0.44%).

Among these, the financial services sector, primarily comprising securities companies, stood out. Numerous securities stocks gained, notably SSI up 1.39%, VIX up 2.26%, VND up 2.37%, SHS up 2.34%, VDS up 2.46%, BVS up 1.93%, and newcomer TCX up 0.54%.

For banking stocks, the green hue was less widespread compared to securities, but the impact was undeniable. The top 10 stocks positively influencing the VN-Index included several banks, led by MBB up 3.67%, contributing 1.69 points to the index, followed by LPB, ACB, HDB, STB, and TCB.

Beyond these “king” stocks, the top 10 also featured other industry giants like FPT, HPG, GVR, and KBC. Collectively, these top 10 stocks added 4.47 points to the index.

However, the top 10 decliners subtracted 8.93 points, primarily responsible for the index’s red close in the morning session, despite most stocks gaining.

Leading the decline were VIC (4.7 points) and VHM (2.17 points). Additionally, VRE subtracted 0.18 points, also making the top 10. These three stocks caused real estate to be the biggest declining sector in the morning session, down 1.2%.

In terms of liquidity, today’s trading was more vibrant than recent periods, with a total trading value of VND 13,448 billion, and HOSE alone accounting for over VND 12,167 billion.

Amid this, foreign investors were not overly active, netting a buy of over VND 175 billion, primarily focused on MBB with nearly VND 667 billion, almost offsetting the market’s net selling.

10:30 AM: Reversal Amid Localized Pressure

After an enthusiastic start nearing 1,740, the VN-Index quickly adjusted, dipping as low as 1,725 points.

As of 10:30 AM, while the HNX-Index and UPCoM-Index retained their green hue, the VN-Index had turned to 1,728.07, down 3.7 points. Liquidity increased faster, reaching nearly VND 9,200 billion, with the VN-Index at VND 8,460 billion, higher than recent averages.

The primary pressure came from the Vingroup sector. Specifically, VIC fell 2.23%, directly causing the VN-Index to lose over 5 points, followed by VHM down 1.78%, subtracting 1.8 points. Additionally, VRE and VPL also declined, impacting the index.

Overall, pressure from the Vingroup sector caused real estate to fall 1.15%, the deepest decline in the market at that time.

Beyond these specific stocks, the green hue spread to 351 stocks, with banking and securities remaining prominent, alongside infrastructure, retail, steel, chemicals, and maritime transport.

The market also recorded 23 stocks hitting their ceiling prices, most notably EVG in real estate and VOS in maritime transport.

Opening: Green Hue Spreads, but Vingroup Sector Quickly Applies Pressure

Vietnamese stocks opened the December 4 session with a green hue across all three indices, but concerns arose early as the Vingroup sector quickly applied pressure.

As of 9:30 AM, the VN-Index rose 3.01 points to 1,734.78, the HNX-Index climbed 1.57 points to 261.24, and the UPCoM-Index increased 0.47 points to 120.63. Total market trading value reached VND 2,717 billion.

The green hue spread to 308 stocks, with 15 hitting their ceiling prices. Meanwhile, 98 stocks declined, and 1,175 remained unchanged.

The market map highlighted the banking sector’s positivity. Leading banking stocks gained, including MBB up 2.44%, HDB up 1.55%, ACB up 1.02%, and TPB up 1.16%. The securities sector was also very active, with VIX up 1.65%, SSI up 1.24%, SHS up 1.4%, and VND up 1.58%.

Meanwhile, the real estate sector, though predominantly green, collectively declined 0.81%, the highest in the market. The primary cause was unsurprisingly the Vingroup sector, with VIC down 1.11%, VRE down 1.74%, and VHM down 1.4%.

|

Green hue spreads, but Vingroup sector applies pressure

Source: VietstockFinance

|

Overnight, U.S. stocks rose as the latest ADP employment data bolstered investor confidence that the Fed would cut rates next week. At the close, the Dow Jones rose 408.44 points (0.86%) to 47,882.90; the S&P 500 advanced 0.3% to 6,849.72, and the Nasdaq Composite edged up 0.17% to 23,454.09.

However, Asian markets opened December 4 with difficulty, with the Nikkei 225 among the few major indices gaining, up 1.42%, while most others declined, including the All Ordinaries, Hang Seng, Shanghai Composite, and Singapore Straits Times.

– 15:50 04/12/2025

Foreign Investors Reverse Course, Selling Hundreds of Billions of Dongs in Session 1/12: Which Stocks Were Hit Hardest?

In the afternoon trading session, foreign investors aggressively accumulated FPT shares, with the total value reaching approximately 93 billion VND.

Vietstock Daily 04/12/2025: Will the Rally Continue?

The VN-Index extended its winning streak to six consecutive sessions, breaking above the 50-day SMA and now hugging the Upper Band of the Bollinger Bands. This bullish outlook is reinforced by the MACD indicator, which continues to widen its gap above the Signal line. However, caution is warranted as the Stochastic Oscillator has ventured deep into overbought territory, leaving investors vulnerable to a potential sell signal in the coming sessions.

Foreign Investors Return to Scoop Up Over VND 650 Billion in Vietnamese Stocks as VN-Index Surges: What’s the Spotlight?

In contrast, foreign investors heavily offloaded ACB shares, recording a net sell value of approximately 75 billion VND.