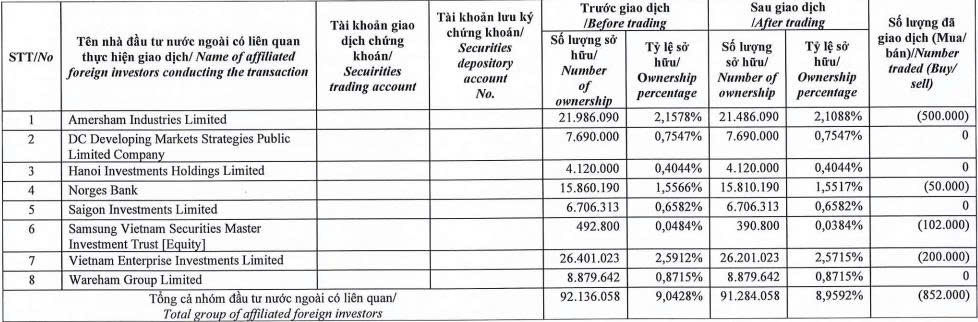

Dragon Capital, a leading foreign fund group, recently released a report detailing changes in ownership among its affiliated foreign investors who hold significant stakes (5% or more) in Dat Xanh Group JSC (Stock Code: DXG, listed on HoSE).

On November 28, 2025, Dragon Capital, through four of its member funds, sold a total of 852,000 DXG shares. The breakdown includes: Amersham Industries Limited selling 500,000 shares, Norges Bank selling 50,000 shares, Samsung Vietnam Securities Master Investment Trust [Equity] selling 102,000 shares, and Vietnam Enterprise Investments Limited selling 200,000 shares.

Source: DXG

Following this transaction, the group’s holdings in DXG shares decreased from over 92.1 million to nearly 91.3 million shares, reducing their ownership stake from 9.0428% to 8.9592% of Dat Xanh Group’s capital.

In other developments, Dat Xanh Group recently approved a resolution to distribute shares in a private placement, as previously agreed upon during the 2025 Annual General Meeting of Shareholders and outlined in Resolution No. 17-1/2025/NQ-DXG/HĐQT dated August 4, 2025.

The company plans to issue 93.5 million shares to a maximum of 20 professional foreign investors. These shares will be subject to a one-year transfer restriction. Investors are required to complete payment for the shares between December 1 and December 8, 2025.

The offering price is set at 18,600 VND per share, matching the market price of DXG shares at the close of trading on December 1, 2025, which was 18,400 VND per share.

Notably, DXG has announced that all issued shares will be sold to foreign investors. To comply with the 50% foreign ownership cap, the company has temporarily locked the foreign ownership ratio for 463.5 million privately placed shares at 45.42%.

DXG anticipates raising 1,739.1 billion VND from this offering. The entire proceeds will be used to capitalize Ha An Real Estate Investment and Business JSC, a subsidiary of DXG. Ha An Real Estate will then invest in its subsidiary, Phuoc Son Investment JSC.

MBS Partners with Dragon Capital to Distribute Open-Ended Fund Certificates on MFUND Platform

MBS and Dragon Capital have officially partnered to distribute open-ended fund certificates via the MFUND platform. This collaboration between a leading billion-dollar market cap securities firm and a top fund manager is poised to enhance product accessibility, foster long-term investment trends, and elevate capital professionalism in the market.

Vietnam’s Recovery Phase: Corporate Profits Poised to Rise, Says Dominic Scriven (Dragon Capital)

At the Annual Listed Companies Conference held on the afternoon of December 3rd, Mr. Dominic Scriven, Chairman of the Board of Directors of Dragon Capital Fund Management JSC, delivered a keynote address. His presentation focused on assessing the global and Vietnamese macroeconomic landscape, emphasizing the critical roles of policy, public investment, and capital markets. Additionally, he provided insightful analysis and predictions regarding the Vietnamese stock market.

Dragon Capital Seeks to List Shares on UPCoM

On December 1st, Dragon Capital Vietnam Fund Management JSC (Dragon Capital – DCVFM) announced a Board of Directors resolution approving the registration of centralized custody of shares with the Vietnam Securities Depository (VSD). Simultaneously, the company has registered for trading its shares on the UPCoM system.