I. FUTURES CONTRACTS OF THE STOCK MARKET INDEX

I.1. Market Trends

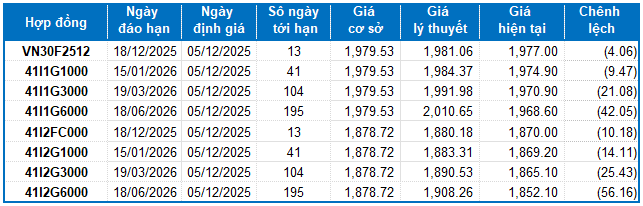

VN30 futures contracts showed mixed movements during the trading session on December 4, 2025. Specifically, VN30F2512 (F2512) rose by 0.25%, reaching 1,977 points; 41I1G1000 (I1G1000) increased by 0.15%, hitting 1,974.9 points; the 41I1G3000 (I1G3000) contract dipped by 0.01%, closing at 1,970.9 points; and the 41I1G6000 (I1G6000) contract fell by 0.26%, ending at 1,968.6 points. The underlying index, VN30-Index, closed at 1,979.53 points.

Meanwhile, VN100 futures contracts unanimously gained during the December 4, 2025 session. Notably, 41I2FC000 (I2FC000) climbed by 0.16%, reaching 1,870 points; 41I2G1000 (I2G1000) surged by 0.41%, attaining 1,869.2 points; the 41I2G3000 (I2G3000) contract advanced by 0.9%, closing at 1,865.1 points; and the 41I2G6000 (I2G6000) contract rose by 0.22%, ending at 1,852.1 points. The underlying VN100-Index closed at 1,878.72 points.

During the December 4, 2025 session, VN30F2512 initially ticked higher but soon faced selling pressure, leading to a prolonged tug-of-war around the reference level during the morning session. In the afternoon, buyers re-emerged, propelling the contract upward, but optimism was short-lived as selling pressure resurfaced, nearly overwhelming the rally and limiting F2512’s gains to a modest 5-point increase at the close.

Intraday Chart of VN30F2512

Source: https://stockchart.vietstock.vn/

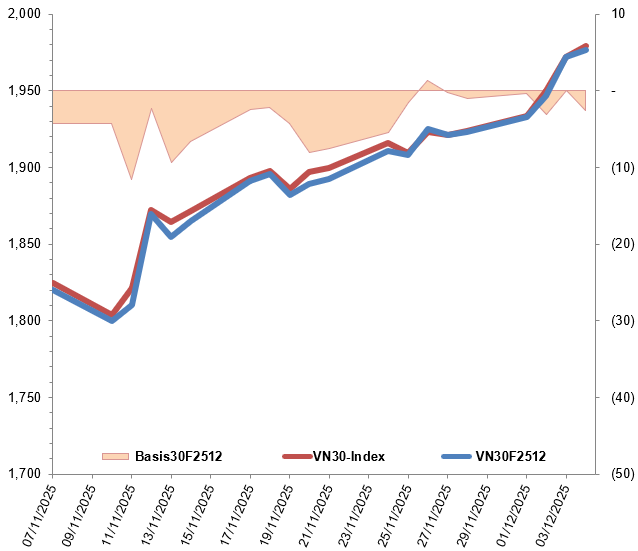

At the close, the basis of the F2512 contract reversed from the previous session, settling at -2.53 points. This shift indicates a return to bearish sentiment among investors.

Fluctuations of VN30F2512 and VN30-Index

Source: VietstockFinance

Note: Basis is calculated as follows: Basis = Futures Contract Price – VN30-Index

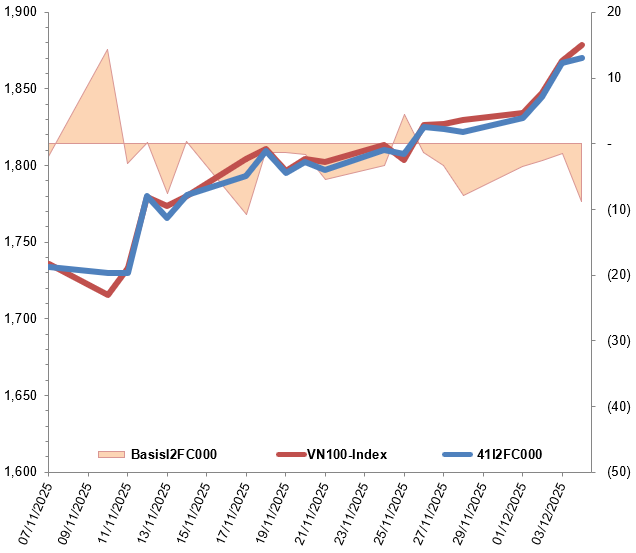

Meanwhile, the basis of the I2FC000 contract widened compared to the previous session, reaching -8.72 points. This expansion reflects heightened bearish sentiment among investors.

Fluctuations of 41I2FC000 and VN100-Index

Source: VietstockFinance

Note: Basis is calculated as follows: Basis = Futures Contract Price – VN100-Index

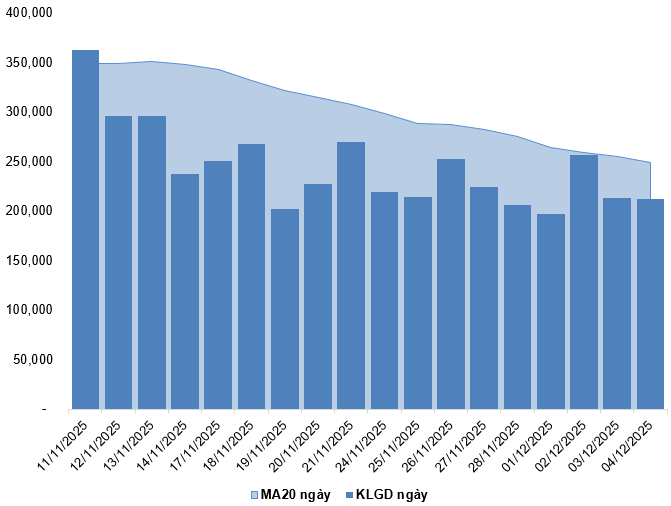

Trading volume and value in the derivatives market decreased by 0.8% and increased by 0.01%, respectively, compared to the December 3, 2025 session. Specifically, F2512 trading volume fell by 0.72%, with 211,357 contracts matched. I2FC000 trading volume reached 48 contracts, surging by 128.57%.

Foreign investors resumed net selling, with a total net sell volume of 1,298 contracts during the December 4, 2025 session.

Daily Trading Volume Fluctuations in the Derivatives Market. Unit: Contracts

Source: VietstockFinance

I.2. Valuation of Futures Contracts

Based on the fair pricing method as of December 5, 2025, the reasonable price range for actively traded futures contracts is as follows:

Summary Table of Derivatives Valuation for VN30-Index and VN100-Index

Source: VietstockFinance

Note: Opportunity costs in the valuation model are adjusted to align with the Vietnamese market. Specifically, the risk-free rate (government treasury bills) is replaced by the average deposit rate of major banks, with maturity adjustments tailored to each futures contract.

I.3. Technical Analysis of VN30-Index

During the December 4, 2025 session, the VN30-Index extended its winning streak to five consecutive sessions, forming a small-bodied candlestick accompanied by above-average trading volume. This pattern suggests investor hesitation.

Currently, the index is approaching the October 2025 high (around 2,000-2,050 points) as the MACD indicator continues to rise and widen its gap from the Signal line following a buy signal. This development indicates that short-term recovery prospects remain intact.

Technical Analysis Chart of VN30-Index

Source: VietstockUpdater

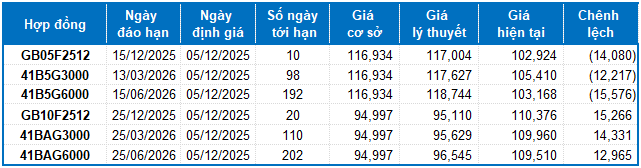

II. FUTURES CONTRACTS OF THE BOND MARKET

Based on the fair pricing method as of December 5, 2025, the reasonable price range for actively traded government bond futures contracts is as follows:

Summary Table of Government Bond Futures Valuation

Source: VietstockFinance

Note: Opportunity costs in the valuation model are adjusted to align with the Vietnamese market. Specifically, the risk-free rate (government treasury bills) is replaced by the average deposit rate of major banks, with maturity adjustments tailored to each futures contract.

According to the above valuation, the GB05F2512, 41B5G3000, and 41B5G6000 contracts are currently attractively priced. Investors should focus on and consider buying these futures contracts in the near term, as they present compelling value in the market.

Economic Analysis & Market Strategy Division, Vietstock Advisory Department

– 18:28 04/12/2025

Derivatives Market Outlook on December 4, 2025: Will Short-Term Prospects Continue to Brighten?

On December 3, 2025, both VN30 and VN100 futures contracts surged in a synchronized rally. The VN30-Index marked its fourth consecutive session of gains, accompanied by steadily rising trading volumes that surpassed the 20-session average. This sustained momentum underscores a prevailing optimism among investors.

Derivatives Market Update: December 2, 2025 – Market Liquidity Plunges Further

On December 1, 2025, most VN30 and VN100 futures contracts closed higher. The VN30-Index remained range-bound, forming a small-bodied candlestick pattern with trading volume below its 20-session average, indicating cautious investor sentiment.