Recently, Vietnam Oil and Gas Group (PV OIL, Stock Code: OIL, UPCoM) announced the Board of Directors’ Resolution approving the establishment and investment plan for PVOIL Aviation Joint Stock Company.

Specifically, PVOIL Aviation is expected to have a charter capital of 300 billion VND, equivalent to 30 million shares with a par value of 10,000 VND per share. PV OIL, as the founding shareholder, will contribute 153 billion VND, holding 51% of PVOIL Aviation’s charter capital. The investment capital will be sourced from PV OIL’s equity.

Illustrative image

PVOIL Aviation will operate as a Joint Stock Company under Point a, Clause 1, Article 137 of the Enterprise Law No. 59/2020/QH14. Its headquarters will be located at 1-5 Le Duan Street, Sai Gon Ward, Ho Chi Minh City.

The company’s primary business activities include aviation fuel trading, buying and selling equipment and materials for petroleum business, leasing equipment and materials for petroleum business, warehousing and storage services, and office rental.

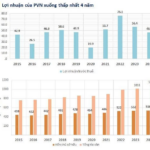

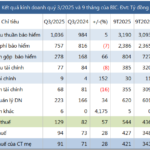

In terms of business performance, in the first nine months of 2025, PV OIL recorded a net revenue of nearly 105,472.4 billion VND, a 10.5% increase compared to the same period in 2024. After-tax profit reached over 370.8 billion VND, a 3% decrease.

For 2025, the company aims to achieve an after-tax profit of 624 billion VND. As of the end of Q3 2025, PV OIL has completed 59.4% of its annual profit target.

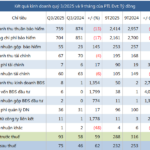

As of September 30, 2025, PV OIL’s total assets decreased by 10.6% compared to the beginning of the year, reaching over 37,318.9 billion VND. Short-term financial investments accounted for nearly 12,315.3 billion VND, or 33% of total assets, while short-term receivables stood at over 10,541.5 billion VND, representing 28.2% of total assets.

On the liabilities side, total payables amounted to over 25,712.9 billion VND, a 15.1% decrease from the beginning of the year. Loans and finance leases totaled nearly 9,489.1 billion VND, or 36.9% of total liabilities, while short-term payables to suppliers reached almost 10,124 billion VND, accounting for 39.4% of total liabilities.

Accelerating Production to Surpass the 2025 Plan

“The most tangible action BSR can take to support our fellow citizens nationwide is to vigorously enhance our production and business operations, striving to meet and exceed our 2025 targets. This effort will help offset the losses our people and country have endured due to recent flooding in various regions. We are proactively developing new growth drivers and gradually establishing a sustainable development model for 2026 and beyond.”

VietinBank Auctions 19.6 Million SGP Shares, Expected to Raise Nearly VND 573 Billion

VietinBank is auctioning over 19.6 million SGP shares of Saigon Port, with a starting price of 29,208 VND per share, aiming to generate a minimum revenue of nearly 573 billion VND.